ONEOK (OKE) and MPLX (MPLX) have partnered to build out the downstream component of their NGL value chain. The arrangement is one East Daley Analytics has speculated on and cements OKE/MPLX as one of six large integrated energy companies transporting Permian NGL supply growth to international markets.

The Deal: OKE and MPLX will jointly develop an LPG export terminal and pipeline connecting to OKE’s Mont Belvieu storage assets.

Texas City Logistics is a 50/50 JV that includes a 400 Mb/d LPG export terminal in Texas City, TX. MPLX will construct and operate the facility, with an in-service date expected in early ’28. MPLX and OKE will each contribute $700MM for a total investment of $1.4B. Each party has contracted for 200 Mb/d of capacity at the low ethane propane (LEP) and NC4 terminal.

MBTC Pipeline LLC is an 80/20 JV owned by OKE (80%) and MPLX (20%). OKE will construct and operate a 24-inch bi-directional pipeline running from OKE’s Mont Belvieu storage facility to the new LPG export site. The companies estimate the pipeline cost at $350MM, ($280MM net to OKE and $70MM net to MPLX).

What We Like: The deal cements MPLX and OKE as one of 6 integrated companies able to connect Permian NGL supply to growing international NGL demand. EDA has speculated that an announcement like this may happen here and here in the bid to jockey for NGL value chain relevance.

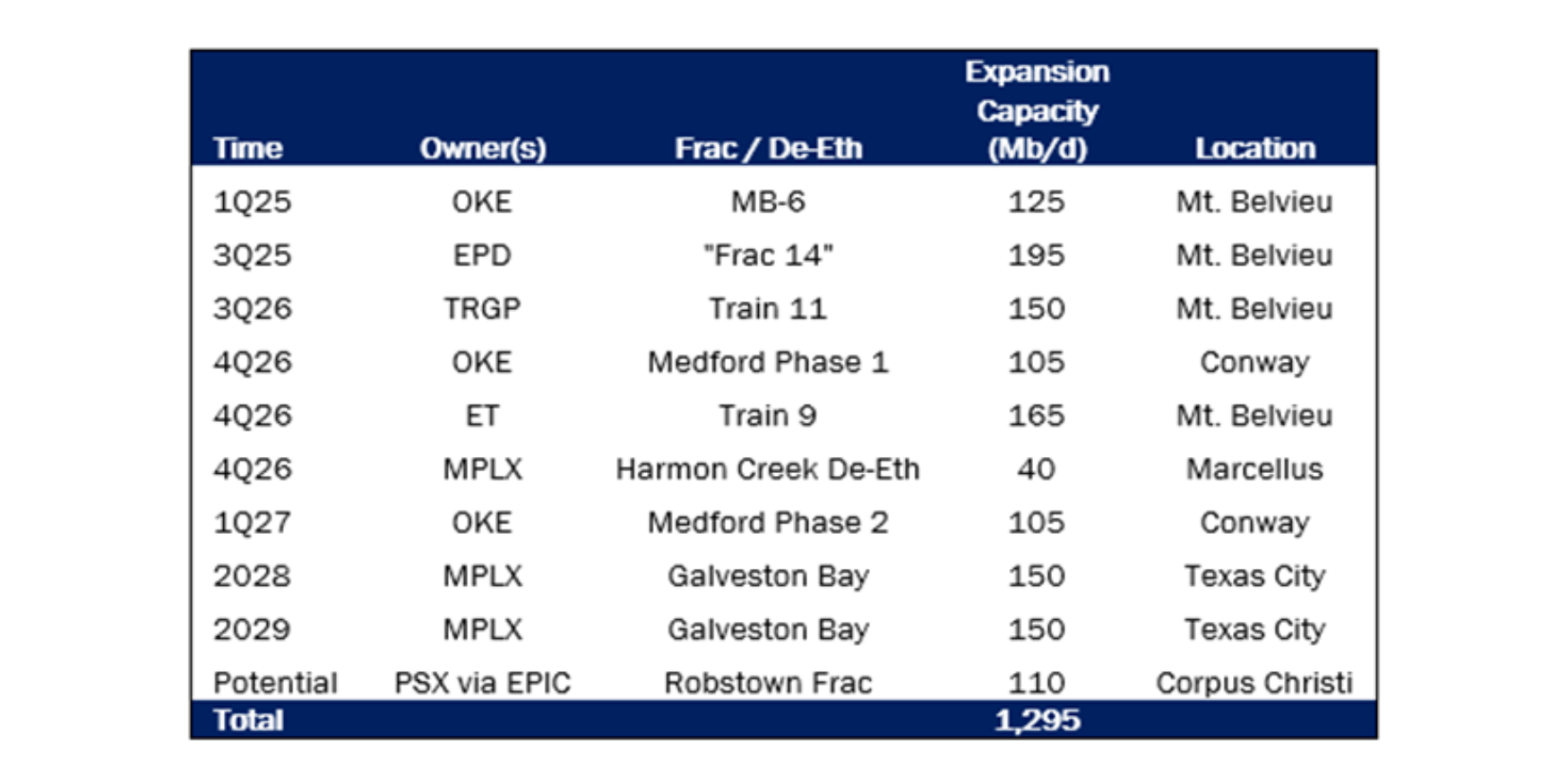

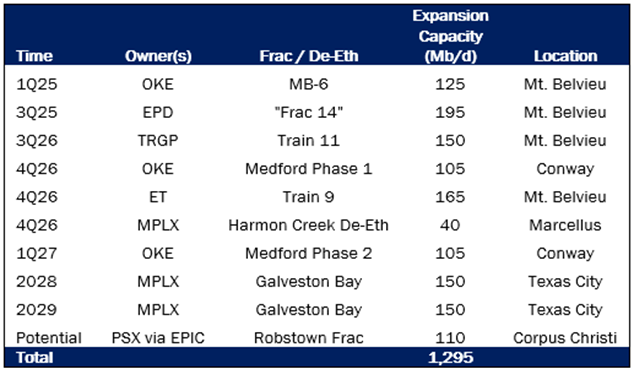

Separately, MPLX announced plans to develop two 150 Mb/d fractionators with an ISD of ’28 and ’29. The fractionators will cost an estimated $2.5B and are added to the list of other newbuild fractionators and de-ethanizers below.

The Knock-On Effect: On its recent 4Q24 earnings call, MPLX said the timing of its fractionation expansion projects coincide with the ability to redirect NGL production from third-party fractionators to its own fracs. MPLX’s 1.2 Bcf/d G&P Delaware Basin system is currently connected into EPIC’s Robstown fractionator (via BANGL) and PSX’s fractionation complex (via BANGL and Sand Hills), posing risk to PSX’s legacy and newly acquired EPIC downstream assets. This only supports EDA’s belief that PSX is on the hunt for Permian G&P assets, as we outlined in a recent webinar to clients. – Rob Wilson, CFA Tickers: MPLX, OKE, PSX.

Data Center Demand Monitor – Available Now !

Introducing Data Center Demand Monitor by East Daley Analytics. This is your go-to source for tracking data center projects and demand. We monitor and visualize nearly 300 US data center projects. Use Data Center Demand Monitor to forecast demand, identify pipeline corridors and track data center projects. — Request your demo now of the Data Center Demand Monitor!

Energy Path – Powered by Energy Data Studio

Introducing Energy Path by East Daley Analytics — a revolutionary tool designed to transform how you view the energy market. With Energy Path, you can seamlessly track the molecule from wellhead to demand, gaining a complete view of the entire oil and gas value chain. From upstream to midstream to downstream, this multi-commodity product offers unparalleled insights across natural gas, NGLs and crude oil. Monitor volumes and fees at every stage, empowering your decision-making with a holistic market perspective.

See energy differently — Request your Energy Path demo now!

The Dirty Little Secrets 2025 Report is Live!

The 2025 Dirty Little Secrets written report is available now. This report goes beyond the webinar discussions to provide a deeper analysis of the topics covered. Learn how commodities are intertwined and identify opportunities for profit from market dislocations. Request a copy of the Dirty Little Secrets report.

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.