National Fuel Gas (NFG) recently received a favorable ruling for its Northern Access pipeline project that could open new takeaway from the Appalachian Basin.

The US Court of Appeals for the District of Columbia granted NFG an extension to complete the pipeline project by December 31, 2024.

Northern Access consists of ~100 miles of new pipeline from Sergeant Township, PA to the Porterville compressor station near Elma, NY. The project would provide 500 MMcf/d of transportation from the Marcellus producing area in McKean County, PA in northeastern Pennsylvania, including potential delivery of 350 MMcf/d into Empire Pipeline and 150 MMcf/d into Tennessee Gas Pipeline (TGP).

NFG will also expand Empire Pipeline as part of the project, adding compression to increase capacity by ~350 MMcf/d for delivery into TC Energy’s (TRP) Canadian Mainline at the border crossing in Erie County, NY. Seneca Resources, NFG’s E&P subsidiary, has subscribed to all of the project’s capacity under a 2014 contract.

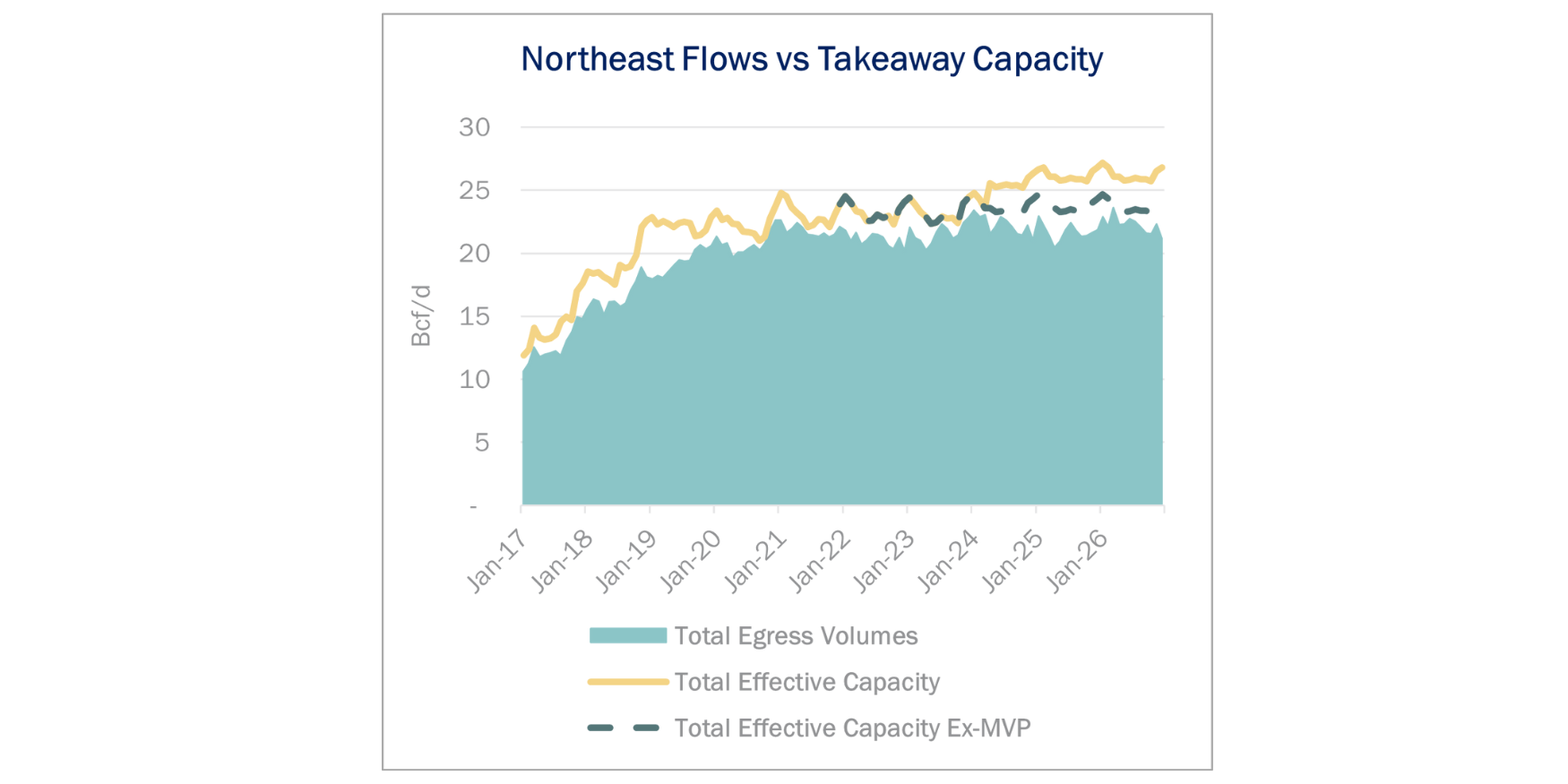

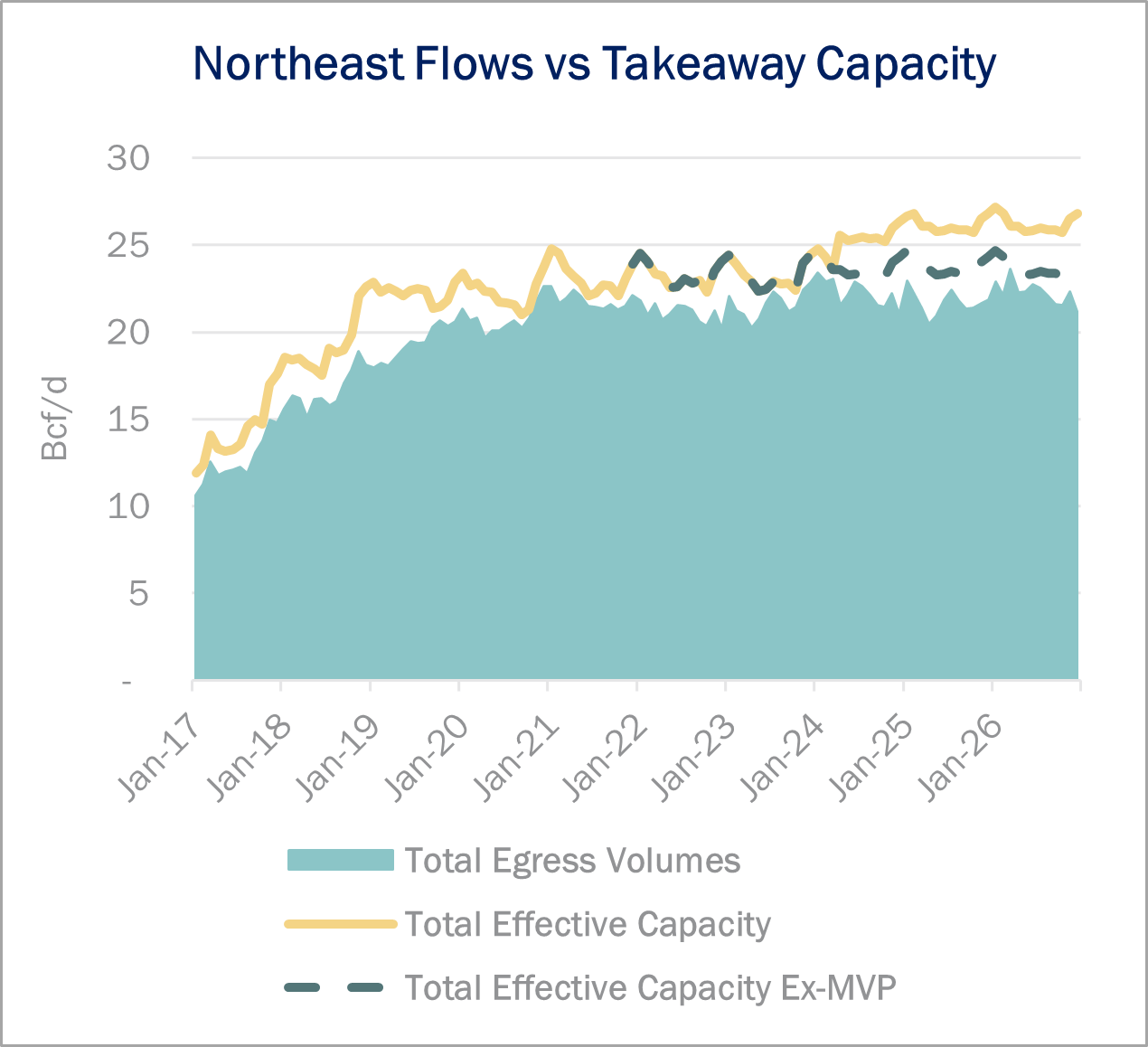

If completed, EDA expects Northern Access to add at least 350 MMcf/d of meaningful egress from the Appalachian Basin via Empire, allowing Pennsylvania production to grow to a higher ceiling. TGP is not expanding its own pipeline facilities, but the project will enable more Appalachian gas to compete with Canadian imports received on TGP at the Niagara border point.

While Mountain Valley Pipeline (MVP) has received the lion’s share of public attention, NFG’s project has faced similar delays obtaining federal permits, including the Section 401 water quality certification and a Section 404 permit from the US Army Corps of Engineers. MVP’s fate is more certain after an intervention by Congress, but Northern Access still has legal hurdles to pass to complete the project. We do not currently model completeion of Northern Access in our models.

In the latest Macro Supply and Demand Forecast, East Daley models a Y-o-Y decline of ~0.5 Bcf/d in Appalachian production in 2024, down from the recent supply peak at YE23 (see figure). Our outlook is shaped by the disincentive of low prices and producer shut-ins. For a more detailed regional view, EDA breaks down the outlook for production, demand and pipeline flows in the Northeast Supply and Demand Forecast. – Alex Gafford Tickers: NFG, TRP.

Gain a Competitive Edge with Southeast Gulf S&D Report

Gain an edge in natural gas with the Southeast Gulf Supply and Demand Forecast. East Daley’s latest product connects supply, demand and midstream developments in the most dynamic regional market. The Southeast Gulf S&D Forecast tracks and forecasts Haynesville production in East Texas and Louisiana, regional pipeline and midstream expansions, and Gulf Coast LNG projects for a comprehensive view of the Louisiana – Gulf Coast market. Learn more about the Southeast Gulf Supply and Demand Forecast.

New EDA Product: Houston Ship Channel Supply & Demand

The Houston Ship Channel Supply & Demand report allows users to dive deep in understanding, and monitoring Houston Ship Channel natural gas dynamics. The product contains monthly updates of relevant price spreads, pipeline flows, production and demand estimates affecting the South Texas market, with forecasts extending 5 years into the future. Learn more about the Houston Ship Channel Supply & Demand report.

New CAPEX Dashboard Creates Superior Visibility into Midstream Budgets

East Daley is excited to launch the CAPEX Dashboard, offering superior visibility into midstream investments. The CAPEX Dashboard provides detailed breakdown of capital projects by commodity, geography and asset type, allowing users to effectively track sector trends, analyze individual companies or compare with peers. Learn more about the CAPEX Dashboard here.

Energy Data Studio

East Daley Analytics has launched Energy Data Studio, a platform for our industry-leading midstream data and commodity production forecasts. All clients have access to the new client portal. If you have not yet logged in, please fill out the form to request a registration email be resent.

Energy Data Studio leverages our G&P data set for insights into midstream assets across every major oil and gas basin in North America. Users can navigate detailed visual dashboards by region, pipeline, or individual asset to understand crude oil, natural gas and NGL supply at the most granular level.

Energy Data Studio is available through data downloads from the visual interface, in Excel files, or as a direct feed delivered into subscribers’ workflow via secure file transfer. To learn more about Energy Data Studio, please contact [email protected].

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.