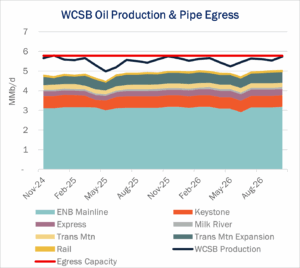

Pipeline takeaway remains the primary constraint for crude oil supply growth from Western Canada, prompting new efforts to expand systems for producers.

Production has been strong recently after a dip in the spring. Alberta’s oil patch faced significant disruptions in May as wildfires curtailed up to 335 Mb/d of production. The wildfires, combined with heavy maintenance turnarounds, cut oil sands production by ~890 Mb/d, the lowest monthly total since 2023. According to East Daley’s Crude Hub Model, June rebounded ~220 Mb/d, bringing total supply from the Western Canadian Sedimentary Basin (WCSB) up to ~5.2 MMb/d.

Production has been strong recently after a dip in the spring. Alberta’s oil patch faced significant disruptions in May as wildfires curtailed up to 335 Mb/d of production. The wildfires, combined with heavy maintenance turnarounds, cut oil sands production by ~890 Mb/d, the lowest monthly total since 2023. According to East Daley’s Crude Hub Model, June rebounded ~220 Mb/d, bringing total supply from the Western Canadian Sedimentary Basin (WCSB) up to ~5.2 MMb/d.

Western Canadian Select (WCS) prices have weakened ~$6 since August to ~$51.50/bbl, with the WCS-WTI spread averaging ~$12.70/bbl and briefly narrowing below $10 in June. Weak US exports have contributed to softer demand for Canadian barrels. Energy Information Administration (EIA) data shows US crude exports slumped to a four-year low of 2,305 Mb/d in July as Asian and European buyers shifted to cheaper barrels, with a narrow $3 WTI-Brent spread limiting the market pull.

Enbridge’s (ENB) 3.21 MMb/d Mainline ran ~98.4% utilized and was apportioned for six of the first eight months of 2025. Vertically integrated with Flanagan South (720 Mb/d capacity) and Seaway (950 Mb/d capacity), ENB is insulated from short-term dips. The strong demand is underscored by the recent oversubscription of the Flanagan South expansion.

Enbridge is considering a 150 Mb/d Mainline expansion, with a final investment decision expected by YE25. The proposed 150 Mb/d Mainline expansion would increase flows to Midwest and Gulf Coast refineries, helping reduce bottlenecks and support growing oil sands output.

Meanwhile, in August 2025, the Ontario government issued a request for a feasibility study on a new Alberta-to-Ontario pipeline and port corridor, signaling renewed interest in eastbound export options. These proposals, alongside ENB’s potential Mainline expansion, highlight that new egress solutions are being explored. Until additional takeaway comes online, WCS pricing and export flows will remain tightly tied to existing pipeline constraints. – Keland Rumsey Tickers: ENB.

Join Our Oil & Gas Production Webinar

East Daley will host our next monthly Oil & Gas Production Webinar on Sept. 17. This month we’ll unpack:

- Gas egress and infrastructure from the Permian Basin

- How our latest forecasts stack up for crude oil, natural gas and NGLs

- Scenarios that stress-test capacity and identify market winners and losers

Join us Sept. 17 at 10 AM MST for the latest information on energy production trends. — RSVP here to attend the Oil & Gas Production Webinar!

Meet Daley, the Best AI Tool in Energy

Meet Daley, the newest member of our energy team. Our new AI assistant is live and available to all East Daley Analytics clients. Early feedback has been phenomenal. Daley is platform-specific, and only pulls from East Daley’s own proprietary data and content. It’s not open-source or generic AI, but built to understand our structure, language and analytics. Whether you’re looking for a specific metric, forecast or explanation, Daley can get you there quicker. — Reach out to learn more about Daley!

Get the Data Center Demand Monitor

The Data Center Demand Monitor is your go-to source for tracking data center projects and demand. Available as part of the Macro Supply & Demand Report, East Daley monitors and visualizes nearly 500 US data center projects. Use the Data Center Demand Monitor to forecast demand, identify pipeline corridors and track data center projects. — Request your demo now of the Data Center Demand Monitor!

The Daley Note

Subscribe to The Daley Note for energy insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.