While the Permian NGL sector is in expansion mode, Phillips 66 (PSX) is one of the few companies not building new pipeline capacity. The emerging market dynamic could leave PSX and its Sand Hills NGL Pipeline exposed. Yet the company has helped mitigate risk via its recent acquisition of Pinnacle Midstream and the associated Midland G&P system.

Using the NGL Hub Model, East Daley Analytics recently flagged a big change ahead for Permian and Gulf Coast NGL markets. Right now takeaway is extremely tight, but new projects totaling almost 1.2 MMb/d of pipeline capacity are set to come online in the next 12 months out of the Permian Basin.

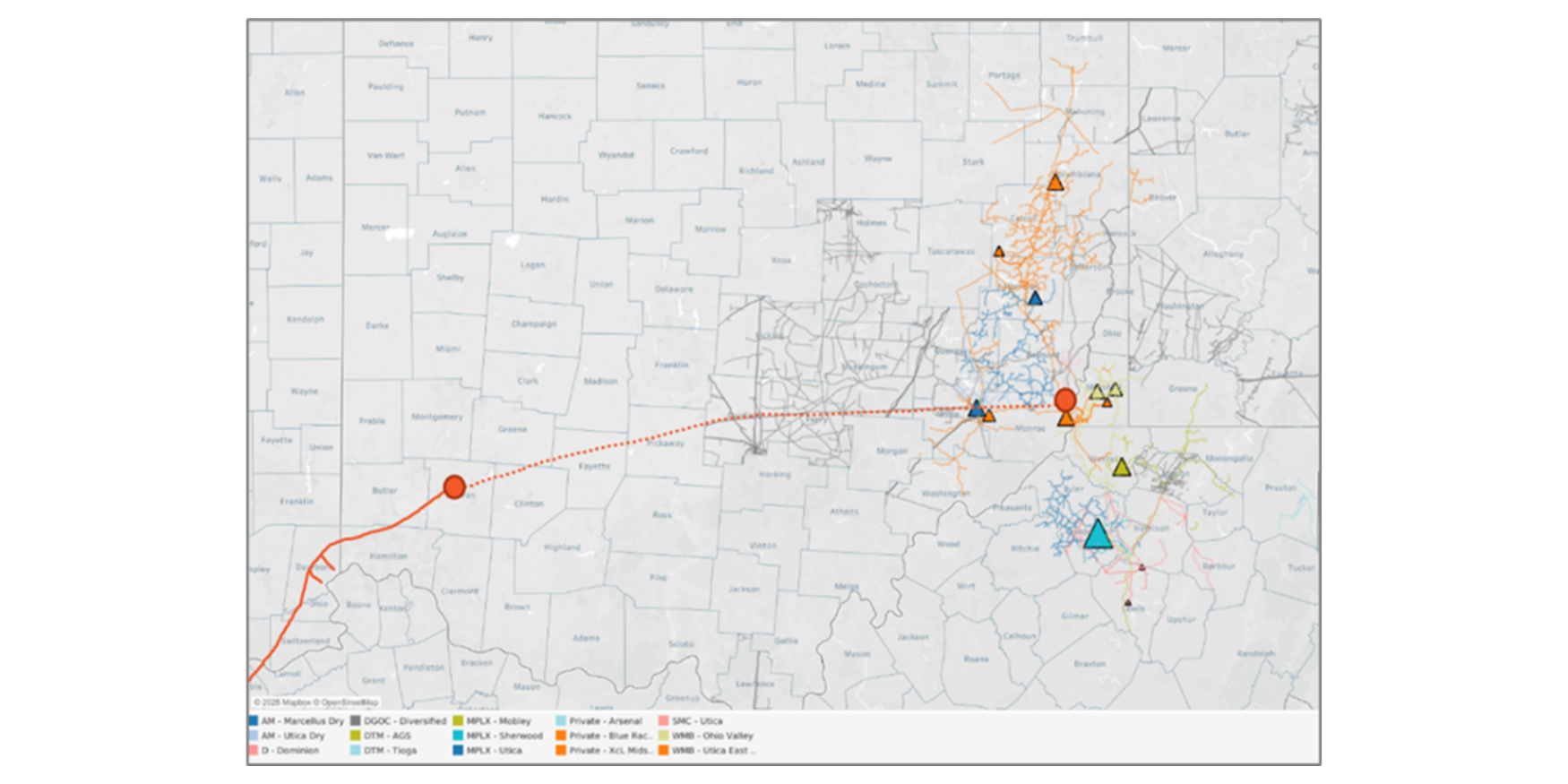

EDA estimates 400 Mb/d of throughput on Sand Hills (asset volumes are no longer reported separately since PSX acquired DCP Midstream). Of the 400 Mb/d of Sand Hills throughput, PSX produces 175 Mb/d of the NGLs from its own G&P assets based in the Permian (127 Mb/d) and Eagle Ford in South Texas (48 Mb/d) (see map). The Permian total includes 18 Mb/d of NGLs from the Dos Picos assets in the Midland Basin, acquired by Phillips 66 in the $550MM deal for Pinnacle Midstream.

This would leave about 225 Mb/d of third-party NGL volumes on Sand Hills at risk of feeding new NGL pipeline capacity. Phillips 66 disclosed in its recent investor deck that only 22% of its total long-haul NGL volumes will expire within the next five years. That same percentage applied to Sand Hills would mean about 50 Mb/d of implied third-party NGL volumes are at risk.

Asset earnings for Sand Hills have been cloudy after ownership transferred hands. In the latest data, DCP Midstream reported equity earnings of $338MM for 2022 on throughput of 299 Mb/d (net to DCP’s 67% ownership share at the time), implying earnings of $3.10/bbl. This translates to about $60MM in earnings risk on $14B of 2025 mid-cycle adjusted EBITDA target.

The Pinnacle system could see volume growth from producers like ExxonMobil (XOM), cushioning any future losses to Sand Hills. Successful re-contracting would also help mitigate earnings risk over the next five years in an overbuilt NGL takeaway market.

The PSX-Pinnacle tie-up is one example of how the fight for Permian NGL barrels is driving consolidation. Check out East Daley’s NGLs webinar on August 28 to learn more. – Rob Wilson, CFA Tickers: ET, EPD, MPLX, OKE, TRGP.

Join East Daley’s Next Webinar - NGLs Heading into a Super-Volatility Cycle

Don't miss this exclusive webinar diving into trends in NGL markets. We will look at:

- NGLs & commodity ties: Gas, NGLs and Crude - One constraint will constrain all

- Permian back on the board in 4Q24 and what it means for supply

- Activity afoot in the Bakken – Double H impact to the NGL market & the long game

Join us on August 28 at 10 AM MST. Register here.

Sign Up for the NGL Insider

East Daley's NGL Insider provides weekly updates on the US NGLs market including supply and demand fundamentals, basin-level views, and analysis of market constraints and infrastructure proposals. We explore sub-basin dynamics and provide market insights on NGL flows, infrastructure, and purity products. Sign up now for the NGL Insider.

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.

-1.png)

-1.png)

-3.png)