New Fortress Energy (NFE) has loaded the first cargo from its floating LNG platform offshore Altamira, Mexico. The start-up of Mexico’s first liquefaction project will contribute new demand at the Agua Dulce hub in South Texas and boost business for two pipelines in particular.

In a Monday (August 12) video update, NFE said its Altamira Fast LNG (FLNG) asset had successfully loaded the inaugural cargo onto the Energos Princess. The LNG ship will sail to NFE’s import terminal near La Paz on the southern tip of Baja California.

New Fortress had expected to finish commissioning work at the Altamira platform last Friday (August 9) after making first LNG earlier in July. In an August 2 update, NFE said the FLNG project will undergo maintenance for several days after the cargo loading, then ramp to full production later in August ’24. The Altamira platform can produce up to 1.4 Mtpa of LNG (~185 MMcf/d) once fully operational.

NFE developed the Altamira project under an agreement with the Comision Federal de Electricidad (CFE), Mexico’s state-owned electric utility. The CFE will provide feedgas to the offshore platform, and NFE will deliver LNG to several CFE power plants in Baja California on Mexico’s Pacific coast. The region has limited gas pipeline infrastructure, and the CFE relies on oil-fired power generation to meet economic needs.

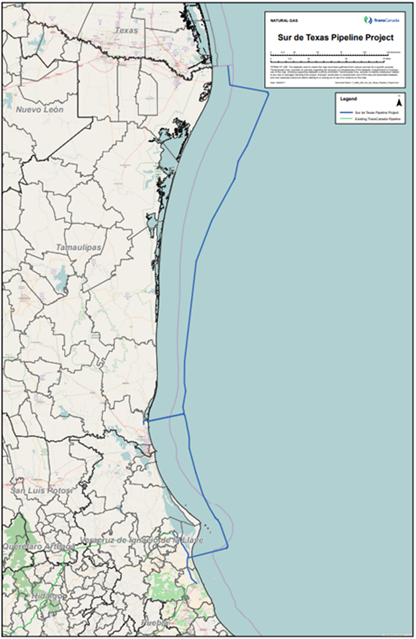

East Daley expects start-up of the Altamira LNG project to bring more demand to several pipeline systems we monitor in the Financial Blueprints. The FLNG platform will receive gas from the offshore Sur de Texas – Tuxpan Pipeline owned by TC Energy (TRP). Sur de Texas receives gas from an interconnect with Enbridge’s (ENB) Valley Crossing Pipeline at the US-Mexico border, and supplies mainly power plants in Altamira, Tamaulipas and Tuxpan, Veracruz (see map).

NFE has received a license from the Department of Energy (DOE) allowing the project to export pipeline gas into Mexico and send LNG to other countries with US free trade agreements. In its DOE application, NFE indicated it would pull gas from the Agua Dulce hub via Valley Crossing Pipeline. The Altamira project is one of several contributing to new demand at the South Texas hub.

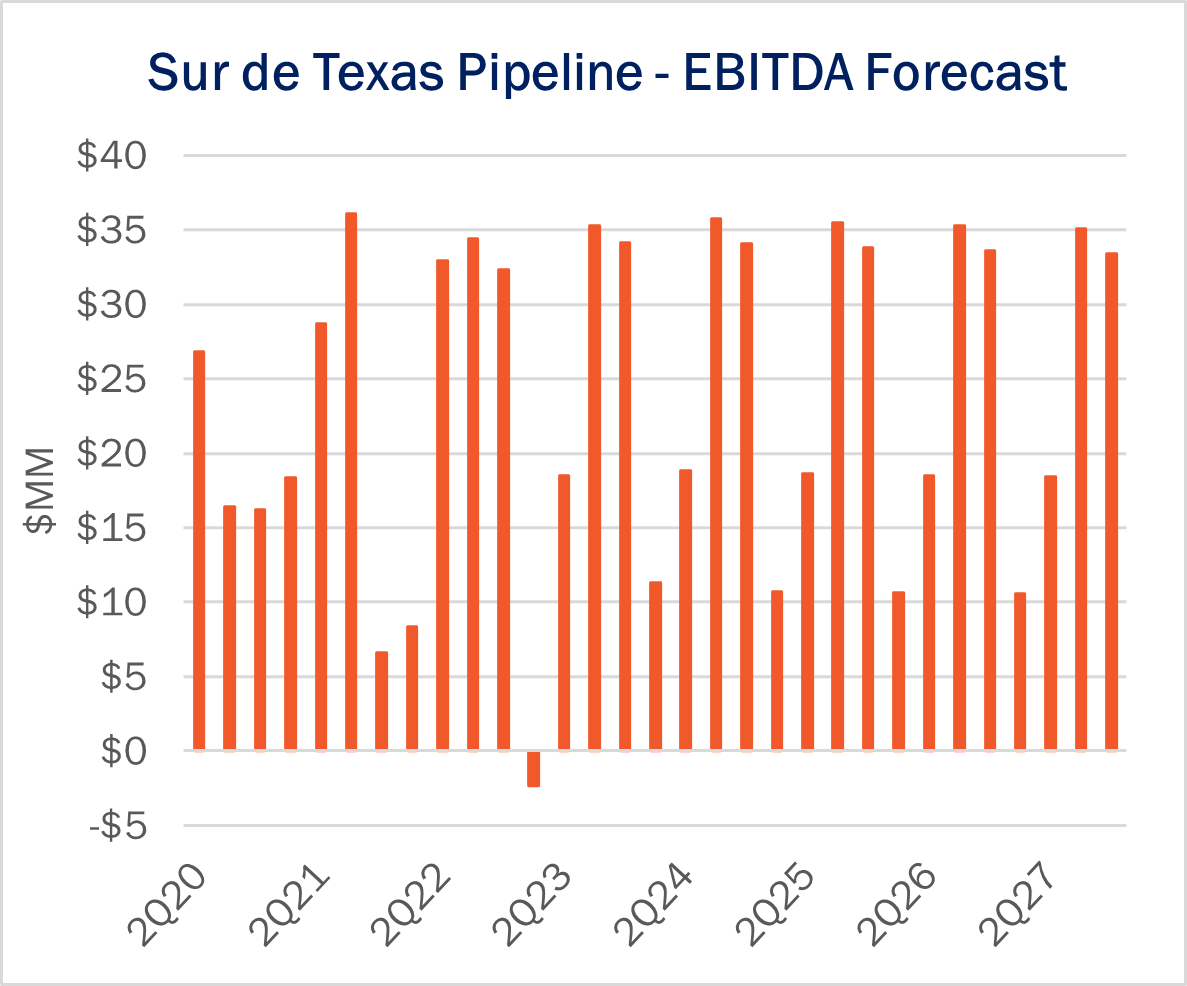

In the case of Sur de Texas, the system historically has seen volatile earnings due to seasonal demand and foreign exchange impacts, but we anticipate the FLNG project will create growth ahead (see EBITDA forecast from the TRP Financial Blueprint). In the long term, NFE envisions developing an LNG export hub at the Altamira site, creating potential upside for the TRP and ENB assets. – Andrew Ware & Zach Krause Tickers: ENB, NFE, TRP.

Join East Daley’s Next Webinar – NGLs Heading into a Super-Volatility Cycle

Don’t miss this exclusive webinar diving into trends in NGL markets. We will look at:

- NGLs & commodity ties: Gas, NGLs and Crude – One constraint will constrain all

- Permian back on the board in 4Q24 and what it means for supply

- Activity afoot in the Bakken – Double H impact to the NGL market & the long game

Join us on August 28 at 10 AM MST. Register here.

Sign Up for the NGL Insider

East Daley’s NGL Insider provides weekly updates on the US NGLs market including supply and demand fundamentals, basin-level views, and analysis of market constraints and infrastructure proposals. We explore sub-basin dynamics and provide market insights on NGL flows, infrastructure, and purity products. Sign up now for the NGL Insider.

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.