NGL takeaway capacity is extremely tight right now from the Permian Basin, but that dynamic is about to change. Almost 1.2 MMb/d of pipeline capacity is set to come online in the next year out of the Permian. East Daley has seen this overbuild movie before, and we’re pretty sure how it will end.

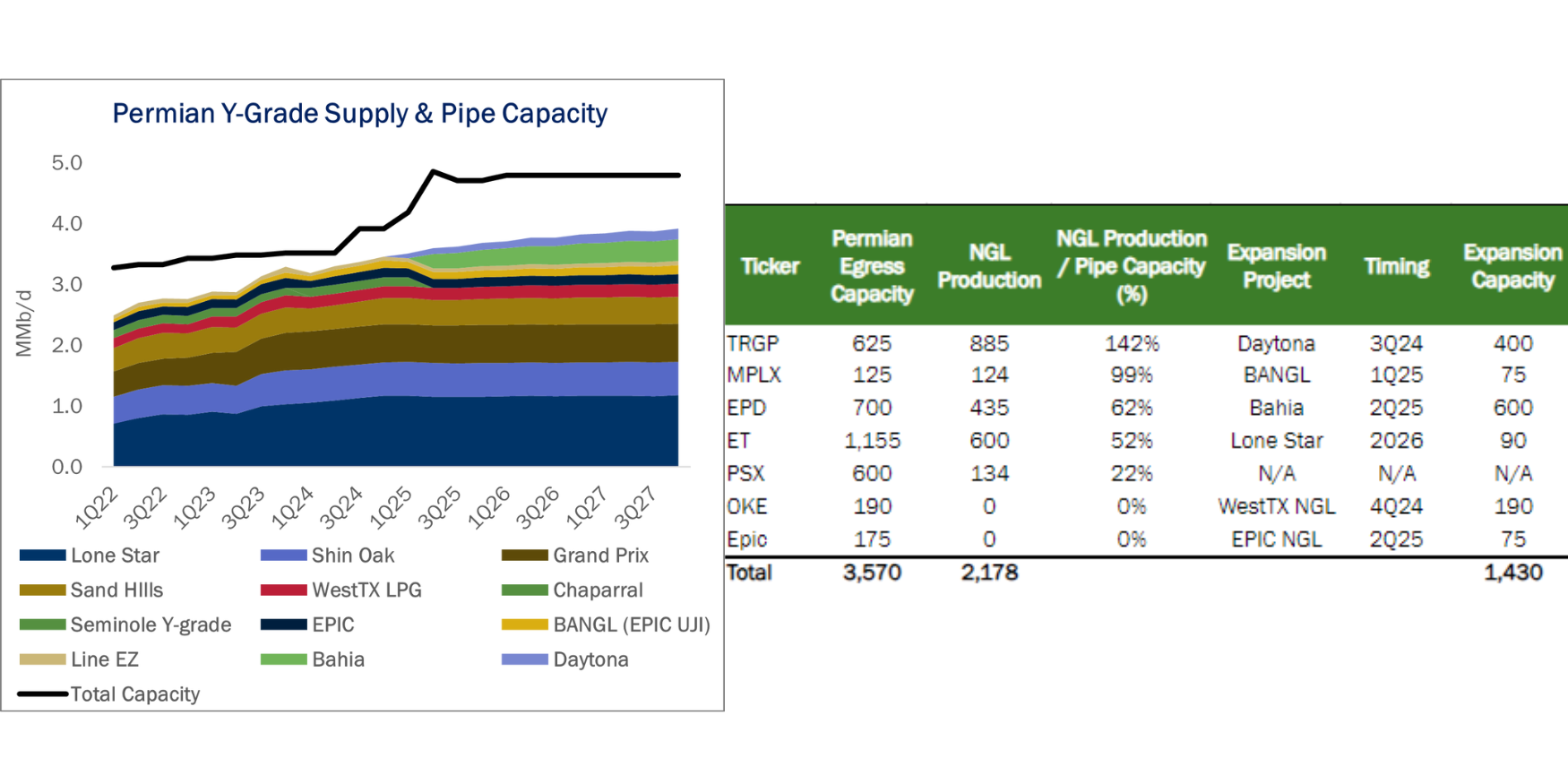

East Daley Analytics is tracking five pipeline expansions in the NGL Hub Model that will loosen NGL pipeline egress from the Permian Basin, and starting soon. Targa Resources (TRGP) plans to begin service on the 400 Mb/d Daytona NGL Pipeline in 3Q or 4Q24. Other expansions ahead include:

- YE24: ONEOK’s (OKE) WestTX NGL expansion (190 Mb/d)

- 2Q25: Enterprise Product’s (EPD) Bahia Pipeline (600 Mb/d)

- 2Q25: MPLX and EPIC’s combined BANGL and EPIC expansions (150 Mb/d)

- 2026: Energy Transfer’s (ET) Lone Star expansion (~90 Mb/d)

These NGL pipeline expansions are shown in the table. Enterprise in 2Q25 plans to return Seminole Pipeline to crude service, reducing NGL takeaway from the Permian by 150 Mb/d. Otherwise, operators over the next 12 months will see significant new options open up to move their NGLs.

We have seen this infrastructure overbuild movie before, and it’s usually legacy pipelines that end up offering free HBO to fill vacancy. In our NGL Hub Model, East Daley expects an average 2025 utilization rate just shy of 80% on pipelines exiting the Permian Basin (see figure).

Ownership of upstream NGL volumes will play a big role separating the winners and losers in this new dynamic. As shown in the table, Targa and MPLX can effectively fill their egress pipes with NGLs produced from their own G&P assets in the Midland and Delaware sub-basins, while Enterprise and ET control over half of the supply moving through their NGL pipelines.

The fight for NGL barrels has been a significant factor driving M&A activity recently in the Permian as the industry prepares for the shift ahead. We will look at the risks, and how companies can defend market share, in the weeks ahead. Check out East Daley’s NGLs webinar on August 28 to learn more. – Rob Wilson, CFA Tickers: ET, EPD, MPLX, OKE, TRGP.

Join East Daley’s Next Webinar – NGLs Heading into a Super-Volatility Cycle

Don’t miss this exclusive webinar diving into trends in NGL markets. We will look at:

- NGLs & commodity ties: Gas, NGLs and Crude – One constraint will constrain all

- Permian back on the board in 4Q24 and what it means for supply

- Activity afoot in the Bakken – Double H impact to the NGL market & the long game

Join us on August 28 at 10 AM MST. Register here.

Sign Up for the NGL Insider

East Daley NGL Insider provides weekly updates on the US NGLs market including supply and demand fundamentals, basin-level views, and analysis of market constraints and infrastructure proposals. We explore sub-basin dynamics and provide market insights on NGL flows, infrastructure, and purity products. Sign up now for the NGL Insider.

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.