MPLX will acquire the remaining 55% interest in BANGL Pipeline for $715MM from affiliates of WhiteWater and Diamondback Energy. The deal is the next big move in the race to control Permian NGLs, expanding MPLX’s reach to export docks on the Texas coast.

MPLX will take full control of the BANGL system stretching from the Permian Basin to fractionation markets on the Gulf Coast. The companies expect to close the deal in July ‘25, according to the February 28 announcement. MPLX guided to mid-teen returns from the purchase.

BANGL can transport up to 250 Mb/d of NGLs currently, and a planned expansion will increase capacity to 300 Mb/d by 2H26.

What We Like: Securing full ownership of BANGL aligns with MPLX’s strategy to control the entire NGL value chain from wellhead to water.

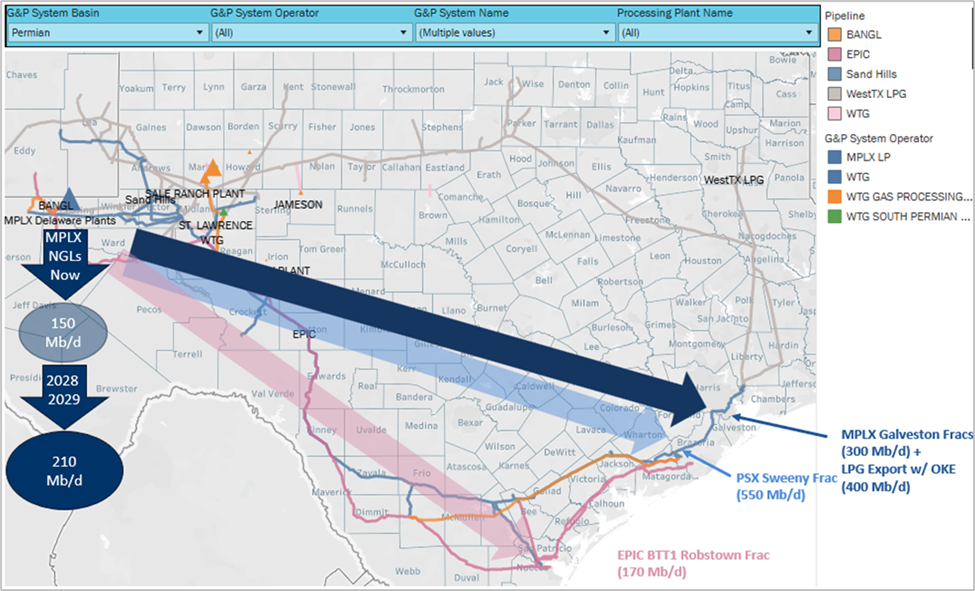

The map in the figure, available in East Daley Analytics’ NGL Hub Model in Energy Data Studio, shows NGL pipeline infrastructure from the Permian to the Texas Gulf Coast. EDA estimates that MPLX currently produces ~150 Mb/d of NGLs from its processing plants in the Permian and sends those volumes to the Robstown and Sweeny fracs on the Texas coast. By 2029, we model MPLX will produce 210 Mb/d of NGLs from its Permian assets, and will be able redirect those liquids to its new fracs under development in Texas City. MPLX can also use BANGL to secure barrels for the new export facility it is developing in a joint venture with ONEOK (OKE).

The Knock-On Effect: The BANGL acquisition introduces downside risk for Phillips 66 (PSX) as MPLX shifts volumes away from PSX’s NGL infrastructure. Phillips owns the Sweeny fractionation complex and is acquiring the Robstown frac via the $2.2B EPIC acquisition. BANGL ownership gives MPLX more flexibility to reduce reliance on PSX systems. – Julian Renton Tickers: MPLX, OKE, PSX.

Data Center Demand Monitor – Available Now!

Introducing Data Center Demand Monitor by East Daley Analytics. This is your go-to source for tracking data center projects and demand. We monitor and visualize nearly 300 US data center projects. Use Data Center Demand Monitor to forecast demand, identify pipeline corridors and track data center projects. — Request your demo now of the Data Center Demand Monitor!

Energy Path – Powered by Energy Data Studio

Introducing Energy Path by East Daley Analytics — a revolutionary tool designed to transform how you view the energy market. With Energy Path, you can seamlessly track the molecule from wellhead to demand, gaining a complete view of the entire oil and gas value chain. From upstream to midstream to downstream, this multi-commodity product offers unparalleled insights across natural gas, NGLs and crude oil. Monitor volumes and fees at every stage, empowering your decision-making with a holistic market perspective.

See energy differently — Request your Energy Path demo now!

The Dirty Little Secrets 2025 Report is Live!

The 2025 Dirty Little Secrets written report is available now. This report goes beyond the webinar discussions to provide a deeper analysis of the topics covered. Learn how commodities are intertwined and identify opportunities for profit from market dislocations. Request a copy of the Dirty Little Secrets report.

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.