In many respects a premiere terminal asset, the Louisiana Offshore Oil Port (LOOP) nevertheless has missed out on rapid growth in Gulf Coast crude oil exports. LOOP’s remote location and nearby pipe constraints pose challenges to ramping exports, a key factor pushing proposals for other deepwater terminals.

Located in the Gulf of Mexico about 20 miles south of Port Fourchon, LOOP boasts several superlatives. It is the only deepwater terminal in the US, meaning LOOP is the only dock capable of loading a very large crude carrier (VLCC) without lightering – eliminating a time-consuming and expensive process. Owned by Shell (46.1%), MPLX (40.7%) and Valero Energy (3.2%), LOOP connects to a major refinery hub at St. James and can load up to 100 Mb/hour of crude.

But is LOOP a good match for exports? Southeastern Louisiana is far away from the Permian and Williston basins, the two main sources of supply growth. In Energy Data Studio, East Daley forecasts Permian oil production to increase by ~3% in 2024 and 7% in 2025. Bakken oil output grows 1% in 2024 and 5% in 2025.

The light sweet barrels from the Bakken and Permian are ideal for export, but LOOP may not be the answer. As currently configured, barrels imported on LOOP are delivered to the St. James market and to tanks in Clovelly, LA with 70+ MMbbl of storage capacity. LOOP’s owners also operate refineries in the area, including Marathon Garyville (597 Mb/d capacity), Valero Saint Charles (340 Mb/d) and the Shell Norco refinery (500 Mb/d). In the Crude Hub Model, we expect St. James refinery demand to remain flat through 2024 and 2025.

In order to boost LOOP exports, investors would need to build more infrastructure to Clovelly. Zydeco Pipeline, the main system delivering barrels into Clovelly, runs nearly full. Moreover, Zydeco and surrounding pipes are configured to carry crude to the refiners in St. James, rather than toward LOOP.

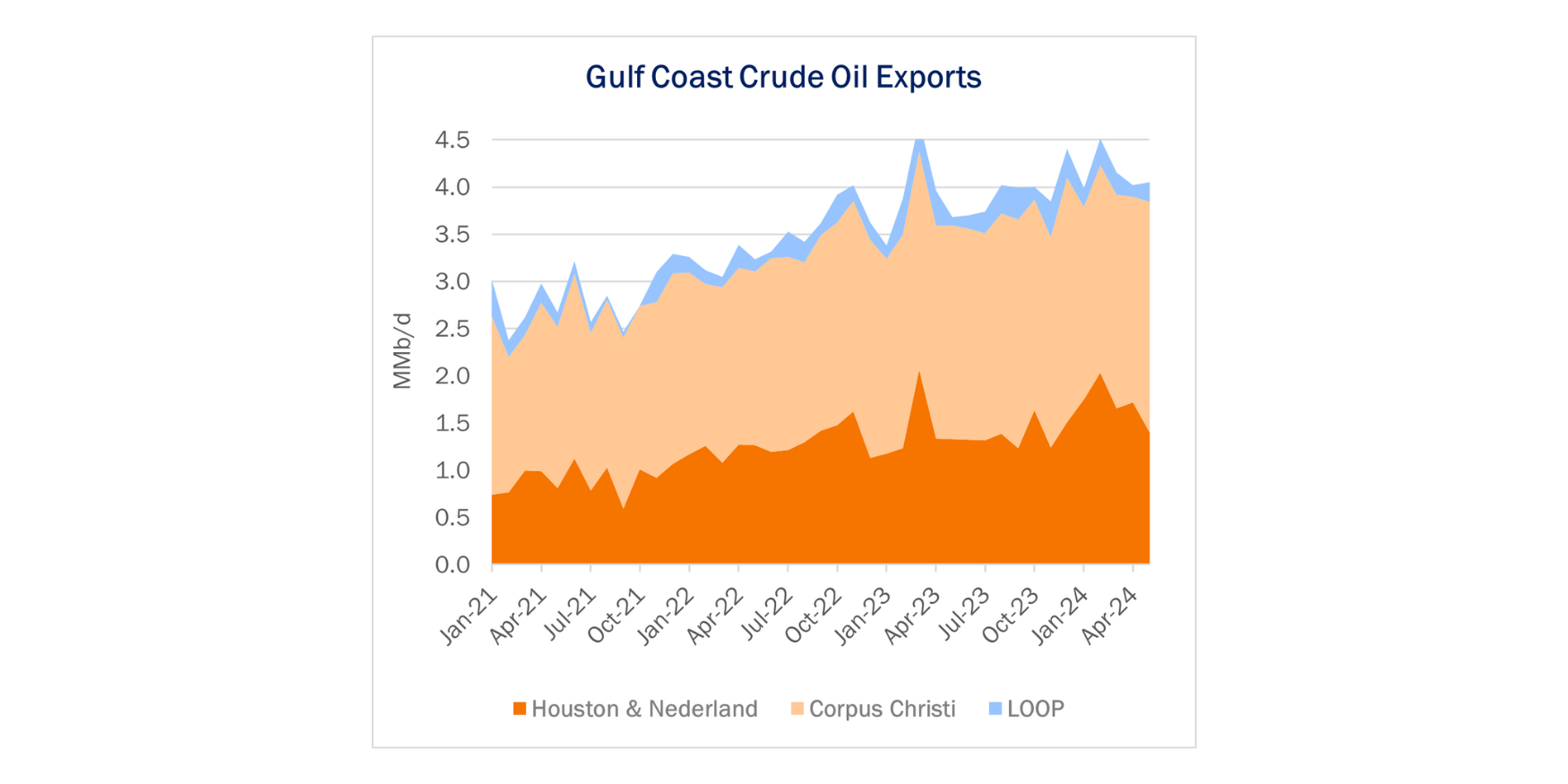

Given these hurdles, LOOP plays a limited role supporting exports. PADD 3 (Gulf Coast) crude oil exports have averaged over 4.1 MMb/d through July ’24, according to Energy Information Administration data, up 1.3 MMb/d since 2021. Yet LOOP only accounts for ~10% of PADD 3 exports, while terminals located near Corpus Christi and around Houston and Nederland have driven growth (see figure from the Crude Hub Model).

East Daley does not believe pipe connectivity around Clovelly will improve any time soon, and we expect LOOP will continue to operate mainly as an import facility. Instead, the industry is competing to build up to four deepwater terminals offshore Texas that could also load a VLCC without lightering. These include Sentinel Midstream’s Texas GulfLink, Energy Transfer’s (ET) Blue Marlin, Enterprise’s (EPD) SPOT, and Phillips 66’s (PSX) Bluewater Texas.

With existing ports nearing capacity on the Gulf Coast, exporters will need new infrastructure to move Permian and Bakken barrels to market. Tickers: EPD, ET, MPLX, PSX, SHEL, VRO.

Sign Up for the NGL Insider

East Daley NGL Insider provides weekly updates on the US NGLs market including supply and demand fundamentals, basin-level views, and analysis of market constraints and infrastructure proposals. We explore sub-basin dynamics and provide market insights on NGL flows, infrastructure, and purity products. Sign up now for the NGL Insider.

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.