Williams (WMB) has won a legal victory in its fight to build Louisiana Energy Gateway (LEG), a critical pipeline for meeting new LNG demand in 2025. The battle over LEG is not over though, creating risk of a supply and demand mismatch in the Gulf Coast market next year.

On June 5, a Louisiana district court ruled in favor of Williams in a lawsuit with Energy Transfer (ET) over rights-of-way to cross ET’s pipelines in southwestern Louisiana. The 36th Judicial District Court in Beauregard Parish granted a permanent injunction to stop ET from interfering with the project, and ruled WMB could proceed with seven proposed crossings for LEG.

Despite the victory, the in-service date for the 1.8 Bcf/d pipeline is still in question. Other segments of the project are still under review outside the parish. ET also has petitioned FERC to review LEG on the grounds that the project should be regulated as an interstate transmission line, rather than as a gathering extension as WMB claims. The petition filed by ET is unusual, so it is unclear how FERC will respond.

The dispute with ET has forced Williams to push back the start date for LEG to 2H25 from 4Q24, creating risk of a pipeline bottleneck when new LNG projects begin service, according to East Daley’s Southeast Gulf Supply & Demand Forecast. Another pipeline project in southwestern Louisiana, Momentum Midstream’s NG3, is also being challenged by ET.

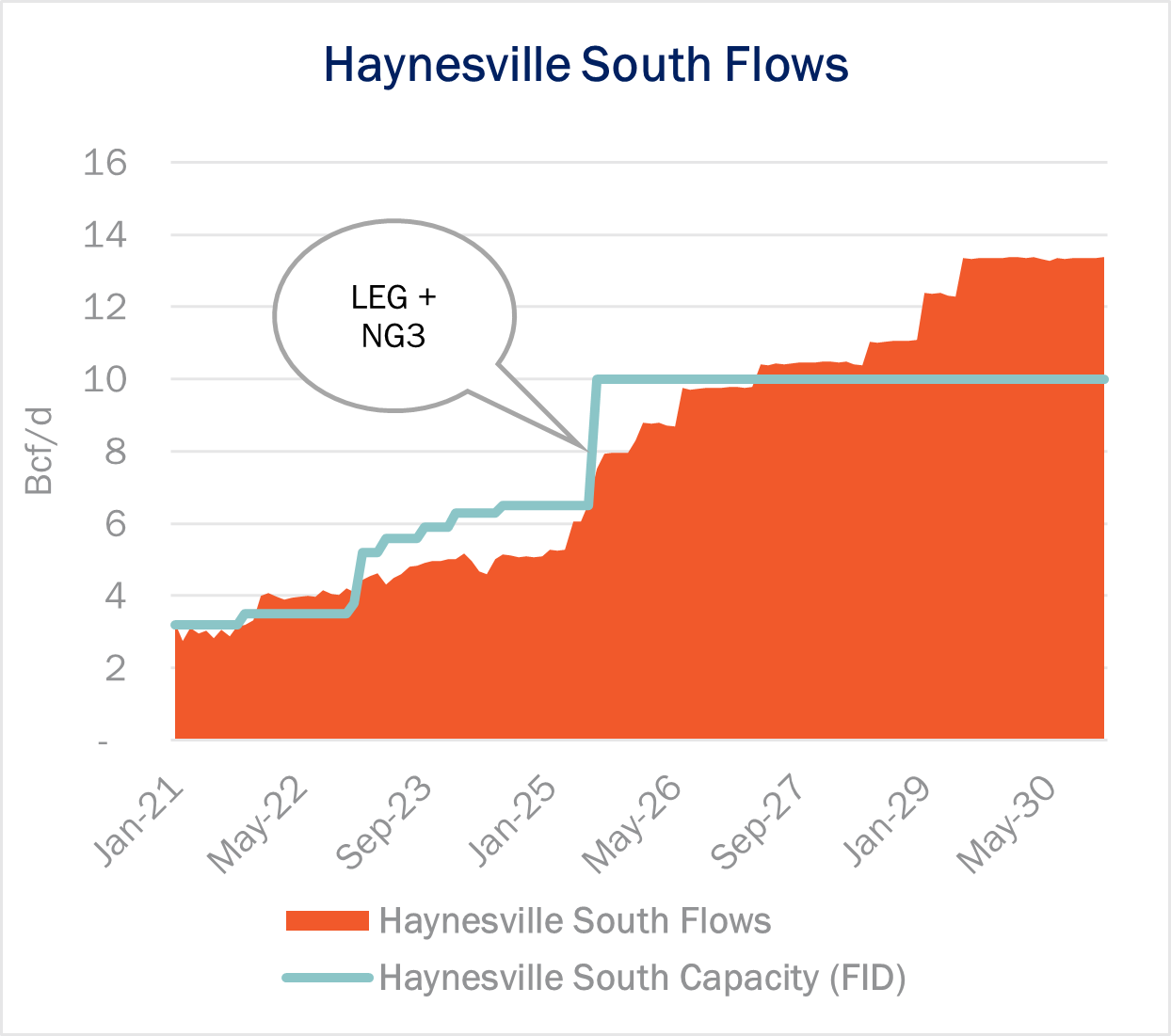

Currently about 5.2 Bcf/d flows on pipelines from the Haynesville to the Louisiana Gulf Coast, or ~82% utilization, according to the Southeast Gulf S&D Forecast. EDA expects spare capacity will fill along this corridor to meet incremental demand from Venture Global’s Plaquemines LNG, and eventually run out past July ’25 (see figure).

If LEG and NG3 are delayed past July ’25, our regional model shows Henry Hub will be short gas needed to meet incremental LNG demand. We have delayed start-up of Golden Pass LNG until July ’25 following the recent bankruptcy of EPD contractor Zachary Holdings, so the Haynesville egress constraint will develop independent of the Golden Pass project.

Any mismatch between supply and demand will have ramifications for regional gas prices. In particular, EDA sees downside risk for the NGPL-TXOK forward curve in 2H25 if new egress pipelines are delayed further. In 2027, we see NGPL-TXOX basis at risk of trading at a significant discount (-$0.90/MMBtu) until additional pipeline capacity connects Haynesville production to LNG export demand. Several midstream companies have announced potential expansions, but we only models projects that have reached a final investment decision (FID). Check out the Southeast S&D Gulf Forecast for more information. – Oren Pilant Tickers: ET, WMB.

Musical Chairs: The Permian G&P Deal Frenzy and Who’s Left Standing Online Webinar

Join us on June 26th at 10 AM MST as we dive into the recent Permian G&P deals, break down the strategic rationale for the buyers, and explore which private G&Ps are next and which publics could make a move. Register here.

Macro S&D: Now Selling Online!

A differentiated methodology using gas infrastructure to track production. Granular in basin production built up into a more accurate macro price forecast. Move beyond daily samples and get ahead of the market. Purchase or learn more about the Macro S&D here.

Sign Up for the Crude Oil Edge.

East Daley’s Crude Oil Edge provides weekly updates on the US crude oil market including supply and demand fundamentals, basin-level views, and analysis of market constraints and infrastructure proposals. We explore sub-basin dynamics and provide market insights on crude oil flows, production growth, and import and export characteristics. Sign up now for the Crude Oil Edge.

Meet with East Daley in Europe. As part of our expansion into European markets, EDA is excited to announce Rob Wilson (VP of Analytics) has an upcoming trip to Europe to present our latest insights on energy markets. Fill out the form to request a meeting.