The Daley Note: May 16, 2023

The latest merger in the Permian oil patch will cost Midstream a few rigs. Several G&P systems are at risk of losing rigs later this year following Callon Petroleum’s (CPE) purchase of Percussion Petroleum Operating II, LLC.

In a bevy of dealmaking, CPE plans to exit the Eagle Ford shale in South Texas while adding to its position in the Permian. The producer announced on May 3 it will acquire the Delaware assets of Percussion Petroleum for $475MM and sell its Eagle Ford assets to Ridgemar Energy Operating, LLC for $655MM. CPE expects to close the two deals effective July 2023.

The sale of the Eagle Ford assets will make Callon an exclusively Permian operator with assets in the Midland and Delaware sub-basins. The combination with Percussion would give CPE estimated production of 107 Mboe/d as of April 2023.

According to CPE’s investor deck, the more streamlined producer does not expect to grow output through 2023. In fact, CPE is guiding to a lower drilling program, cutting back to 5 rigs by YE23 from prior plans for running 6-7 rigs. CPE said it also intends to consolidate 1 Percussion rig into its existing program, suggesting the latest Permian merger could cost up to 3 rigs total.

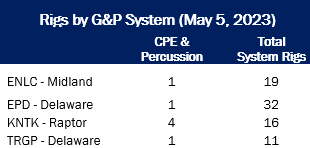

Rig data from East Daley’s Energy Data Studio shows there is currently 1 Percussion rig on Targa Resource’s (TRGP) Delaware system. We are tracking 6 CPE rigs across the Permian that we allocate to EnLink Midstream (ENLC), Enterprise Products (EPD) and Kinetik (KNTK) G&P systems.

We don’t know which midstream companies are vulnerable when CPE pulls back, but based on sheer numbers, Kinetik would be the most susceptible to a cut. The KNTK – Raptor system in the Delaware has the most CPE activity with 4 rigs operating as of May 5, according to our rig allocations. Each of the other systems has 1 CPE rig (see table).

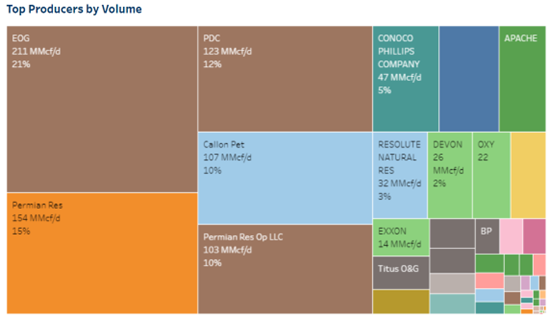

Using the “G&P System Analysis” interface in Energy Data Studio, we can screen for exposure to CPE activity for each of these G&P systems. For example, CPE is a top 4 producer on the KNTK – Raptor system with a 10% share (107 MMcf/d) of processed natural gas volumes (see figure). Other leading producers on the Raptor system include EOG (211 MMcf/d; 21% of total), Permian Resources (154 MMcf/d; 15%) and PDC (123 MMcf/d; 12%). – Kristine Oleszek Tickers: CPE, ENLC, EOG, EPD, KNTK, PDCE, TRGP.

1Q23 Earnings Previews Now Available in Energy Data Studio

East Daley Analytics has published 1Q23 Earnings Previews and Financial Blueprint Models for all midstream companies in our coverage. Our industry-leading Blueprints provide historical and forecasted volumes and financial information for 1,300+ midstream infrastructure assets by individual company.

1Q23 Earnings Previews and updated Financial Blueprints models are available for the following companies: AM, CEQP, DTM, ENB, ENLC, EPD, ET, ETRN, GEL, KMI, KNTK, MMP, MPLX, OKE, NS, PAA, PBA, SMLP, TRGP, TRP, WES and WMB.

Subscribers can access these reports on the Energy Data Studio platform. For more information about East Daley’s Financial Blueprints, please reach out.

Track Midstream Performance in 1Q23 Earnings Reviews

East Daley Analytics is publishing 1Q23 Earnings Reviews as companies provide updates. Use the Earnings Reviews to evaluate performance against our Financial Blueprint Models for the midstream sector. Our industry-leading Blueprints provide historical and forecasted volumes and financial information for 1,300+ midstream infrastructure assets by individual company.

1Q23 Earnings Reviews are now available for AM, CEQP, DTM, ENB, ENLC, EPD, ET, ETRN, GEL, KMI, KNTK, MMP, MPLX, OKE, PAA, PBA, NS, SMLP, TRGP, TRP, WES and WMB. Subscribers can access these reports on the Energy Data Studio platform. For more information about Earnings Reviews, please reach out.

Request Access to Energy Data Studio

East Daley Analytics has launched Energy Data Studio, a platform for our industry-leading midstream data and commodity production forecasts. All clients have access to the new client portal. If you have not yet logged in, please fill out the form to request a registration email be resent.

Energy Data Studio leverages our G&P data set for insights into midstream assets across every major oil and gas basin in North America. Users can navigate detailed visual dashboards by region, pipeline, or individual asset to understand crude oil, natural gas and NGL supply at the most granular level.

Energy Data Studio is available through data downloads from the visual interface, in Excel files, or as a direct feed delivered into subscribers’ workflow via secure file transfer. To learn more about Energy Data Studio, please contact [email protected].

Review the Year Ahead in Dirty Little Secrets

The 2023 Dirty Little Secrets is Now Available! Is Midstream on the cusp of another infrastructure wave? Find out in our new annual report.

Dirty Little Secrets reviews the outlook for Midstream and commodity markets in 2023 and the years ahead. East Daley discusses the outlook for crude oil, natural gas and NGLs and the impacts to midstream assets in our 2023 Dirty Little Secrets annual market report. Click here for a copy of the 2023 Dirty Little Secrets report.

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.