The Daley Note: April 19, 2023

Ethane recovery has taken a hit in the Rockies region as gas prices soared in the West this winter. Volatile commodity markets could create risk for midstream companies balancing spreads and contractual commitments.

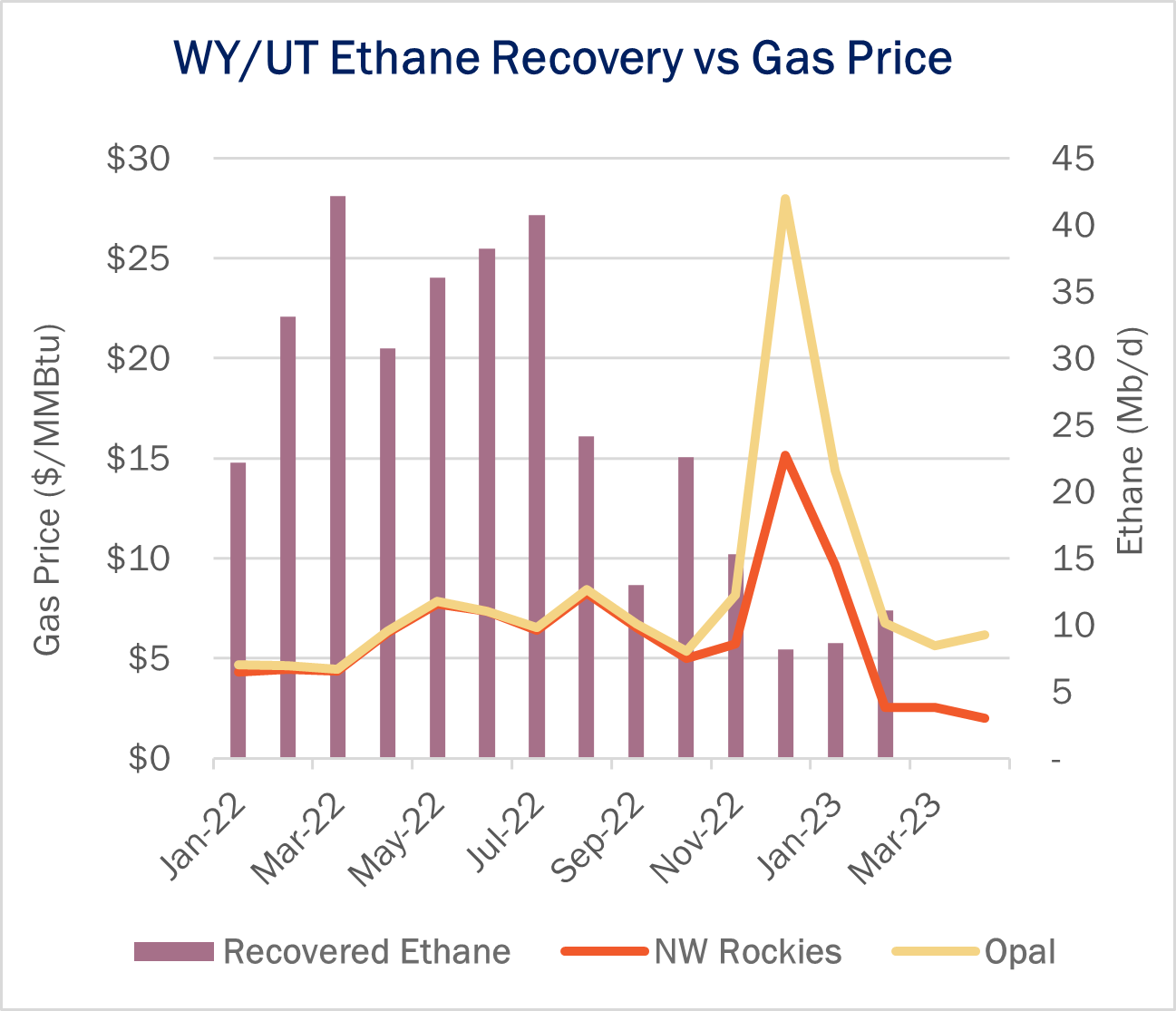

West Coast natural gas prices skyrocketed this winter amid severe weather, record-low regional storage and infrastructure constraints. Strong demand and frigid weather also pulled up gas prices in the Rockies. Spot prices at the Opal and NW Rockies hubs averaged $28 and $15/MMBtu, respectively in December 2022. The price premium in the West has remained in place even as gas prices have fallen to the $2 level nationally.

Ethane recovery becomes uneconomic when natural gas prices are high, since the Btus have more market value sold in the gas stream. The dynamic is evident in East Daley’s processing plant dataset in Energy Data Studio. Total recovered ethane from plants located in Wyoming and Utah saw a sharp drop in volumes as gas prices spiked in December 2022 and January 2023.

The companies contributing the most to this decline are Enterprise Products (EPD) and Williams (WMB). The companies operate EPD – Pioneer and WMB – Echo Springs, two of the largest G&P systems in the Green River Basin.

EPD and WMB could see ripple effects on assets. The sharp drop in recovered ethane will directly affect volumes on NGL egress pipelines such as EPD’s Mid-American Pipeline (MAPL) and WMB’s Overland Pass. East Daley covers these pipelines in the NGL Network Model and as assets in the Financial Blueprints. Moreover, the commodity-exposed contracts underpinning the G&P systems are a cause for concern.

According to the EPD and WMB Financial Blueprints, both companies’ Green River systems are backed by “keep-whole” processing contracts. This type of processing contract allows companies to keep the NGLs extracted from the wet gas stream, but they must replace the Btus with equivalent natural gas. Keep-whole contracts work in Midstream’s favor when gas prices are low and NGL prices are high, but they can lead to financial duress when gas prices spike, as seen in recent months.

Yet, according to our research, the negative implications are not likely to be as bad as commodity spreads suggest. Rockies gas prices remained high in January and February and, while we expect 1Q23 earnings from these assets to fall Y-o-Y and Q-o-Q, earnings remain positive due to stipulations in the keep-whole contracts that place a price ceiling on the gas-replacement cost.

For a detailed update on Enterprise and Williams, check out our latest Financial Blueprints available ahead of 1Q23 earnings. – AJ O’Donnell Tickers: EPD, WMB.

1Q23 Earnings Previews Now Available in Energy Data Studio

East Daley Analytics has published 1Q23 Earnings Previews and Financial Blueprint Models for midstream companies in our coverage. Our industry-leading Blueprints provide historical and forecasted volumes and financial information for 1,300+ midstream infrastructure assets by individual company.

1Q23 Earnings Previews and updated Financial Blueprints models are now available for the following companies: AM, CEQP, DTM, ENB, ENLC, EPD, ET, ETRN, GEL, KMI, KNTK, MMP, MPLX, OKE, NS, PAA, SMLP, TRGP and WES.

Subscribers can access these report on the Energy Data Studio platform. For more information about East Daley’s Financial Blueprints, please reach out.

Request Access to Energy Data Studio

East Daley Analytics has launched Energy Data Studio, a platform for our industry-leading midstream data and commodity production forecasts. All clients have access to the new client portal. If you have not yet logged in, please fill out the form to request a registration email be resent.

Energy Data Studio leverages our G&P data set for insights into midstream assets across every major oil and gas basin in North America. Users can navigate detailed visual dashboards by region, pipeline, or individual asset to understand crude oil, natural gas and NGL supply at the most granular level.

Energy Data Studio is available through data downloads from the visual interface, in Excel files, or as a direct feed delivered into subscribers’ workflow via secure file transfer. To learn more about Energy Data Studio, please contact [email protected].

Review the Year Ahead in Dirty Little Secrets

The 2023 Dirty Little Secrets is Now Available! Is Midstream on the cusp of another infrastructure wave? Find out in our new annual report.

Dirty Little Secrets reviews the outlook for Midstream and commodity markets in 2023 and the years ahead. East Daley discusses the outlook for crude oil, natural gas and NGLs and the impacts to midstream assets in our 2023 Dirty Little Secrets annual market report. Click here for a copy of the 2023 Dirty Little Secrets report.

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.