East Daley forecasts Bakken rich gas to grow at a 2% CAGR from 2024 to ’26, and Hess Midstream (HESM) just took the over on that line. The company issued a bullish outlook that could signal broader supply growth in Bakken commodity streams.

HESM reported earnings last week and guided to CAGR of 10% over the 2024-26 period. The guidance creates upside to EDA’s supply outlook for the company’s Bakken Tioga and Little Missouri G&P asset system, and potentially for the Bakken in general.

HESM accounts for more than 10% of total processed gas in the basin and guided to inlet volumes of about 460 MMcf/d in ’25, fueled by 4 Hess (HES) rigs.

To handle the growth, HESM expects to spend $300MM in 2025 on 1) gas gathering and compression expansions ($175MM) and 2) a new processing plant north of the Missouri River with nameplate capacity of 125 MMcf/d ($125MM).

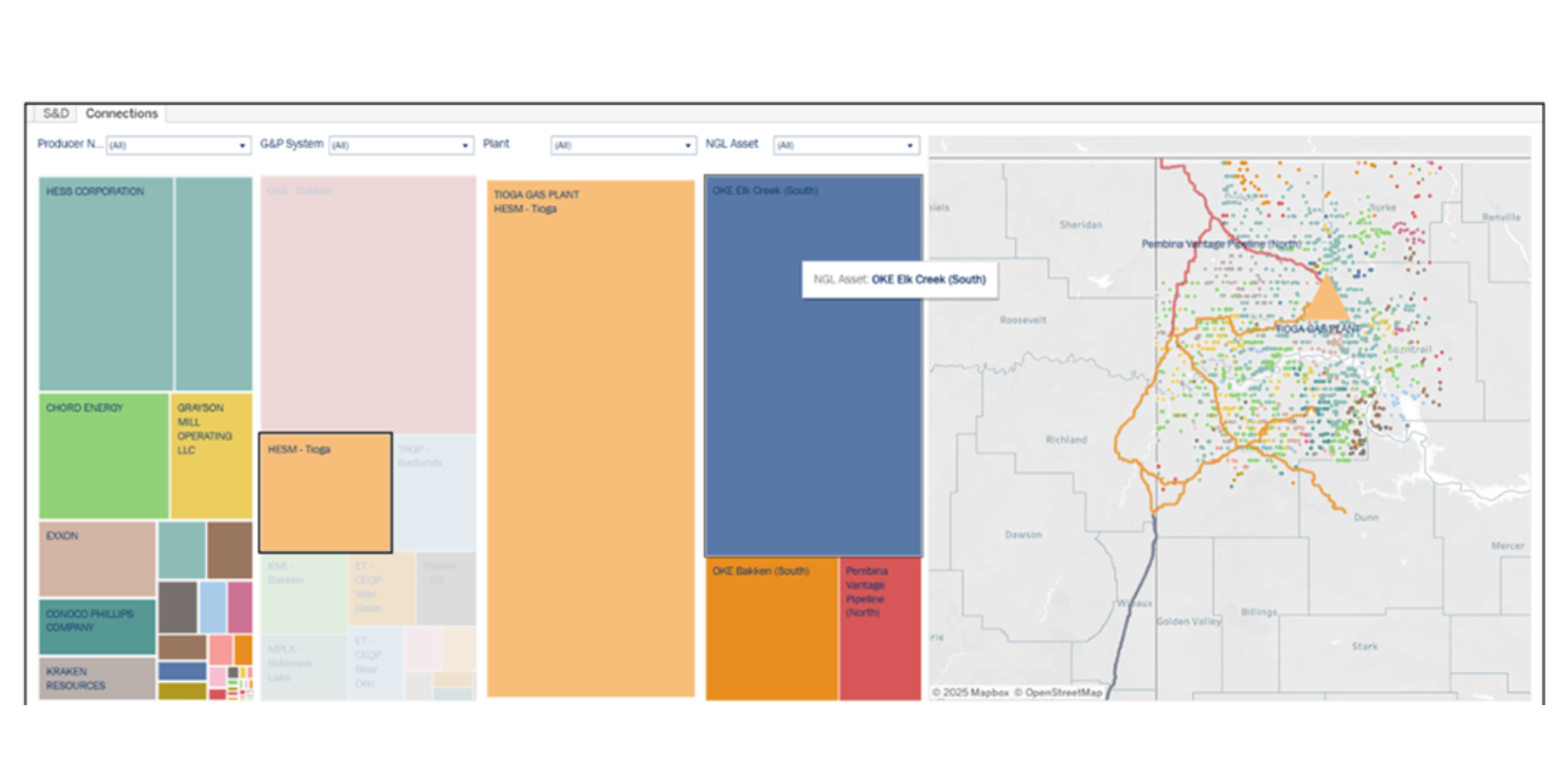

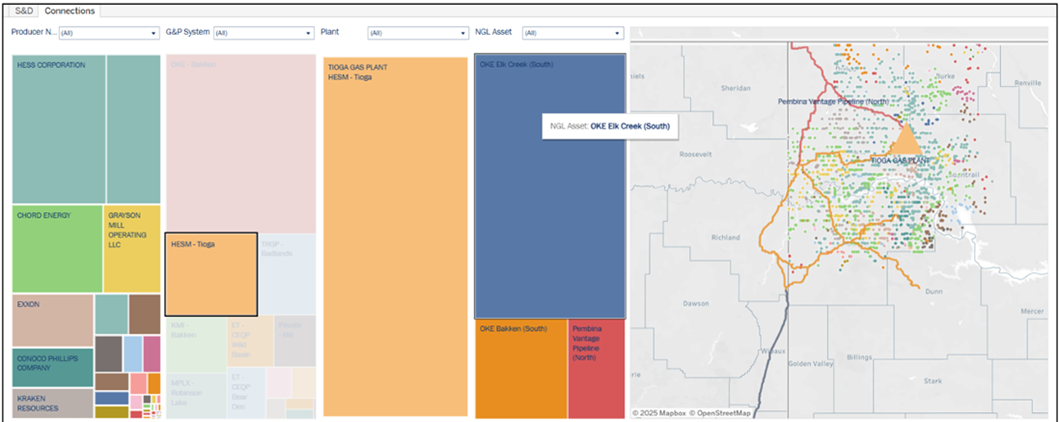

Downstream of the plant, Hess Midstream sends most of its NGLs down ONEOK’s (OKE) Elk Creek Pipeline. The relationship is shown in East Daley’s new Energy Path tool (pictured above) in Energy Data Studio that highlights the pathway a molecule takes from the producer at the wellhead to demand markets. OKE is expanding Elk Creek’s capacity to 435 Mb/d this quarter.

While the Federal Trade Commission has finalized consent for Chevron’s (CVX) acquisition of HES, the deal has been held up by an arbitration case initiated by ExxonMobil (XOM) and CNOOC regarding their rights of first refusal to HES’ 30% stake in the Stabroek Block offshore of Guyana. A three-judge arbitration panel is set to review the case in May ’25.

Reach out to East Daley for a demo of the new Energy Path tool. – Rob Wilson, CFA Tickers: CVX, HES, HESM, OKE, XOM.

Energy Path – Powered by Energy Data Studio

Introducing Energy Path by East Daley Analytics — a revolutionary tool designed to transform how you view the energy market. With Energy Path, you can seamlessly track the molecule from wellhead to demand, gaining a complete view of the entire oil and gas value chain. From upstream to midstream to downstream, this multi-commodity product offers unparalleled insights across natural gas, NGLs and crude oil. Monitor volumes and fees at every stage, empowering your decision-making with a holistic market perspective.

See energy differently — Request your Energy Path demo now!

The Dirty Little Secrets 2025 Report is Live!

The 2025 Dirty Little Secrets written report is available now. This report goes beyond the webinar discussions to provide a deeper analysis of the topics covered. Learn how commodities are intertwined and identify opportunities for profit from market dislocations. Request a copy of the Dirty Little Secrets report.

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.