Oil production in the Denver Julesburg Basin has been steadily rebounding off lows hit during the 2020 downturn and will near pre-COVID output in 1Q24, according to East Daley Analytics’ latest supply forecast.

Located on the Front Range of Colorado and Wyoming, the DJ Basin produced 516 Mb/d of crude oil in September 2023, the latest available field data. In the Production Scenario Tools in Energy Data Studio, East Daley forecasts DJ production will average 521 Mb/d in 1Q24, eclipsing output levels of 516 Mb/d in 1Q20 ahead of the downturn. Production in the DJ would be up 140 Mb/d from the lows hit in 1Q21, though still down 8% from a high of 565 Mb/d reached in November 2019.

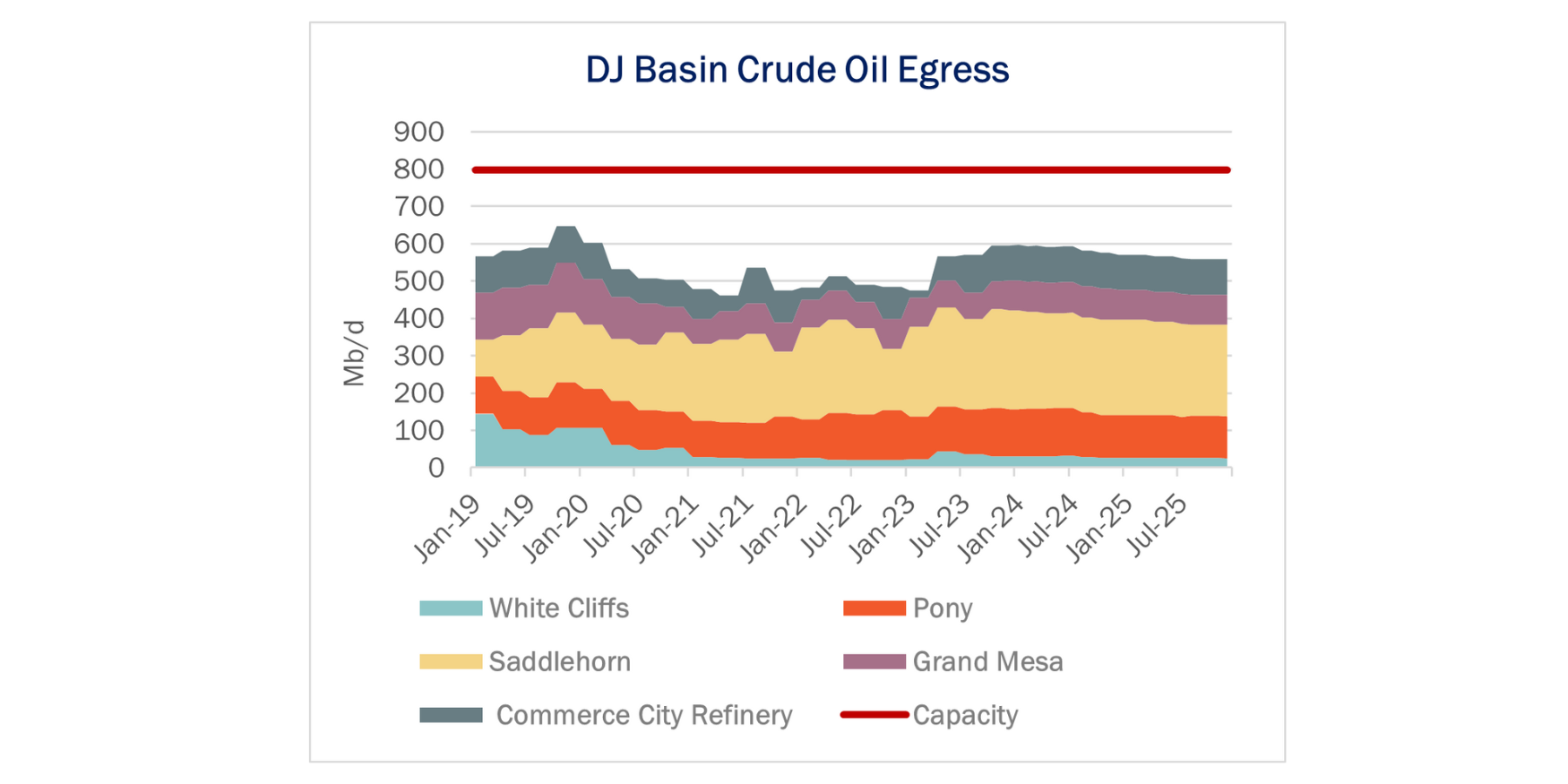

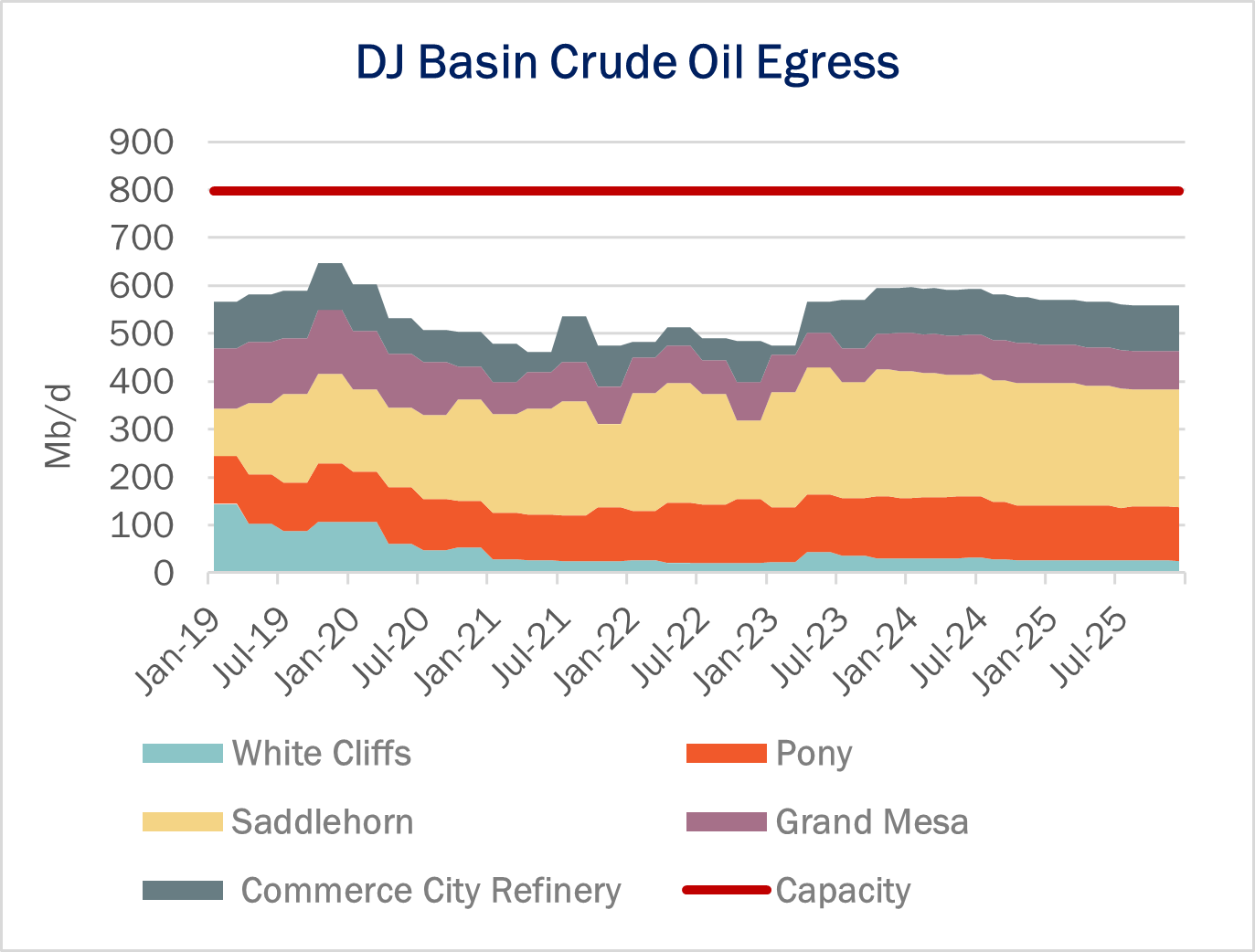

Pipelines serving the DJ Basin also pick up crude oil from the Williston and Powder River basins, and these flows are at an all-time high of 114 Mb/d, according to EDA’s Crude Hub Model. The local DJ production plus inbound flows brought total oil volumes moved out of the DJ to 630 Mb/d in September 2023.

At a high level, the DJ appears to have plenty of pipeline egress with overall utilization of 79%. However, two of the four main pipelines delivering barrels to the Cushing hub are nearing capacity. Saddlehorn Pipeline, owned by Plains All American (PAA) and ONEOK (OKE; formerly Magellan), and Tallgrass Energy’s Pony Express are both at ~86% utilization in the Crude Hub Model.

Pony Express has excelled at attracting Bakken and Guernsey barrels in Wyoming through joint tariffs with Double H and TrueCos/Bridger pipelines. Additionally, Pony Express expanded the Northeast Colorado lateral to move barrels in Laramie County, WY and northeastern Weld County, CO. Saddlehorn Pipeline also provides optionality to attract Powder River production at the Guernsey market via Plains Pipeline. In late December 2023, Plains announced an alternative destination at Platteville, CO in the event transportation to Cushing is constrained.

Energy Transfer’s (ET) White Cliffs Pipeline and NGL Partners’ Grand Mesa both have opportunities for more volume at 32% and 47% utilization, respectively. Last week, NGL Partners published an aggressive interruptible tariff rate of $1.95/bbl from Platteville, CO to Cushing.

EDA forecasts DJ Basin production to reach a near-term peak of 522 Mb/d in February ‘24 and then gradually decline through 2H24. Based on our outlook, pipelines serving the DJ should look to firm up long-term commitments before production turns over later this year. – Kristine Olesczek Tickers: ET, OKE, PAA.

Dirty Little Secrets is Now Available

Dirty Little Secrets is now available. East Daley held our Dirty Little Secrets annual webinar on Wednesday, December 13. In “Volatility Will Continue Until Morale Improves,” we reviewed the factors likely to drive volatility ahead in oil, natural gas and NGL markets. We review the outlook for these markets and the midstream sector. Review the Dirty Little Secrets webinar here.

East Daley, Hart Bring NEW Gas & Midstream Weekly

East Daley is teaming up with Hart Energy on the NEW Gas & Midstream Weekly newsletter. This new report combines the strengths of Hart Energy’s journalistic reporting and analysis on natural gas, LNG, midstream energy and deal-making with EDA’s deep research and intelligence of hydrocarbons, storage and transportation.

Published every Thursday morning, this new powerhouse newsletter is an interactive and enlightening read highlighting breaking news, exclusive interviews, videos, charts, maps and more. The newsletter utilizes East Daley’s Energy Data Studio tools for natural gas predictive analytics with Hart Energy’s Rextag mapping tools to present a holistic view of pricing triggers, infrastructure growth, pipeline and processing bottlenecks, regulatory and legal hurdles, and the inevitable solutions.

Energy Data Studio

East Daley Analytics has launched Energy Data Studio, a platform for our industry-leading midstream data and commodity production forecasts. All clients have access to the new client portal. If you have not yet logged in, please fill out the form to request a registration email be resent.

Energy Data Studio leverages our G&P data set for insights into midstream assets across every major oil and gas basin in North America. Users can navigate detailed visual dashboards by region, pipeline, or individual asset to understand crude oil, natural gas and NGL supply at the most granular level.

Energy Data Studio is available through data downloads from the visual interface, in Excel files, or as a direct feed delivered into subscribers’ workflow via secure file transfer. To learn more about Energy Data Studio, please contact [email protected].

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.