The Daley Note: September 8, 2022

Energy Information Administration (EIA) data for the week ending August 19 continues to show weakening domestic petroleum demand relative to pre-pandemic levels. The demand values would be worse if it weren’t for total petroleum exports, which are on a tear in 2022 after hitting a record 11.1 MMb/d last week.

Driven by tightening international supply and growing production out of the Permian Basin, East Daley expects petroleum exports will continue to post record numbers well into 2023. This is a bullish tailwind for export assets owned by Enterprise Products (EPD), Enbridge (ENB) and NuStar (NS).

Inventories also continue to decline, albeit at a slower pace than last week’s report, falling ~3.3 MMbbl to 421.7 MMbbl. PADD 5 led the decline at ~2 MMbbl, while the Cushing Hub saw a small build of +426 Mbbl, leaving inventories at a paltry 25.8 MMbbl.

Crude production saw a 100 Mb/d decline for the second week in a row to 12.0 MMb/d according to the EIA, trailing East Daley’s expectation of 12.25 MMb/d for August. Relative to the EIA, we are also bullish crude oil production well into 2023.

according to the EIA, trailing East Daley’s expectation of 12.25 MMb/d for August. Relative to the EIA, we are also bullish crude oil production well into 2023.

The EIA data indicates the production decline originates in the lower 48, with Alaska’s production down only 6 Mb/d W-o-W. EIA reports updated weekly crude data later today (Wednesday, August 31) in its Petroleum Status Report.

For an updated outlook on crude volumes, request access to our August Crude Network Model (released Aug. 31) or log in to East Daley to download the latest model. Contact AJ O’Donnell with any questions about our crude forecasting.

Subscribe to The Daley Note (TDN), “midstream insights delivered daily,” covers news, commodity prices, security prices, and EDA research likely to affect markets in the short term.

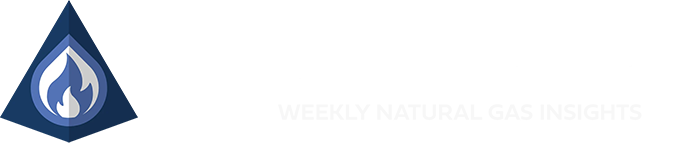

North American Energy Indicators and Equity Prices

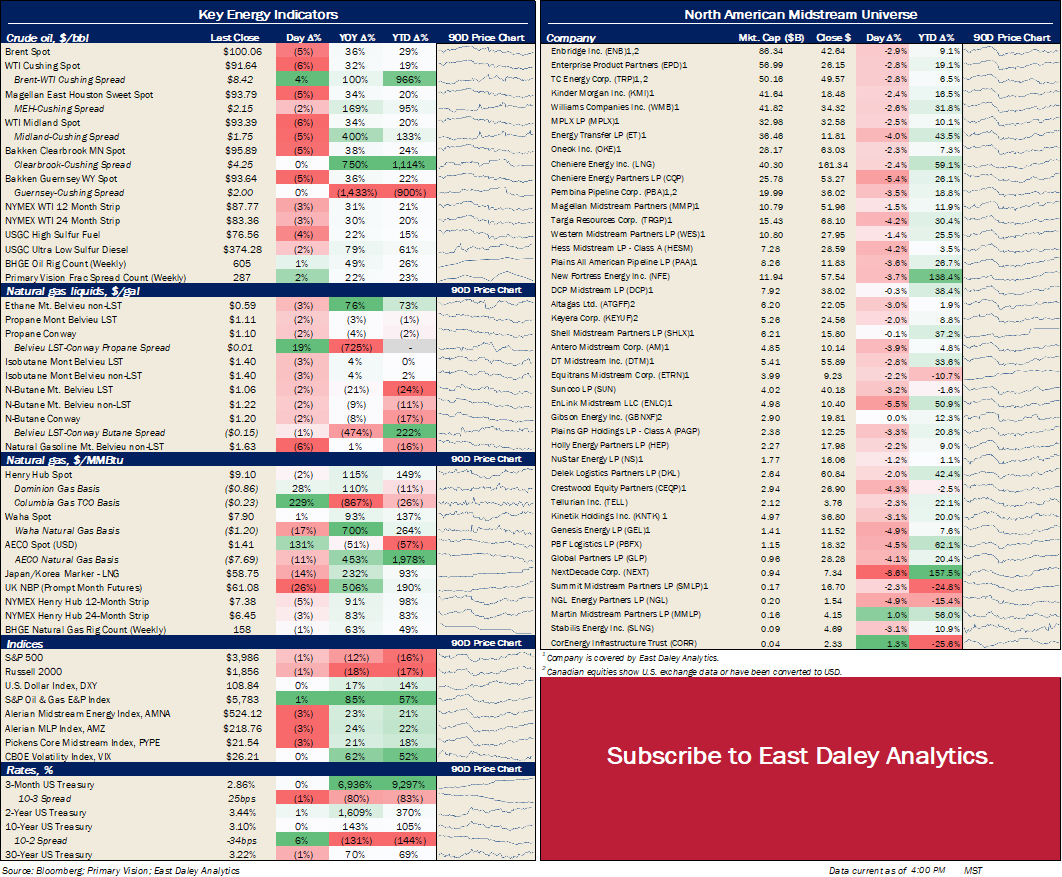

Key Private Debt Metrics

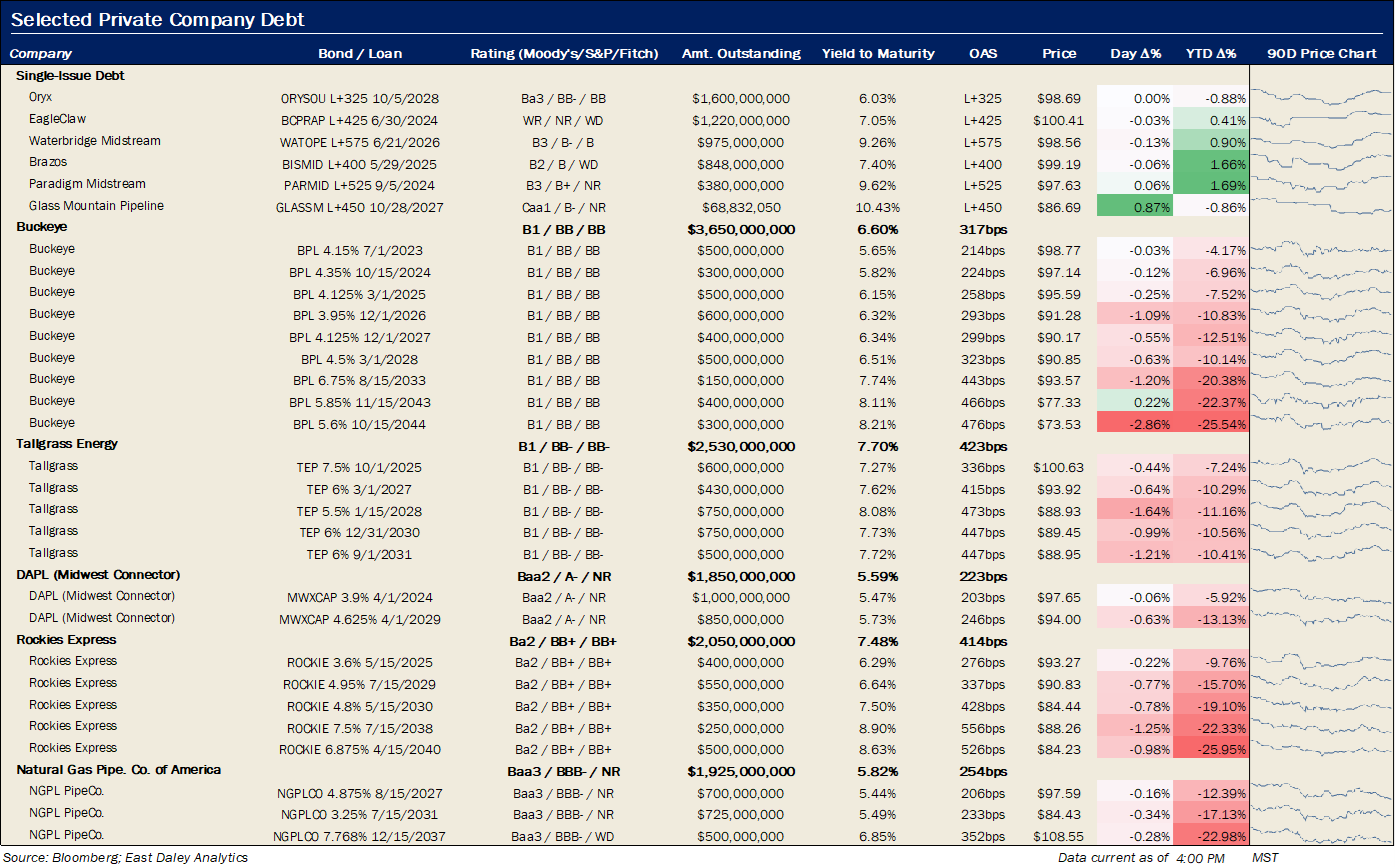

North American Natural Gas Prices

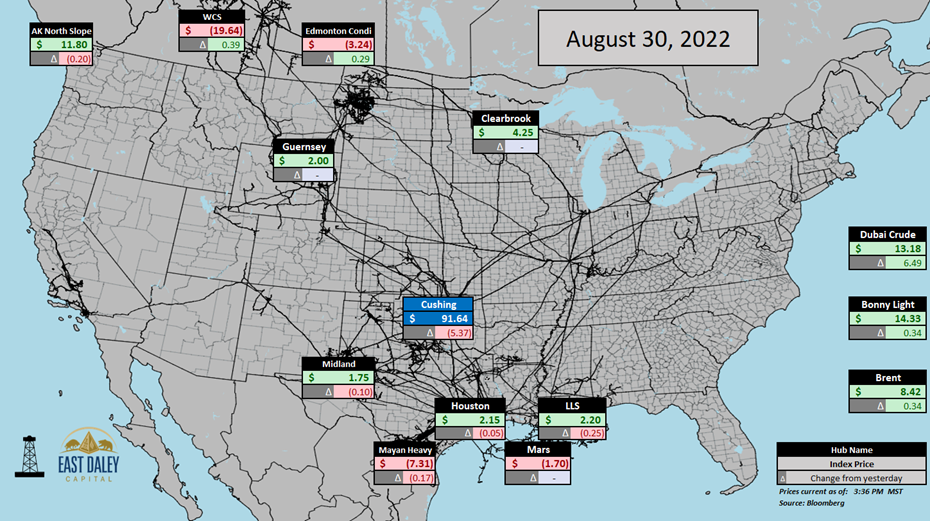

North American Crude Oil Prices

North American Natural Gas Liquids Prices

Subscribe to The Daley Note (TDN), “midstream insights delivered daily,” covers news, commodity prices, security prices, and EDA research likely to affect markets in the short term.