Western Midstream (WES) is riding growing interest in the Powder River Basin thanks to its recently acquired Meritage Midstream assets. Rig counts in the Powder River have ticked up from 9 in mid-February to 13 currently, and WES is capturing much of the action, according to East Daley Analytics’ rig allocation model.

The recent rig gains in the Powder River buck a broader decline in US drilling activity in 2024, dragged down by industry consolidation and low natural gas prices. Small private operators 1876 Resources, Rockies Resources, Ballard Petroleum, and WRC Energy recently brought back rigs to the Powder River, while regulars such as Anshutz and Continental Resources have long used multiple rigs in the Wyoming basin.

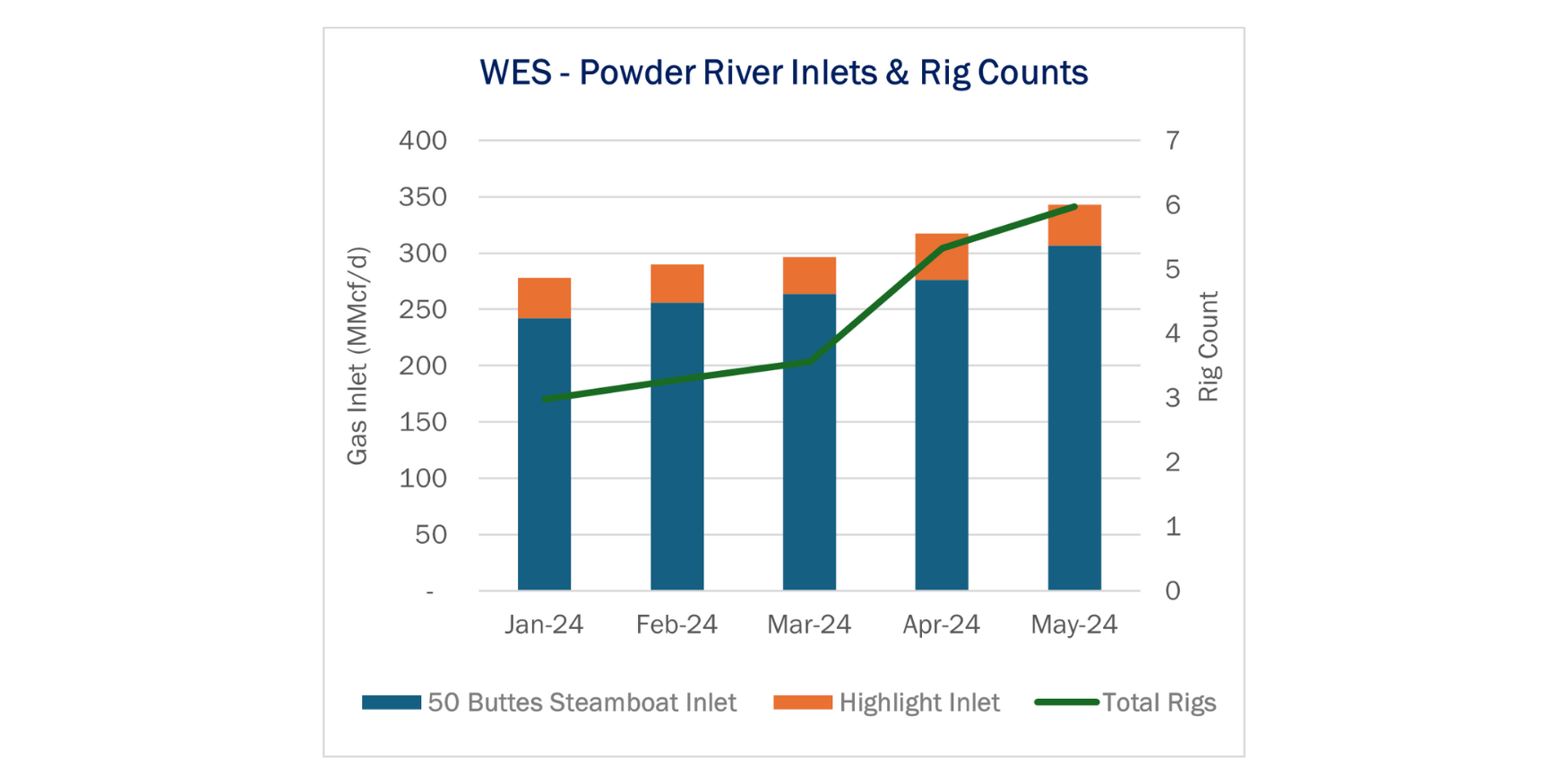

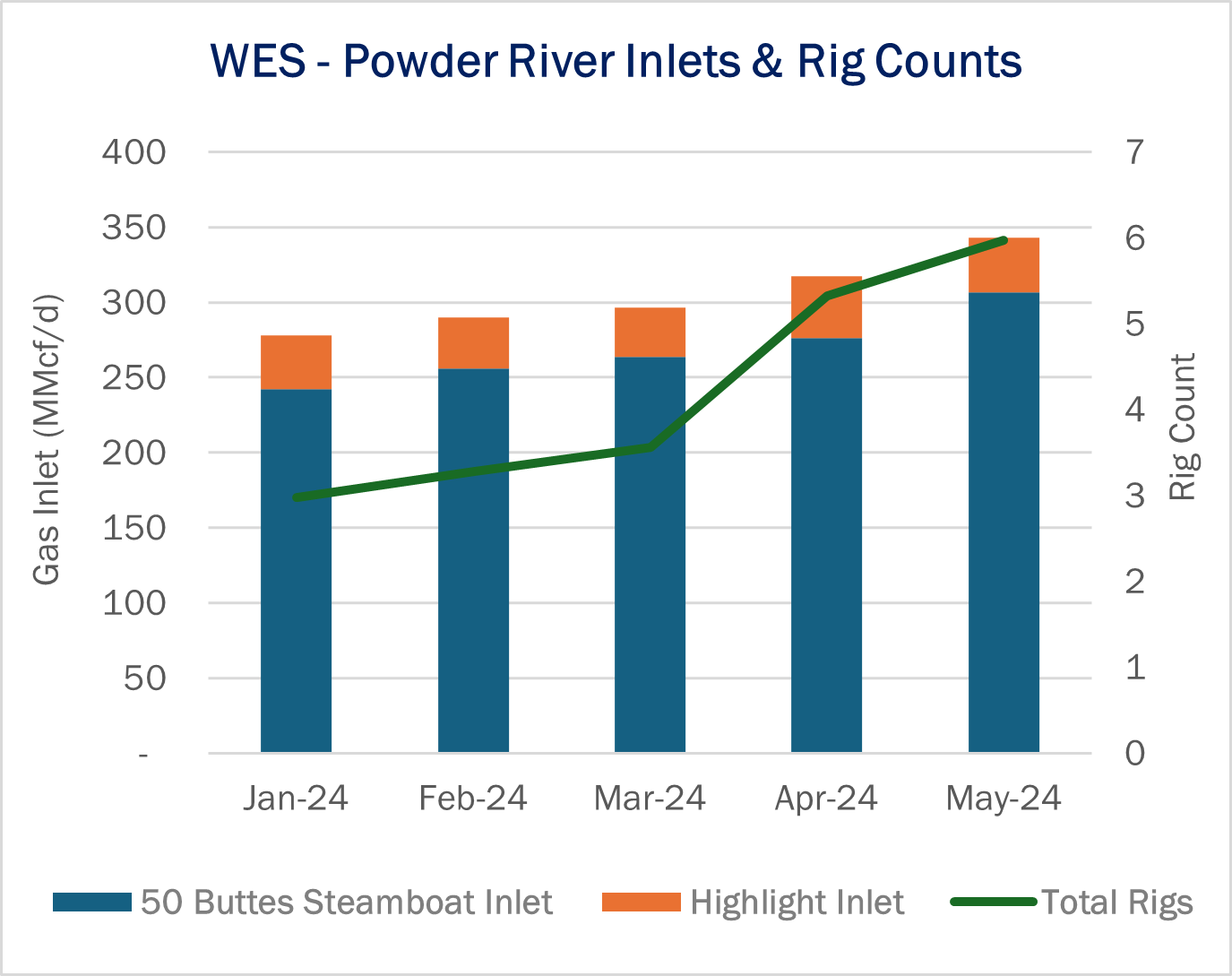

EDA monitors rig counts by basin and by G&P system in the weekly Midstream Activity Tracker. In our G&P allocation model, we currently allocate 6 rigs to WES’ G&P systems in the Powder River, including 4 on Meritage Midstream and 2 on the legacy Hilight asset (see figure). Both systems have picked up activity recently. We allocate 2 additional rigs from 1876 Resources and Rockies Resources to the Meritage system, and 2 rigs from WRC Energy and Ballard Petroleum to Hilight.

WES closed on the $885MM Meritage Midstream acquisition in October ’23. Since the start of 2024, combined gas inlet volumes for the Meritage and Hilight systems have grown 58%, with nearly all of the gains occurring on the Meritage assets (i.e. the 50 Buttes and Steamboat processing plants).

The growth in gas volumes is also benefiting the Thunder Creek NGL pipeline acquired from Meritage. The Thunder Creek line collects NGLs from the 50 Buttes and Steamboat plants, and throughput increased 35% in 1Q24 vs 1Q23 levels, according to data reported to the Federal Energy Regulatory Commission (FERC).

In the WES Financial Blueprint, East Daley estimates the Powder River Basin Meritage G&P and NGL assets will contribute $125MM in EBITDA in 2024. The assets account for nearly 8% of EBITDA in WES’ Gathering and Processing segment and 5% of companywide EBITDA. – James Taylor Tickers: WES.

Propane Supply and Demand Report and Data Set: Coming Soon

Propane Supply and Demand is a Data File & Report that includes historical and forecasted supply and demand components for propane including gas plant propane production, refinery propane production, domestic demand from steam crackers and other consumption, plus propane (LPG) exports. Learn more about the Propane Supply and Demand Report and Data Set.

Sign Up for the Crude Oil Edge

East Daley’s Crude Oil Edge provides weekly updates on the US crude oil market including supply and demand fundamentals, basin-level views, and analysis of market constraints and infrastructure proposals. We explore sub-basin dynamics and provide market insights on crude oil flows, production growth, and import and export characteristics. Sign up now for the Crude Oil Edge.

Energy Data Studio

East Daley Analytics has launched Energy Data Studio, a platform for our industry-leading midstream data and commodity production forecasts. All clients have access to the new client portal. If you have not yet logged in, please fill out the form to request a registration email be resent.

Energy Data Studio leverages our G&P data set for insights into midstream assets across every major oil and gas basin in North America. Users can navigate detailed visual dashboards by region, pipeline, or individual asset to understand crude oil, natural gas and NGL supply at the most granular level.

Energy Data Studio is available through data downloads from the visual interface, in Excel files, or as a direct feed delivered into subscribers’ workflow via secure file transfer. To learn more about Energy Data Studio, please contact [email protected].

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.