Haynesville operators are sitting on ~1.2 Bcf/d of unused gas production from choked or delayed wells, according to a review by East Daley Analytics of the ArkLaTex Basin model. This latent supply isn’t affecting markets now but does lend confidence in our bullish outlook for Haynesville assets in 2025.

Our estimate of spare production capacity is based on a trend EDA has observed in the monthly basin forecasts in the Production Scenario Tools (available in Energy Data Studio), whereby gas delivery from the Haynesville play in East Texas and northern Louisiana has consistently underperformed our model.

Since January 2023, producers in the Haynesville have cut drilling activity roughly in half, from a peak count of 91 rigs in March ‘23 to a low of 41 rigs in July ‘24. Today rigs sit at 44. Yet even with these steep cuts, gas production has fallen much more sharply than rig counts alone would indicate in our basin model. This wedge of ‘unseen’ supply includes wells that operators have choked back or shut in, plus a growing inventory of drilled but uncompleted wells (DCUs) as operators slow completion work.

This 1.2 Bcf/d of ‘ready’ production can come online more quickly than rig-driven supply and will help ArkLaTex producers respond rapidly to higher gas prices. In the US Macro Supply & Demand Forecast, we anticipate growing LNG demand this winter and through 2025 from the start-up of Plaquemines LNG and the Corpus Christi Phase 3 expansion.

G&P assets in the Haynesville have seen a weaker performance in 2024 given low prices and underwhelming supply. In the US Macro Supply & Demand Forecast, East Daley expects gas prices to rise above $3/MMBtu this winter, spurring a resurgence in Haynesville production.

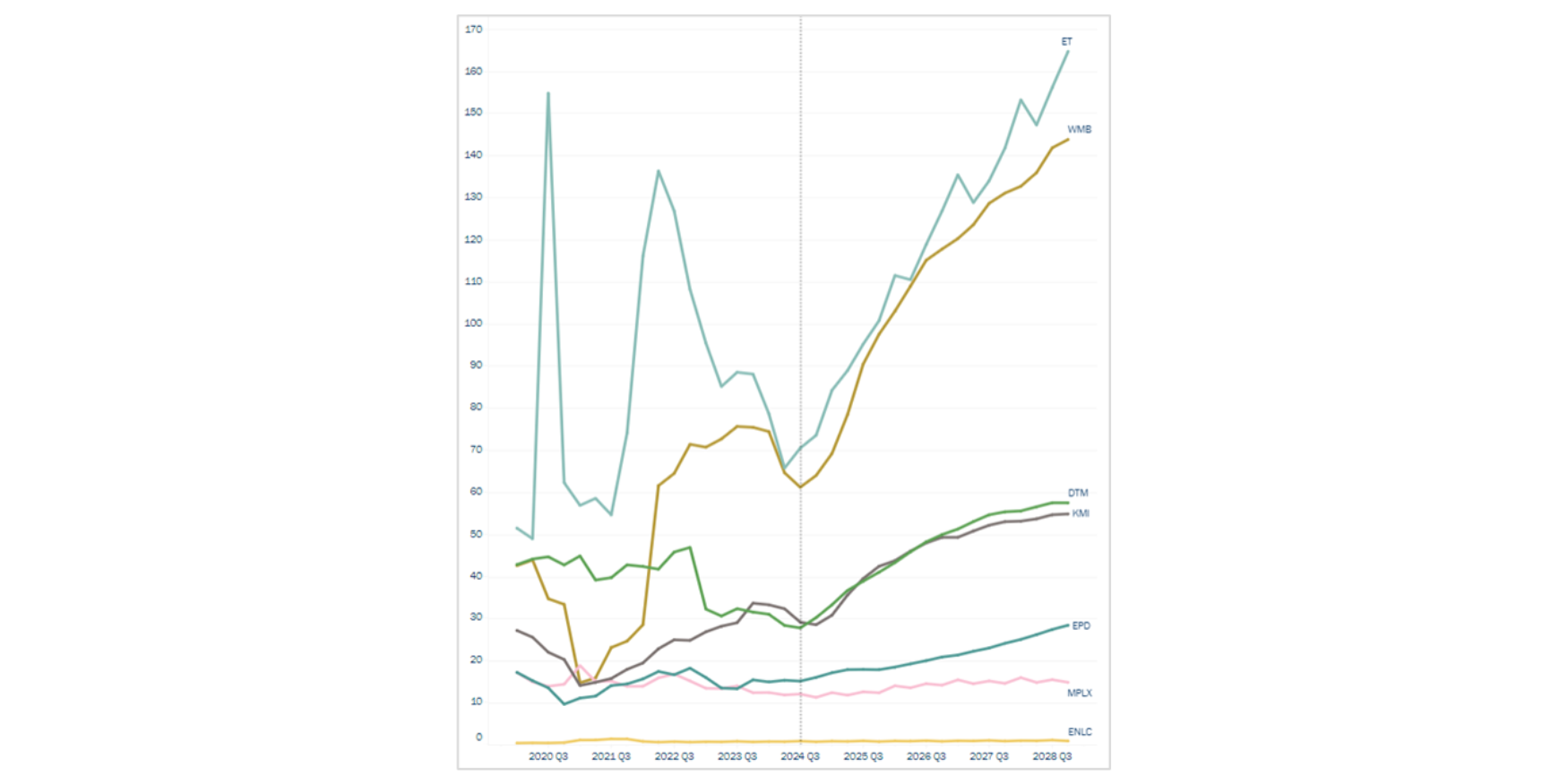

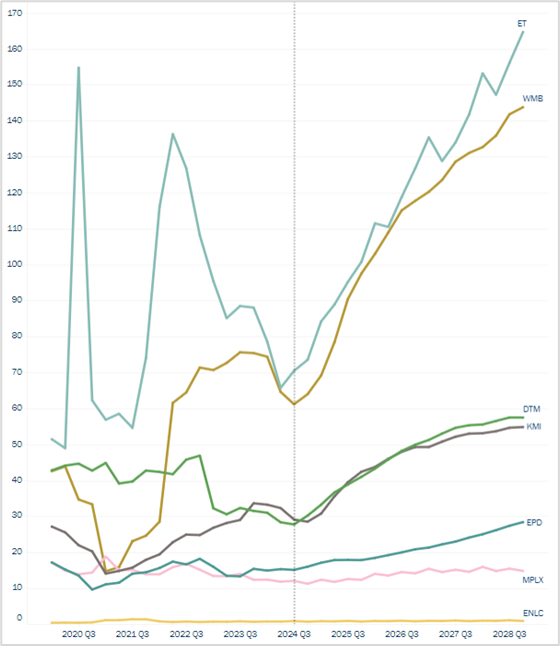

This outlook for improved performance in 2025 is also reflected in the Financial Blueprints for Haynesville G&P asset owners. The figure shows ours EBITDA forecast for ArkLaTex assets by company, courtesy of the Peer Comparison Tool in Energy Data Studio.

As shown in the figure, EDA forecasts higher earnings in 1Q and 2Q25 for many Haynesville G&P systems, including for owners Energy Transfer (ET), Williams (WMB) and DT Midstream (DTM). Assuming new LNG projects start as planned next year, the latent Haynesville capacity gives us confidence that gas supply can respond rapidly and grow earnings for these companies. – Alex Gafford Tickers: DTM, ET, WMB.

NEW Webinar – Fast and Furious: Production, Constraints and Opportunity

East Daley will host our latest MCAP webinar on September 25th at 10 am MT. In “Fast and Furious: Production, Constraints and Opportunity,” we will look at opportunities across the energy complex:

- Crude: Double H Conversion’s impact on crude fundamentals, and who can capture that upside.

- Gas: What the Blackcomb pipeline means for TRGP’s G&P growth in the Permian.

- NGLs: The fight for barrels in the Permian, and the implications of OKE’s acquisition of ENLC.

Register here to join us.

Sign Up for the NGL Insider

East Daley NGL Insider provides weekly updates on the US NGLs market including supply and demand fundamentals, basin-level views, and analysis of market constraints and infrastructure proposals. We explore sub-basin dynamics and provide market insights on NGL flows, infrastructure, and purity products. Sign up now for the NGL Insider.

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.