Natural Gas Weekly: August 24, 2023

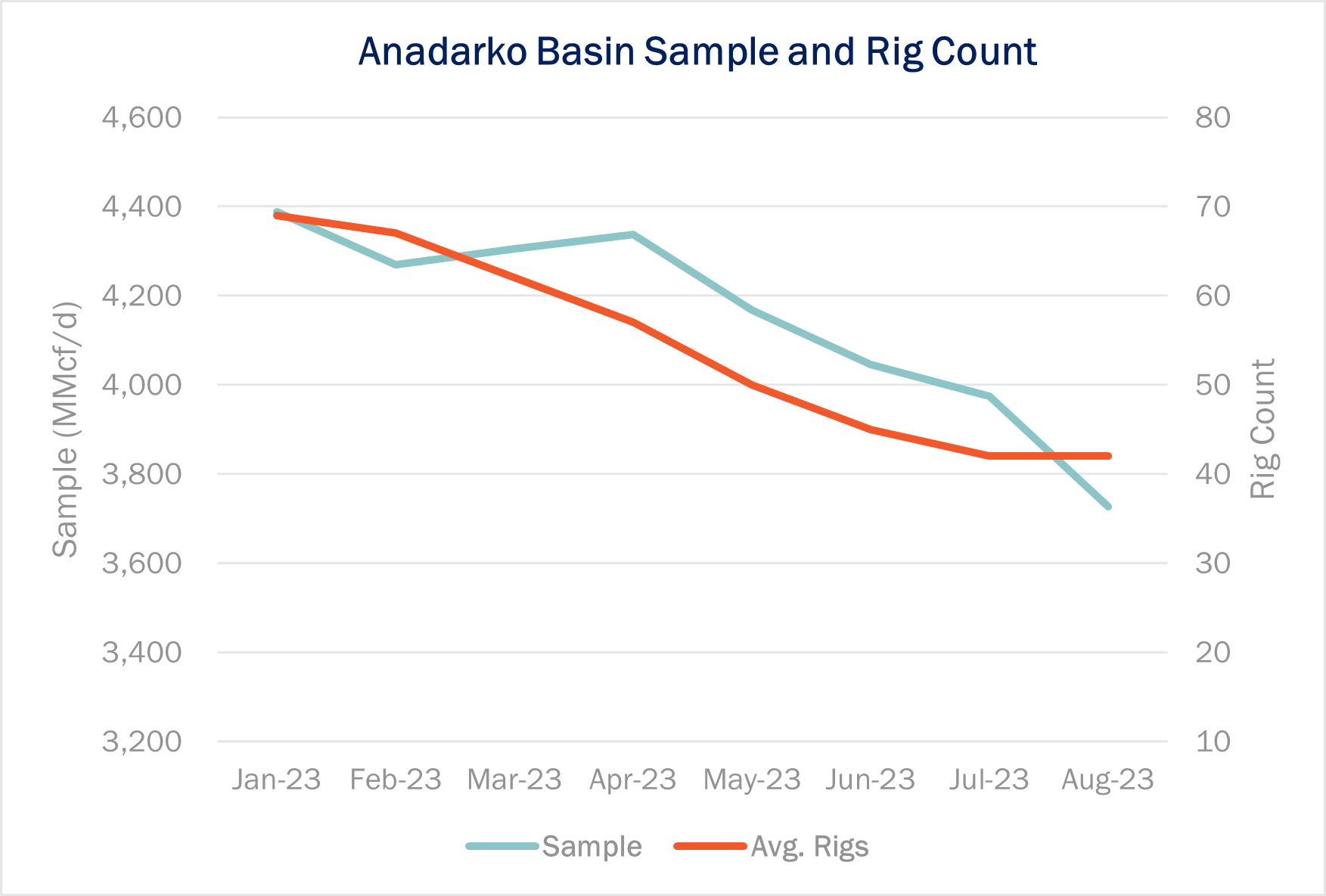

Flows – Gas flows have been sliding in the Anadarko Basin as lower drilling activity slows production. Anadarko pipeline samples are down nearly 6% M-o-M so far in August and are nearly 18% lower since the start of 2023.

The Anadarko has seen rig counts fall in 2023 due to lower natural gas prices. Rigs have averaged 42 so far in August, down from an average of 69 rigs in January ’23. Midstream companies in the basin report that producers are building inventories of drilled but uncompleted wells (DUCs) in anticipation of a more favorable prices this winter and in 2024.

The Anadarko has seen rig counts fall in 2023 due to lower natural gas prices. Rigs have averaged 42 so far in August, down from an average of 69 rigs in January ’23. Midstream companies in the basin report that producers are building inventories of drilled but uncompleted wells (DUCs) in anticipation of a more favorable prices this winter and in 2024.

Infrastructure – Tropical Storm Hilary roared into Southern California on Sunday, August 20, resulting in flooding and power outages. As of Monday morning, roughly 60,000 people were left without power, with half of those outages reported in Los Angeles and San Bernadino counties.

Total gas deliveries on the SoCal system fell by about 200 MMcf/d on Sunday and Monday (August 20-21) vs Saturday levels, a 10% decline. Deliveries were off over 600 MMcf/d from the prior week on August 15-16. when Los Angeles temperatures topped out in the high 90-degree range. SoCal basis fell $0.66/MMBtu (-40%) from Friday to Monday and remains deflated mid-week.

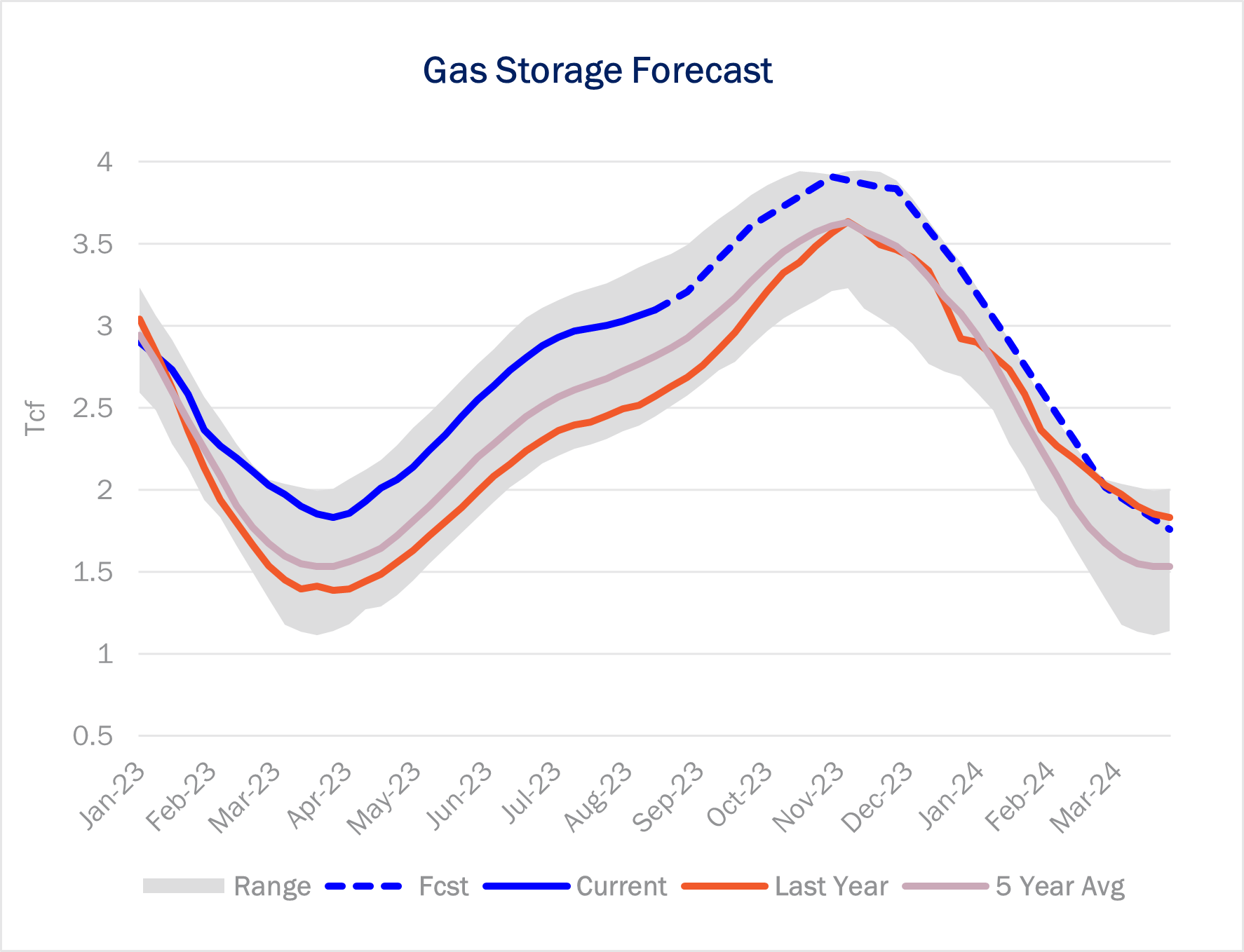

Storage – Traders expect EIA to report a 31 Bcf storage withdrawal for the August 24 week following widespread hot temperatures. EIA reported a 35 Bcf storage injection for the August 17 week to leave working gas inventories at 3,065 Bcf, or 299 Bcf above the 5-year average. Despite recent tightening in the storage balance, the Henry Hub September front-month contract has been under pressure as hot weather is expected to ease in many regions.

Storage – Traders expect EIA to report a 31 Bcf storage withdrawal for the August 24 week following widespread hot temperatures. EIA reported a 35 Bcf storage injection for the August 17 week to leave working gas inventories at 3,065 Bcf, or 299 Bcf above the 5-year average. Despite recent tightening in the storage balance, the Henry Hub September front-month contract has been under pressure as hot weather is expected to ease in many regions.

Looking ahead, we expect high storage to keep pressure on prices in the autumn shoulder months and through the 2023-204 winter. In East Daley’s new August US Macro Supply and Demand Forecast, we predict storage inventories will build to 3,917 Bcf by the end of October, a level that could send cash prices lower as spare storage capacity becomes scarce. Our outlook is for Henry Hub prices to average $3.15/MMBtu through March 2024, or $0.42 lower than the prevailing futures strip.

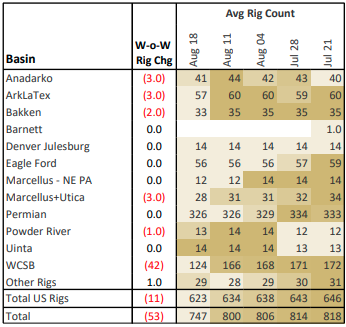

Rigs – US rigs decreased by 11 W-o-W to bring the total count to 623 for the August 18 week. The Anadarko, ArkLaTex and Marcellus+Utica are each down 3 rigs, the Bakken is down 2 rigs, and the Powder River Basin is down 1 rig.

Rigs – US rigs decreased by 11 W-o-W to bring the total count to 623 for the August 18 week. The Anadarko, ArkLaTex and Marcellus+Utica are each down 3 rigs, the Bakken is down 2 rigs, and the Powder River Basin is down 1 rig. Natural Gas Weekly

East Daley Analytics’ Natural Gas Weekly provides a weekly update to our monthly Macro Supply and Demand Forecast. The update covers rigs, flows, production, prices and capacity constraints that materially change our view on supply and demand. This update highlights what investors and traders need to monitor in natural gas to ensure they are on the right side of the market. Subscribe to the Natural Gas Weekly.