MPLX is positioning to join a small group of companies that own all parts of the NGL value chain linking Permian Basin supply growth to international demand.

In mid-December, MPLX filed an air permit with the Texas Commission on Environmental Quality (TCEQ) for NGL fractionation and storage. The project would be the company’s first investment in NGL fractionation on the Gulf Coast. On the company’s recent 4Q23 earnings call, MPLX also announced it has acquired its partners’ 40% interest in two Delaware Basin gas processing plants – Tornado I & II.

MPLX will have 1.4 Bcf/d of gas processing capacity after completing the Preakness II (+200 MMcf/d, ISD 1Q24) and Secretariat (+200 MMcf/d, ISD 2Q25) projects. Users can review the counterparties and historical performance of MPLX gas plants in Energy Data Studio, and East Daley’s company forecast in the MPLX Financial Blueprint.

The new capacity MPLX is building will make way for producer-backed growth, fueled by Coterra Energy (CTRA) and GBK (see volumes breakdown in figure from Energy Data Studio). As a result, MPLX is likely to produce almost 150 Mb/d of NGLs from the tailgate of its own plants by early 2025.

As we discuss in the 2024 Dirty Little Secrets annual, East Daley believes a few midstream players are poised to link together disparate parts of the NGL value chain and try to mimic the success realized by Energy Transfer (ET), Enterprise Products (EPD) and Targa Resources (TRGP), the other three vertically integrated behemoths in NGLs.

MPLX is emerging as one of those players making a move. In addition to the 1.4 Bcf/d of gas processing capacity in the Delaware, MPLX owns a 25% interest in the BANGL NGL pipeline to move liquids from its plants. BANGL provides access to the Corpus Christi and Sweeney NGL markets on the Texas Gulf Coast, where NGL storage, fractionation and export docks are in place.

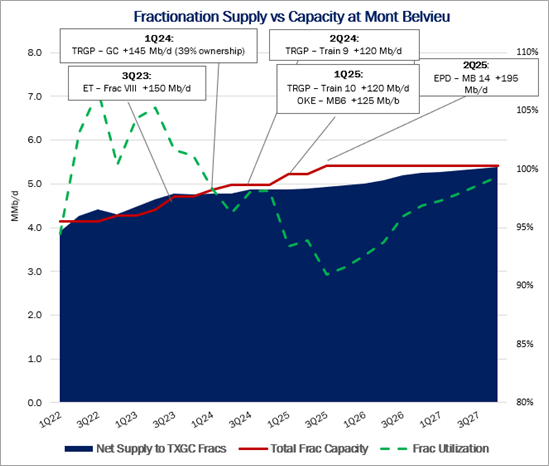

The air permit MPLX filed with the TCEQ could be a first step to owning frac capacity. Even with other fractionation expansions already announced by competitors (see figure), MPLX has an opportunity to participate in building additional frac capacity to meet NGL supply growth on the Gulf Coast. MPLX has entered the chat. – Rob Wilson, CFA Tickers: EPD, ET, MPLX, TRGP.

New EDA Product: West Coast Supply & Demand

The West Coast Supply & Demand report is your go-to resource for mastering the energy market from the California coast to the western Colorado Rockies. This dynamic product offers extensive regional coverage, precise production forecasts for key basins, and in-depth pricing analysis, specifically examining the Colorado pricing spread from CIG Mainline to NW Pipeline Rockies.

Stay ahead of the competition with strategic insights, ensuring you make informed decisions and capitalize on emerging opportunities. Elevate your business with unparalleled market intelligence – invest in the West Coast Supply & Demand report today.

Dirty Little Secrets is Now Available

Dirty Little Secrets is now available. East Daley held our Dirty Little Secrets annual webinar on December 13, 2023. In “Volatility Will Continue Until Morale Improves,” we reviewed the factors likely to drive volatility ahead in oil, natural gas and NGL markets. We review the outlook for these markets and the midstream sector. Review the Dirty Little Secrets webinar here.

East Daley, Hart Bring NEW Gas & Midstream Weekly

East Daley is teaming up with Hart Energy on the NEW Gas & Midstream Weekly newsletter. This new report combines the strengths of Hart Energy’s journalistic reporting and analysis on natural gas, LNG, midstream energy and deal-making with EDA’s deep research and intelligence of hydrocarbons, storage and transportation.

Published every Thursday morning, this new powerhouse newsletter is an interactive and enlightening read highlighting breaking news, exclusive interviews, videos, charts, maps and more. The newsletter utilizes East Daley’s Energy Data Studio tools for natural gas predictive analytics with Hart Energy’s Rextag mapping tools to present a holistic view of pricing triggers, infrastructure growth, pipeline and processing bottlenecks, regulatory and legal hurdles, and the inevitable solutions.

Energy Data Studio

East Daley Analytics has launched Energy Data Studio, a platform for our industry-leading midstream data and commodity production forecasts. All clients have access to the new client portal. If you have not yet logged in, please fill out the form to request a registration email be resent.

Energy Data Studio leverages our G&P data set for insights into midstream assets across every major oil and gas basin in North America. Users can navigate detailed visual dashboards by region, pipeline, or individual asset to understand crude oil, natural gas and NGL supply at the most granular level.

Energy Data Studio is available through data downloads from the visual interface, in Excel files, or as a direct feed delivered into subscribers’ workflow via secure file transfer. To learn more about Energy Data Studio, please contact [email protected].

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.