Exec Summary

Market Movers: ONEOK and Plains All American fully own BridgeTex Pipeline after buying out the 50% interest of OMERS.

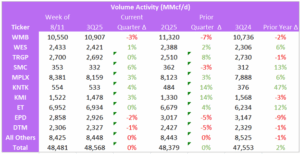

Flows: Williams is down 267 MMcf/d from last week due to lower flows on several G&P systems.

Calendar: Post-call model updates will be released for PAA, SMC and KNTK this week.

Market Movers:

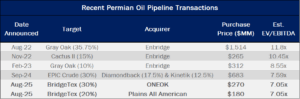

ONEOK (OKE) and Plains All American (PAA) have taken over BridgeTex Pipeline, buying out the interest of the Ontario Municipal Employees Retirement System (OMERS). The companies become the sole owners of a crude oil pipeline that, despite a checkered recent history, is positioned for upside.

OKE increased its ownership in BridgeTex to 60% on July 22, paying $270MM for an additional 30% stake, the company disclosed in its 10-Q last week. In its 2Q25 earnings last Friday (Aug. 8), PAA announced an additional 20% stake for $100MM net to its interest. In a 10-Q filed last Monday (Aug. 10), Plains revealed it paid $180MM for the 20% interest.

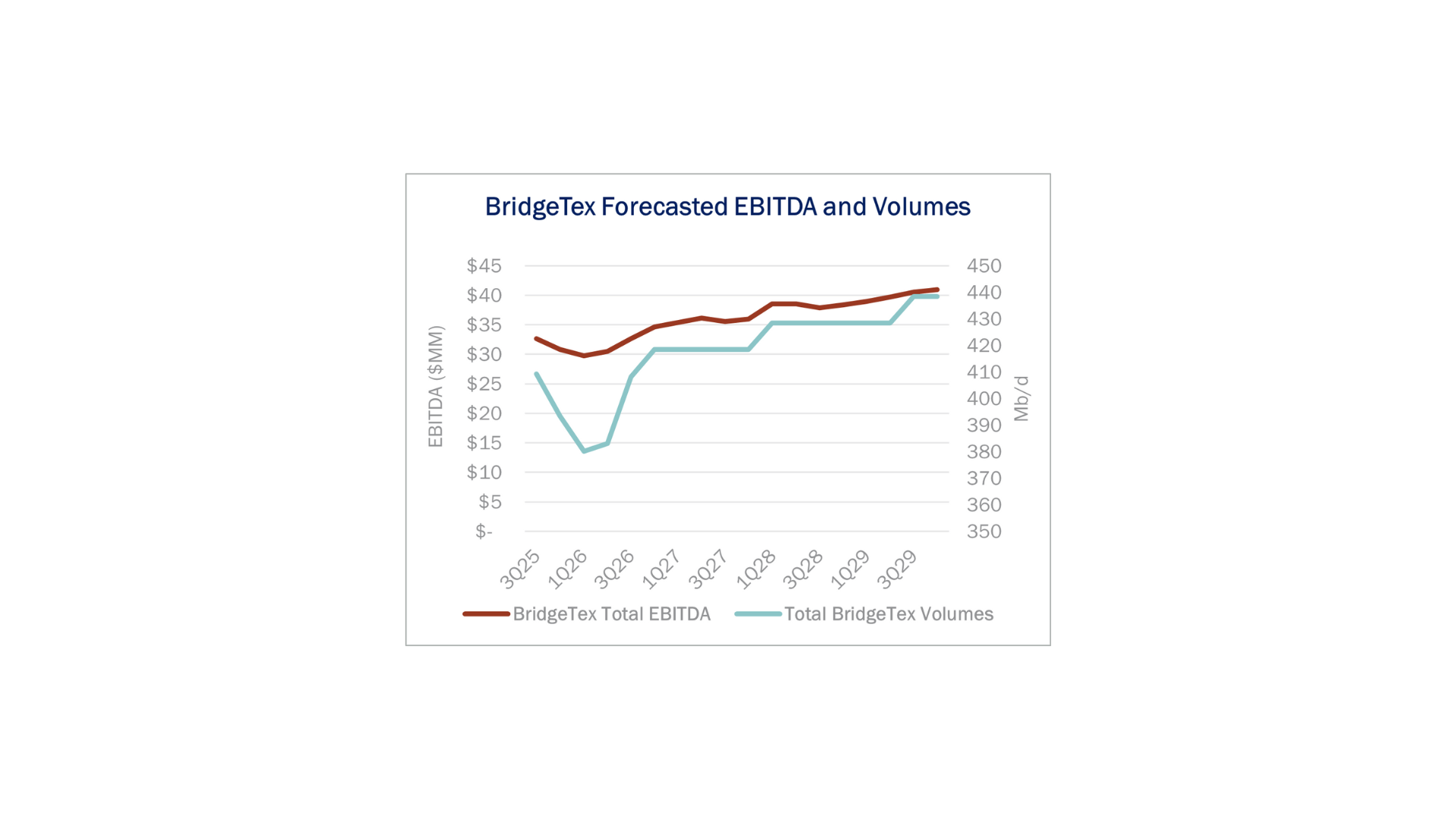

The new OKE and PAA stakes imply a $900MM valuation for BridgeTex, or a 7x multiple based on East Daley Analytics’ forecast for 2026 EBITDA. Prior to the two deals, BridgeTex was owned by OMERS (50%), OKE (30%) and PAA (20%). Governance in the pipeline is unchanged at an effective 50/50 split between OKE and PAA.

The transactions follow substantial financial restructuring. In 4Q24, BridgeTex recognized $290MM in deferred revenue, contributing to $340MM in quarterly net income, of which OMERS would have received ~$170MM. In 1Q25, the pipeline canceled all FERC-related contracts and shifted to oversight solely by the Texas Railroad Commission, removing federal reporting requirements for volumes and financials.

BridgeTex has historically underperformed its Houston-bound peers, reaching a nadir in 2023 when anchor shipper Occidental (OXY) elected to move its barrels to other pipes. Despite this, we expect to see improving economics as Permian Basin egress tightens. East Daley’s Crude Hub Model forecasts pipeline utilization at 83% by YE25, with Houston-bound pipelines at 86%. Corpus Christi remains the premier destination for Permian crude. However, with Enterprise Products’ (EPD) Midland-to-ECHO 2 pipeline returning to service later this year, the Houston market will take in 38% of the Permian’s total supply.

In July, BridgeTex filed a revised tariff designed to attract more long-term committed shippers. We expect a brighter future for the system given the improving macro environment (see figure). With a stronger ownership position, streamlined regulation and an improving market backdrop, BridgeTex is positioned for stable utilization in 2026 and potential growth later in the decade.

Flows:

- WMB is down 267 MMcf/d from last week and below the historical trend, primarily driven by lower flows on the Louisiana/Magnolia, Ohio Valley, and Susquehanna Supply Hub G&P systems.

- DTM is down, driven by declines on the AGS G&P system.

Calendar: