Exec Summary

Market Movers: MPLX is acquiring Northwind Midstream Partners for $2.375 billion in cash, a strategic move to strengthen MPLX’s position in the NGL market.

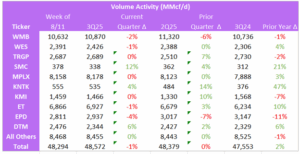

Flows: DTM flow sample increased by 6%, primarily due to growth in the Blue, Union, Bluestone, and Tioga systems, which offset the decline observed in the AGS system.

Calendar: Post-call model updates has been released for PAA, SMC, and KNTK this week.

Market Movers:

MPLX will acquire Northwind Midstream Partners for $2.375B in cash, the latest move in the industry race to secure NGLs for downstream projects.

MPLX announced the Northwind acquisition July 31. The price represents a 7x multiple on expected 2027 EBITDA, MPLX said, putting the expected 2027 EBITDA contribution at $340MM. The companies expect to close the deal in 3Q25.

The Assets: Northwind operates gas gathering and treating assets in Lea County, NM in the northern Delaware Basin. The Northwind system gathers sour gas and transports volumes south to the Titan processing facility on the Texas/New Mexico border, where carbon dioxide and hydrogen sulfide are separated from the gas stream. The assets can treat 150 MMcf/d of sour gas currently, and an expansion will take treating capacity to 440 MMcf/d in 2H26. Northwind also operates a carbon capture facility with two acid gas injection wells.

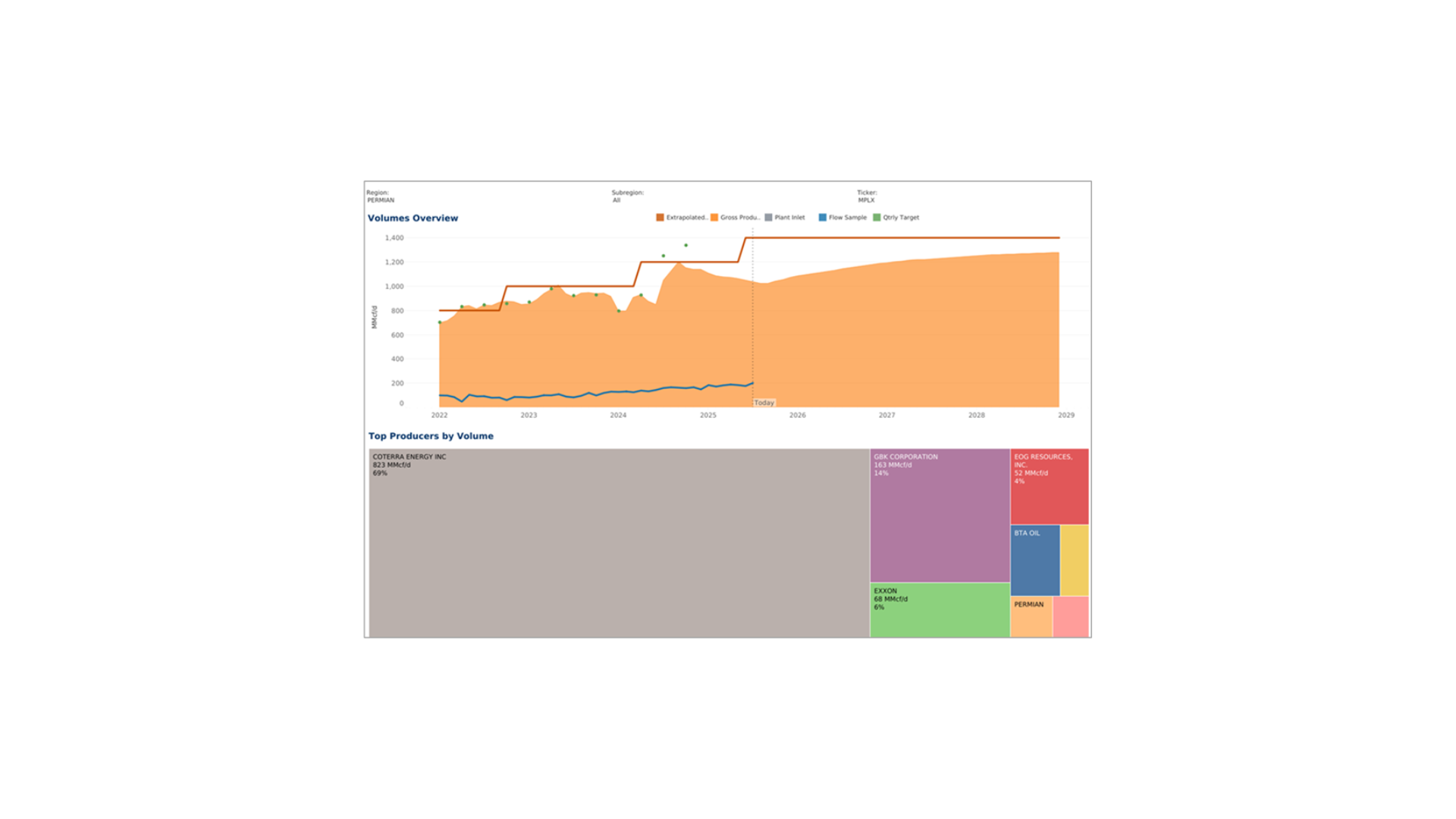

Matador Resources (MTDR) and Coterra Energy (CTRA) are the main producers behind the Northwind system, accounting for 75% of the volumes. The acquisition further entwines Coterra and MPLX, as CTRA currently provides 70% of the volumes on MPLX’s Delaware G&P system. The counterparty data for the MPLX system, available in East Daley Analytics’ Energy Data Studio, is shown in the figure.

The Strategy: The acquisition will leverage unused capacity on MPLX’s Delaware assets. The MPLX – Delaware system is currently operating ~400 MMcf/d below its 1,400 MMcf/d processing capacity, as shown from the “G&P System Analysis” screen in Energy Data Studio. The addition of Northwind to MPLX’s portfolio would help fill the complex by 2026.

East Daley believes access to NGLs also drove the deal. MPLX in 1Q25 acquired the remaining 55% interest in BANGL and is extending the pipeline to Texas City, where it is building an LPG export terminal as part of its joint venture with ONEOK (OKE). MPLX can send the additional Y-grade from its Delaware plants along BANGL and feed volumes directly to Texas City, then fractionate the Y-grade and load the LPGs at the Texas City terminal for export.

Using calculations from the MPLX Financial Blueprint model, we estimate the Northwind system can produce over 60 Mb/d of NGLs at full capacity, with 24 Mb/d of that composed of propane and butane. This would represent a little over 10% of the 200 Mb/d capacity MPLX will own at the export dock.

The Verdict: East Daley views the acquisition as a solid move that furthers management’s strategy to establish MPLX in the NGL export market while providing other sources of EBITDA. The Northwinds assets will increase gas transportation out of the Permian to Gulf Coast markets in anticipation of Waha prices strengthening as more Permian egress is brought online in the coming years.

Flows:

- DTM flow sample increased by 6%, primarily due to growth in the Blue, Union, Bluestone, and Tioga systems, which offset the decline observed in the AGS system.

- EPD is down, driven by declines on the East Texas system.

Calendar: