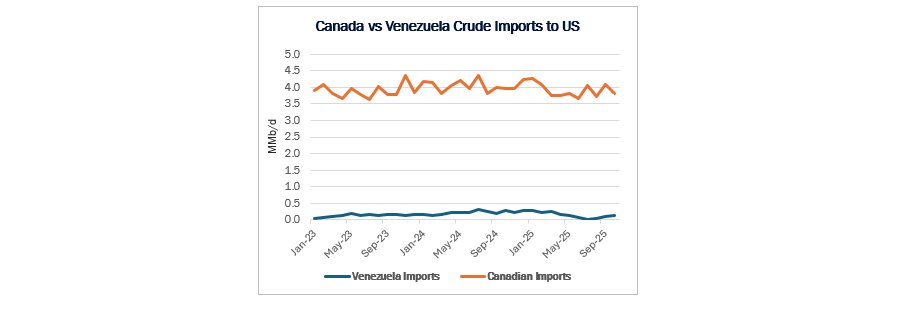

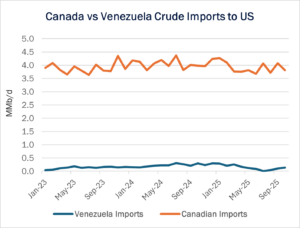

Is the US intervention in Venezuela bullish or bearish for crude oil? Prices have gyrated wildly since the US seized Venezuelan President Nicolas Maduro on Jan. 3, and equity prices are higher for several companies.

President Trump faced some skepticism when he met with top energy executives Friday (Jan. 9) to drum up interest for $100B in investments in the Venezuelan oil sector. ExxonMobil (XOM) CEO Darren Woods said the country is “uninvestable” without significant changes to its legal and commercial systems. XOM, along with ConocoPhillips (COP), are former investors in Venezuela whose assets were nationalized under previous governments.

Chevron (CVX) is the only US firm currently active in Venezuela. A CVX executive told the White House meeting that the company has a plan to ramp its current production of ~240 Mb/d by 50% over the next 18-24 months.

For now, no deal appears on the table with the leading companies. Oil prices are also a sticking point. Current spot and WTI futures under $60/bbl don’t encourage new investments in risky places. Prices are at the point where growth has even stalled in the Permian Basin, where many of the potential Venezuela investors are leading operators.

We are skeptical the administration and industry can thread this needle, and bring more Venezuelan crude to market without also displacing some Lower 48 supply or pressuring prices. But parties could potentially reach an “America First” deal that places market risk on Canadian production and supporting infrastructure.

The Permian Basin at a Crossroads: Why This Pipeline Boom is Different

The Permian’s next big buildout is already taking shape, but this time the driver isn’t oil. East Daley Analytics’ latest white paper reveals how gas demand from AI data centers, utilities and LNG exports is rewriting the midstream playbook. Over 10 Bcf/d of new capacity and $12 billion in investments are reshaping flows, turning the Permian into a gas powerhouse even as rigs decline. Read Part II: Why This Pipeline Boom is Different

Venezuelan crude is a close substitute for the heavy barrels mined in the Canadian oil sands. If Venezuelan barrels are brought to market, they would create more competition for capacity at the US Gulf Coast refiners designed to process these heavy barrels.

Venezuelan crude is a close substitute for the heavy barrels mined in the Canadian oil sands. If Venezuelan barrels are brought to market, they would create more competition for capacity at the US Gulf Coast refiners designed to process these heavy barrels.

If Canadian volumes are displaced, demand would also decline for condensate volumes out of PADD 2 on pipelines like Enbridge’s (ENB) Southern Lights and Pembina’s (PBA) Cochin. In addition to reduced condensate transport, volumes on crude pipelines from Canada to the US such as TransMountain (TMX), Keystone and the Enbridge Mainline may be pressured.

If US producers can capitalize on returning Venezuelan barrels to market, those facing the most risk are likely to be Canadian producers and Canadian midstream companies. – Zach Krause and Alec Gravelle Tickers: ENB, PBA.

Meet Daley, the Best AI Tool in Energy

Meet Daley, the newest member of our energy team. Our new AI assistant is live and available to all East Daley Analytics clients. Early feedback has been phenomenal. Daley is platform-specific and only pulls from East Daley’s own proprietary data and content. It’s not open-source or generic AI, but built to understand our structure, language and analytics. Whether you’re looking for a specific metric, forecast or explanation, Daley can get you there quicker. — Reach out to learn more about Daley!

The Daley Note

Subscribe to The Daley Note for energy insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.