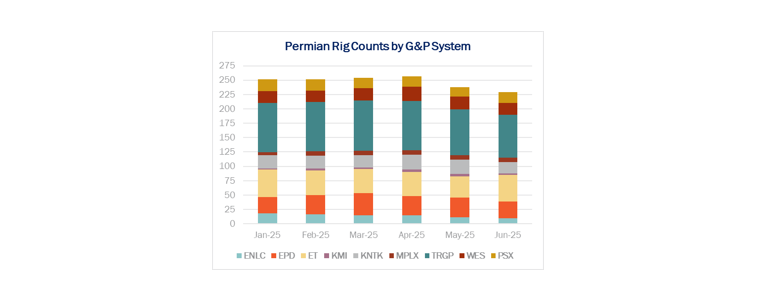

Drilling in the Permian Basin fell by 34 rigs in 2Q25, a 12% Q-o-Q decline, and continues to slide as softer oil prices and upstream consolidation take a toll on activity. The impacts of fewer drill bits at work aren’t hitting equally, splitting the midstream into haves and have-nots, according to allocation data in East Daley Analytics’ Energy Data Studio.

Combined rigs in the Delaware and Midland sub-basins fell from an average of 292 in March to 258 in June. Activity in the Permian continues to fall, down to 251 rigs as of July 26, according to our Rig Activity Tracker. The Delaware bore the brunt of the declines in 2Q25, losing 24 rigs as counts fell from 173 to 148 (–14.2%). The Midland lost 10 rigs (-8.3%) from March to June, tumbling from 120 to 110.

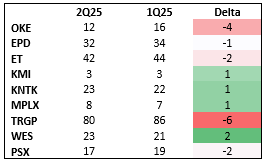

Midstream Exposure: The table shows changes in rigs from March to June by Permian G&P system, according to allocations from the Rig Activity Tracker in Energy Data Studio.

Midstream Exposure: The table shows changes in rigs from March to June by Permian G&P system, according to allocations from the Rig Activity Tracker in Energy Data Studio.

We estimate Targa Resources (TRGP) lost 6 rigs and ONEOK (OKE) 4 rigs, the largest declines in our coverage. Energy Transfer (ET) and Phillips 66 (PSX) each lost 2 rigs over the three months. Those declines point to potential volume headwinds for their respective G&P systems.

By contrast, East Daley believes Kinetik (KNTK), Kinder Morgan (KMI), MPLX and Western Midstream (WES) bucked the trend and gained rigs on their Permian systems from March to June.

Who’s throttling back? Counterparty data in Energy Data Studio reveals which Permian producers are idling rigs. A concentrated set of E&Ps drove the downturn in 2Q:

- Diamondback Energy (FANG) dropped 5 rigs.

- Coterra Energy (CTRA) and CrownQuest Operating each cut 3 rigs.

- Chevron (CVX), Continental Resources, BP and SM Energy (SM) each laid down 2 rigs.

Together, these seven E&Ps account for 19 of the 34 rigs dropped in 2Q25.

East Daley updated our Financial Blueprints for these companies ahead of 2Q25 earnings to incorporate the changes in Permian activity. By mapping movements from the upstream through midstream financials, these models equip stakeholders to anticipate changes, assess risk and make well-informed strategic decisions. – Jaxson Fryer Tickers: BP, CTRA, CVX, ET, FANG, KMI, KNTK, MPLX, OKE, PSX, SM, TRGP

NEW Webinar – August Monthly Production Stream

Join East Daley on August 13 for the August Monthly Oil & Gas Production Webinar – your essential update on the latest production trends and midstream impacts across natural gas, NGLs and crude oil. In today’s energy markets, all commodities are tied together. Join us as we review shifts in Lower 48 production across key basins, plus infrastructure-driven volume trends, and how a shift in one market can send ripples through the others. Please sign up to join us August 13 at 10 AM MST.

NEW – The Burner Tip

The Burner Tip provides East Daley’s weekly coverage of natural gas markets. Every Thursday, The Burner Tip brings you our expert perspective on drivers shaping prices and flows in North America — including production trends, infrastructure dynamics, and forward-looking fundamentals — all grounded in EDA’s proprietary data and models. Whether you’re trading, investing, or managing risk, The Burner Tip delivers the insights you need to drive smarter strategy. Subscribe now to The Burner Tip!

The Daley Note

Subscribe to The Daley Note for energy insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.