Ignore the red cape – we know Matador Resources’ (MTDR) real volumes. East Daley believes we have a good bead on the producer’s results ahead of its 4Q25 earnings reveal.

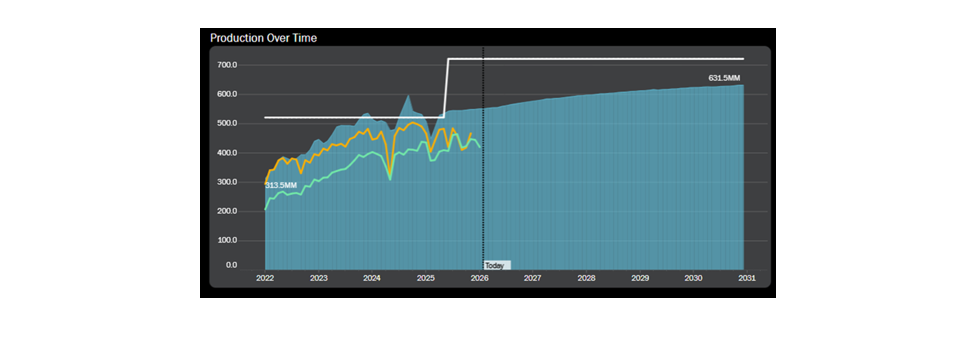

East Daley Analytics’ Energy Data Studio indicates Matador is tracking to 4Q25 oil production of ~117 Mb/d and natural gas volumes of ~516 MMcf/d, down ~2.3% and ~4% Q-o-Q respectively (see figure below). Energy Data Studio captures 4Q25 plant inlet and residue samples roughly a month ahead of MTDR’s earnings report, giving investors an early read on the likely print.

These estimates broadly line up with MTDR’s guidance from its 3Q25 earnings. Management estimated 4Q25 oil production of 119–121 Mb/d and gas production of 516–522 MMcf/d (total 205–208 Mboe/d). If MTDR lands near those targets, the stock is less likely to move on the quarter’s results, and more likely to trade on 2026 guidance and its capital spending plan.

Why the market cares: The investor debate in the Permian has shifted from “How fast can you grow?” to “How durable is your free cash flow?” In a $55–60/bbl oil price environment, many investors interpret growth as value-destructive, unless it is clearly paired with discipline on returns and progress toward strengthening balance sheets.

Why the market cares: The investor debate in the Permian has shifted from “How fast can you grow?” to “How durable is your free cash flow?” In a $55–60/bbl oil price environment, many investors interpret growth as value-destructive, unless it is clearly paired with discipline on returns and progress toward strengthening balance sheets.

In the 2026 Dirty Little Secrets, East Daley highlights the new macro reality: The US barrel is increasingly export-linked, the connection between shale supply growth and global liquids demand is weakening, and Permian operators are broadly embracing minimal growth as the new baseline.

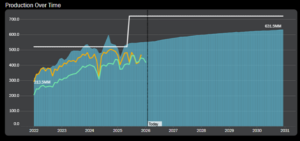

That reality is reflected in Permian producer guidance (see figure). Across the group, growth from 2025 to ’26 averages in the low single digits (~1–1.5%), reinforcing that discipline is now the consensus posture.

Interpreting the signal: Gas softness is likely an economics story. Matador’s gas can be exposed to Permian basis and Waha volatility; curtailments in poor pricing windows can make Q-o-Q gas production look weaker, even when underlying well performance is stable. Investors typically view that as discipline, if oil holds and the company explains the trade-offs clearly.

Oil is the “quality check.” Oil is the cleaner signal for execution and intent. A print in line with the company’s estimated range supports the view that 4Q is stable; a miss would raise harder questions about cadence, downtime, and the reliability of the 2026 setup.

Matador is scheduled to report 4Q25 results after the market close on Feb. 24. We expect investors will interpret the results through one lens: Does MTDR prioritize value and balance sheet durability, or will it chase growth into a weaker tape? – Jaxson Fryer Tickers MTDR.

Download Part II of East Daley’s Permian Basin White Paper Series

Download Part II of East Daley’s Permian Basin White Paper Series

The Permian Basin’s next big buildout is already taking shape, but this time the driver isn’t crude oil. In The Permian Basin at a Crossroads: Why This Pipeline Boom is Different, East Daley Analytics’ latest white paper reveals how gas demand from AI data centers, utilities and LNG exports is rewriting the midstream playbook in the leading US basin. Over 10 Bcf/d of new capacity and $12 billion in investments are reshaping flows, turning the Permian into a gas powerhouse even as rigs decline. Read Part II: Why This Pipeline Boom is Different

Meet Daley, the Best AI Tool in Energy

Meet Daley, the newest member of our energy team. Our new AI assistant is live and available to all East Daley Analytics clients. Early feedback has been phenomenal. Daley is platform-specific and only pulls from East Daley’s own proprietary data and content. It’s not open-source or generic AI, but built to understand our structure, language and analytics. Whether you’re looking for a specific metric, forecast or explanation, Daley can get you there quicker. — Reach out to learn more about Daley!

The Daley Note

Subscribe to The Daley Note for energy insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.