US ethane exports likely hit a record high in September thanks to a ramp at Enterprise Products’ (EPD) new Neches River terminal and the return of Chinese buyers. Ethane prices have been climbing in response to firmer demand.

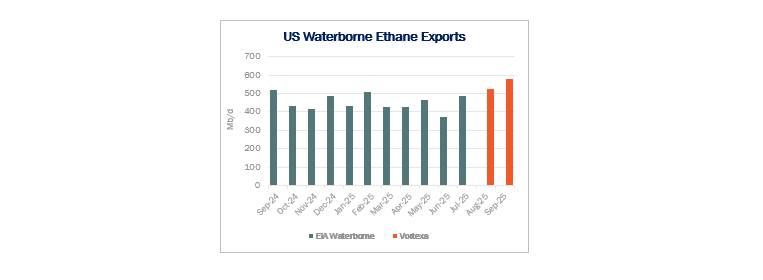

According to shipping-data provider Vortexa, waterborne ethane exports surged to an all-time high in September, averaging 580 Mb/d. That pace would easily eclipse the record of 517 Mb/d reached in Sept ’24 in historical Energy Information Administration (EIA) data. Ethane exports from terminals also neared that mark in February, averaging 508 Mb/d ahead of the the Trump administration setting sweeping new tariffs (see figure).

According to shipping-data provider Vortexa, waterborne ethane exports surged to an all-time high in September, averaging 580 Mb/d. That pace would easily eclipse the record of 517 Mb/d reached in Sept ’24 in historical Energy Information Administration (EIA) data. Ethane exports from terminals also neared that mark in February, averaging 508 Mb/d ahead of the the Trump administration setting sweeping new tariffs (see figure).

Enterprise’s Neches River project drove most of the gains. Ethane cargoes leaving the new terminal near Beaumont, TX averaged nearly 59 Mb/d in September, according to Vortexa data, more than double exports of 27 Mb/d in August. EPD started exports in July at Neches River and continues commissioning work at the new terminal.

Exports to China are set to hit a record as well, despite uncertainty over the trajectory of the US-China ethane trade. Cargoes destined for China accounted for 403 Mb/d of September exports, or nearly 70% of the total in the Vortexa data. The Chinese government in June reportedly doubled its import quota for naphtha, a competing feedstock for making ethylene, signaling a potential replacement for some US ethane after the trade war heated up with Washington. The two countries reached a trade accord in early July. The return of Chinese buyers could signal a thawing in the relationship, a welcome development for terminal operators like EPD and Energy Transfer (ET).

The additional demand is spurring gains in ethane prices. Mont Belvieu ethane traded for $0.28/gal last Thursday (Oct. 22), up from prices in the $0.20-0.22/gal range in August. Meanwhile, exports to India have trended lower in September, down from highs seen during the period of trading restrictions with China. Those restrictions drove prices lower, prompting Indian buyers to snap up barrels at a discount.

See East Daley Analytics’ Ethane Supply & Demand Report to learn more about the ethane market outlook. – Alex Albazzaz Tickers: EPD, ET.

Bakken Energy Path – Powered by Energy Data Studio

Energy Path is a revolutionary tool designed to transform how you view energy markets. With Energy Path, you can seamlessly track the molecule from wellhead to demand, gaining a complete view of the entire oil and gas value chain. From upstream to midstream to downstream, this multi-commodity product offers unparalleled insights across natural gas, NGLs and crude oil. The Bakken Energy Path is available now – monitor volumes and fees at every stage, empowering your decision-making with a holistic market perspective. — Request your Energy Path demo now!

Get the Data Center Demand Monitor

The Data Center Demand Monitor is your go-to source for tracking data center projects and demand. Available as part of the Macro Supply & Demand Report, East Daley monitors and visualizes nearly 500 US data center projects. Use the Data Center Demand Monitor to forecast demand, identify pipeline corridors and track data center projects. — Request your demo now of the Data Center Demand Monitor!

The Daley Note

Subscribe to The Daley Note for energy insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.