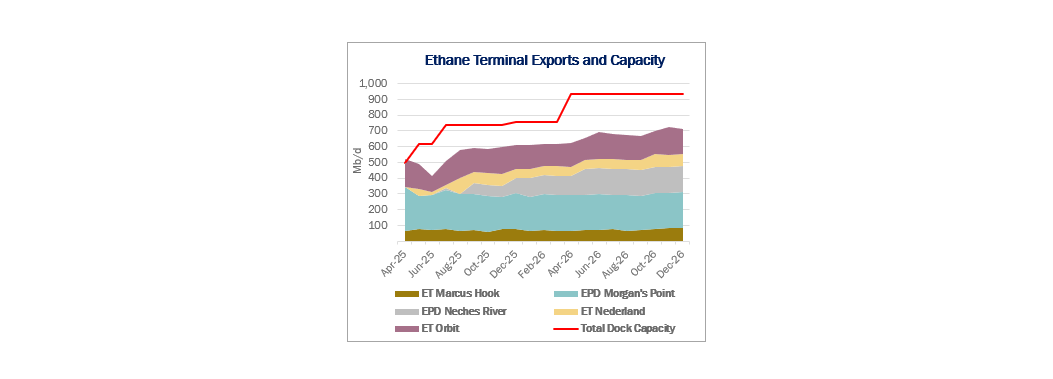

The industry is on track to overbuild Permian NGL pipelines and LPG export docks, but the excess capacity may prove beneficial for ethane over the long term. For now, companies must contend with fallout from the recent trade spat with China.

In an uncertain geopolitical environment, the best-positioned assets are those with feedstock flexibility at the dock, like Enterprise Products’ (EPD) Neches River and Energy Transfer’s (ET) Nederland Flexport. Those facilities can pivot between LPG and ethane, giving midstream operators the ability to capture incremental volumes and defend utilization regardless of which product is in demand.

In a world where LPG spot rates fall and there is downside risk to recontacting along the NGL value chain, midstream strategy shifts to volume capture. The key is to keep volumes on a system and maximize infrastructure use. When LPG dock space sits empty, the incentive increases for ethane recovery and export. Recovery can be flipped on dynamically, and there is ample ethane available.

In a world where LPG spot rates fall and there is downside risk to recontacting along the NGL value chain, midstream strategy shifts to volume capture. The key is to keep volumes on a system and maximize infrastructure use. When LPG dock space sits empty, the incentive increases for ethane recovery and export. Recovery can be flipped on dynamically, and there is ample ethane available.

The challenge now is demand. Enterprise says Neches River is 100% contracted for ethane beginning in 2026, but an EPD executive noted on the company’s 2Q25 earnings call that a potential customer “made a decision to contract naphtha, which is supplied globally versus just coming to the US to get ethane.” ET likewise said it will be “a little bit more difficult to contract with Chinese crackers” following the May decision by the Department of Commerce to restrict ethane exports to the country. Those restrictions left a “bit of a black eye” on the industry, management said.

US ethane is poised for explosive global growth. However, geopolitics and feedstock competition, rather than infrastructure, are the main bottlenecks. If Chinese demand falters, India and Europe are the next candidates to absorb volumes, though their growth curves are slower and less certain. Overbuilt US export capacity gives midstream operators the flexibility to move quickly when new demand does appear. That optionality also can lure global buyers, knowing the US can supply at scale once contracts are in place. – Julian Renton Tickers: EPD, ET.

Meet Daley, the Best AI Tool in Energy

Meet Daley, the newest member of our energy team. Our new AI assistant is live and available to all East Daley Analytics clients. Early feedback has been phenomenal. Daley is platform-specific, and only pulls from East Daley’s own proprietary data and content. It’s not open-source or generic AI, but built to understand our structure, language and analytics. Whether you’re looking for a specific metric, forecast or explanation, Daley can get you there quicker. — Reach out to learn more about Daley!

Get the Data Center Demand Monitor

The Data Center Demand Monitor is your go-to source for tracking data center projects and demand. Available as part of the Macro Supply & Demand Report, East Daley monitors and visualizes nearly 500 US data center projects. Use the Data Center Demand Monitor to forecast demand, identify pipeline corridors and track data center projects. — Request your demo now of the Data Center Demand Monitor!

The Daley Note

Subscribe to The Daley Note for energy insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.