Executive Summary: Rigs: Week over week, rig activity in the US remained relatively stable. Infrastructure: Incentivized by government policies, including subsidies and a $1/gal blending credit, several small- to medium-sized refineries are converting capacity to produce renewable diesel. Storage: East Daley expects a build of 4.9 MMbbl in commercial and Strategic Petroleum Reserve (SPR) inventories for the week ending February 16.

Rigs:

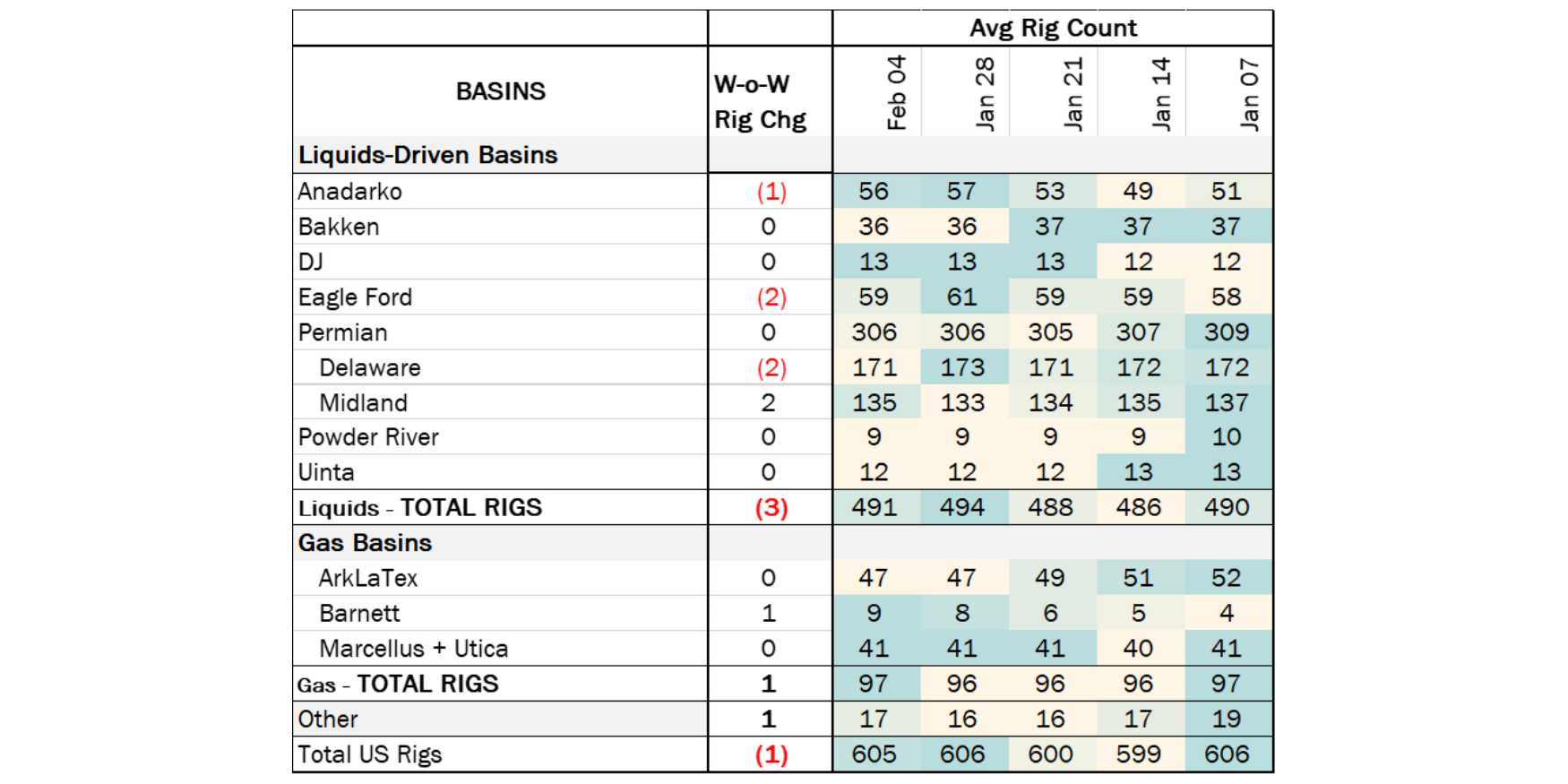

Week over week, rig activity in the US remained relatively stable. The Anadarko, Eagle Ford and Permian basins drove changes in liquid-driven basins. The Anadarko and Eagle Ford each lost rigs, 1 and 2 respectively, between January 28-February 4. In the Permian, the Midland gained 2 rigs and the Delaware lost 2.

Oerators Crescent Energy and Marathon Oil dropped rigs W-o-W in the Eagle Ford. Large Permian operators Callon Petroleum (CPE), ExxonMobil (XOM), Chevron (CVX) and Ovintiv (OVV) added and subtracted rigs across the basin, setting the total Permian count to 306 rigs.

Infrastructure:

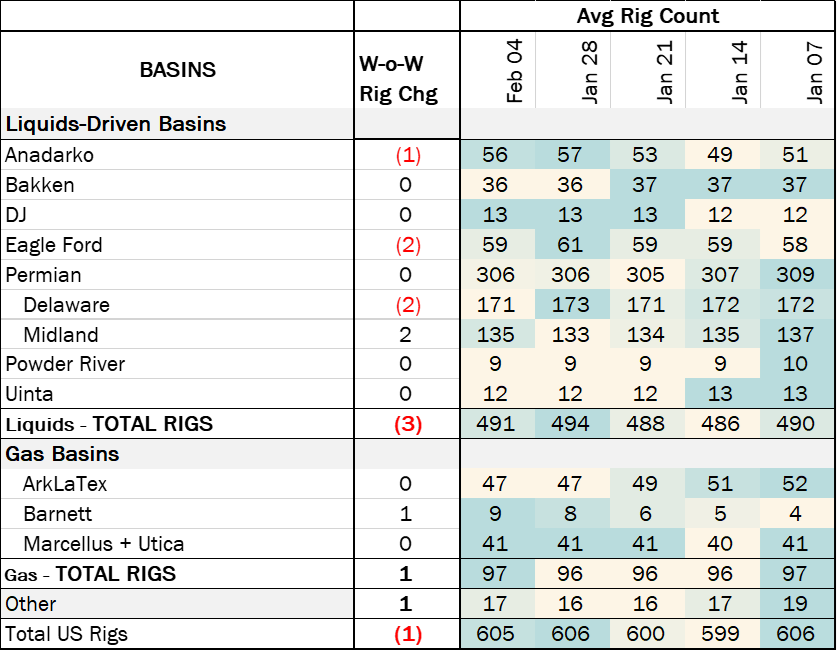

Incentivized by government policies, including subsidies and a $1/gal blending credit, several small- to medium-sized refineries are converting capacity to produce renewable diesel. The switch comes as conventional refining faces challenging market conditions and more stringent environmental regulations.

US petroleum refining capacity has remained relatively stable since 2021 at ~18 MMb/d, as modeled in East Daley Anlaytics’ Crude Hub Model, but is lower than the pre-pandemic level of ~19 MMb/d. Meanwhile, refining capacity to produce renewable diesel is poised to expand.

Renewable diesel is fuel made from fats and oils, such as soybean or canola oil, and is processed to be chemically the same as petroleum diesel. Renewable diesel production capacity totaled 170 Mb/d in 2022 and is projected to rise to 384 Mb/d by YE25, according to estimates by the Energy Information Administration (EIA). The EIA’s outlook is based on announcements for projects under construction or soon to begin development. Smaller refiners that lack economies of scale have been more likely to consider the switch to renewable diesel.

In 2023, EIA identified eight new renewable diesel refinery projects that would remove ~143 Mb/d (excluding Shell’s Norco, LA plant) of petroleum refining capacity. Among these, the Rodeo Renewed project by Phillips 66, formerly the San Francisco refinery in Rodeo, CA, is set to begin operations by the end of 1Q24. The project will enable the facility to produce renewable diesel and sustainable aviation fuel (SAF).

Storage:

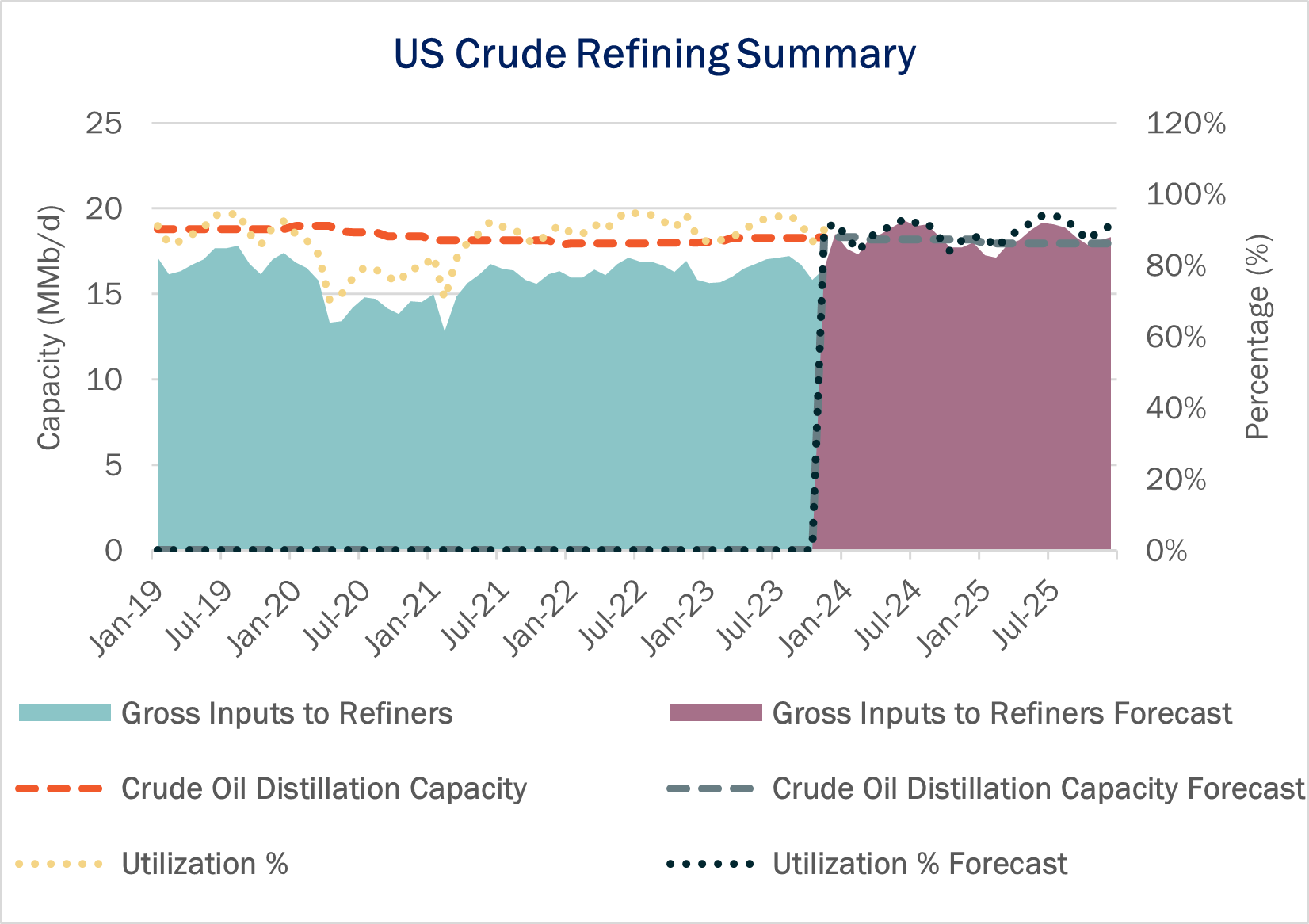

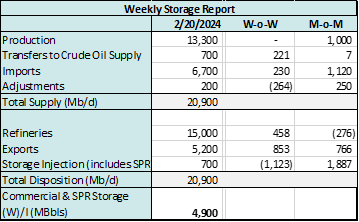

East Daley expects a build of 4.9 MMbbl in commercial and Strategic Petroleum Reserve (SPR) inventories for the week ending February 16. We expect total US stocks, including the SPR, will close at 803.113 MMbbl.

The US natural gas pipeline sample, a proxy for change in oil production, decreased by 0.4% in liquids-focused basins. The Rockies saw a 0.3% decrease W-o-W. The Permian Basin saw a decrease of 0.9% W-o-W. The Rockies has excellent pipeline sample coverage at ~92%, whereas the Permian Basin sample coverage is much lower at ~40%. We expect US crude production to hold at 13.3 MMb/d.

According to US bill of lading data, US crude imports increased by ~230 Mb/d W-o-W to 6.7 MMb/d. More than 60% of the supply originated from Canadian pipelines into the US, with the remainder largely coming from ships carrying crude from Mexico, Nigeria and Venezuela.

As of February 16, there was ~1,239 Mb/d of refining capacity offline, including downtime for planned and unplanned maintenance. EDA expects gross crude inputs into refineries to increase 458 Mb/d W-o-W, coming in at 15.0 MMb/d.

Vessel traffic monitored by EDA along the Gulf Coast increased W-o-W. There were 34 vessels loaded for the week ending February 16 and 26 the prior week. EDA expects US exports to be 5.2 MMb/d.

The SPR awarded contracts for 2.1 MMbbl for delivery in February 2024. The SPR has 358.763 MMbbl in storage as of February 9, 2024.

Regulatory and Tariffs

Presented by ARBO

Tariffs:

Marketlink, LLC Marketlink Pipeline, operated by TC Energy, raised its Volume Incentive Rates/Temporary Discounted Rate by ~$0.10 or ~6.78% on shipments from Cushing, OK to Port Arthur or Houston, TX effective 1, 2024. (FERC No 3.22.0 IS24- 176, filed January 30, 2024)

Plains Oryx Permian Basin Pipeline LLC Plains has established a new gathering location on Oryx Basin Pipeline at Flaming Snails Gathering in Eddy County, NM. Initial rates have been established along with associated committed rates with the agreement of at least one non-affiliated shipper effective January 31, 2024. (FERC No 12.4.0 IS24- 189, filed January 30, 2024)

The above information is provided by ARBO’s Oil Pipeline Tariff Monitor. For more information on regulatory proceedings or tariff rates, please contact please contact Corey Brill via email at [email protected] or phone at 202-505-5296. https://www.goarbo.com/