Executive Summary: Rigs: The total US rig count decreased by 5 for the June 9 week, down from 565 to 560. Infrastructure: As the Bakken continues to grow, East Daley’s Crude Hub Model forecasts a significant portion of the incremental barrels will feed Pony Express and Saddlehorn Pipelines. Storage: East Daley expects an injection of 1.06 MMbbl in commercial and Strategic Petroleum Reserve (SPR) inventories for the week ending June 21.

Rigs:

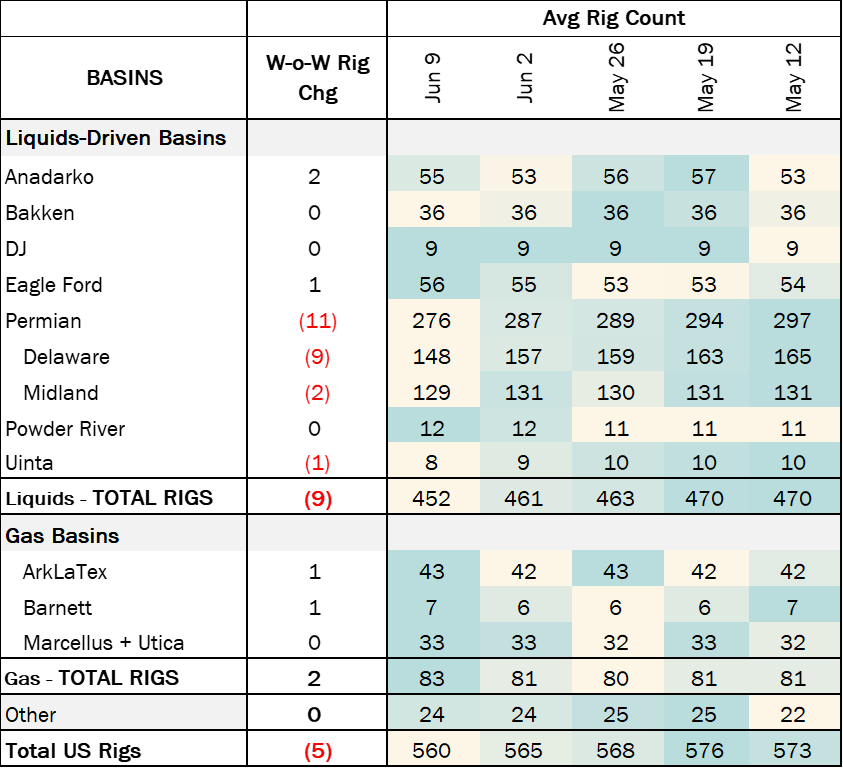

The total US rig count decreased by 5 for the June 9 week, down from 565 to 560. Liquids-Driven Basins saw the largest decrease, decreasing by 9 rigs w-o-w, moving from 461 rigs to 452. The Permian saw the largest loss of rigs with a decrease of 11 rigs, 9 from the Delaware and 2 from the Midland. The Uinta also decreased their total rig count by 1. However, the Anadarko saw an increase of 2 rigs and the Eagle Ford also gained 1 rig.

In the Delaware, EOG Resources (EOG), Occidental Petroleum (OXY), and Chevron (CVX) reduced their rig counts by 2 rigs each. Permian Resources (PR), Exxon (XOM), and APA Corp. (APA) also saw a decrease of 1 rig. In the Midland, operators XOM and Highpeak Energy (HPK) each decreased their rig counts by 1. In the Uinta basin, operator Koda Resources saw a decrease of 1 rig.

Infrastructure:

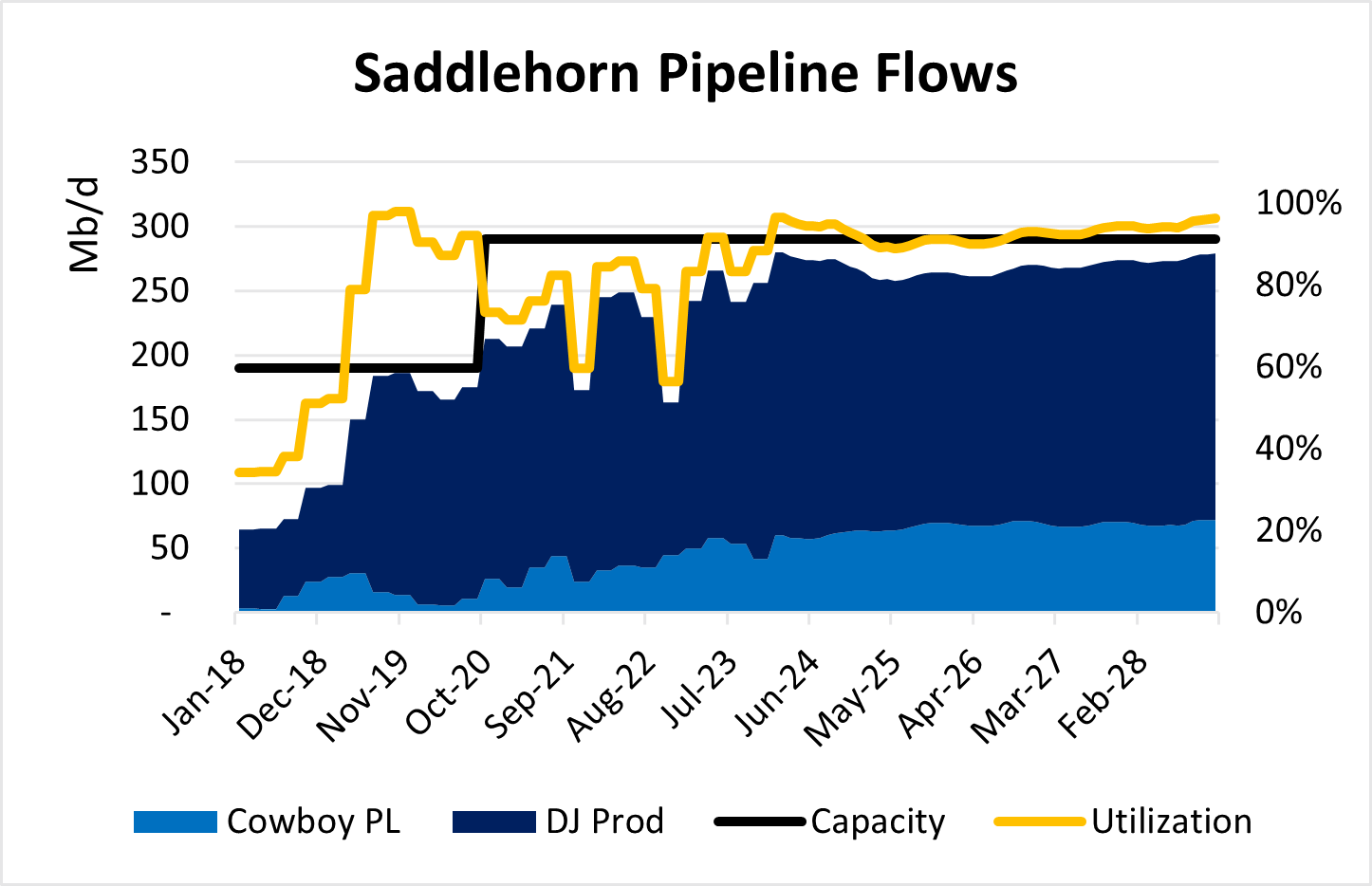

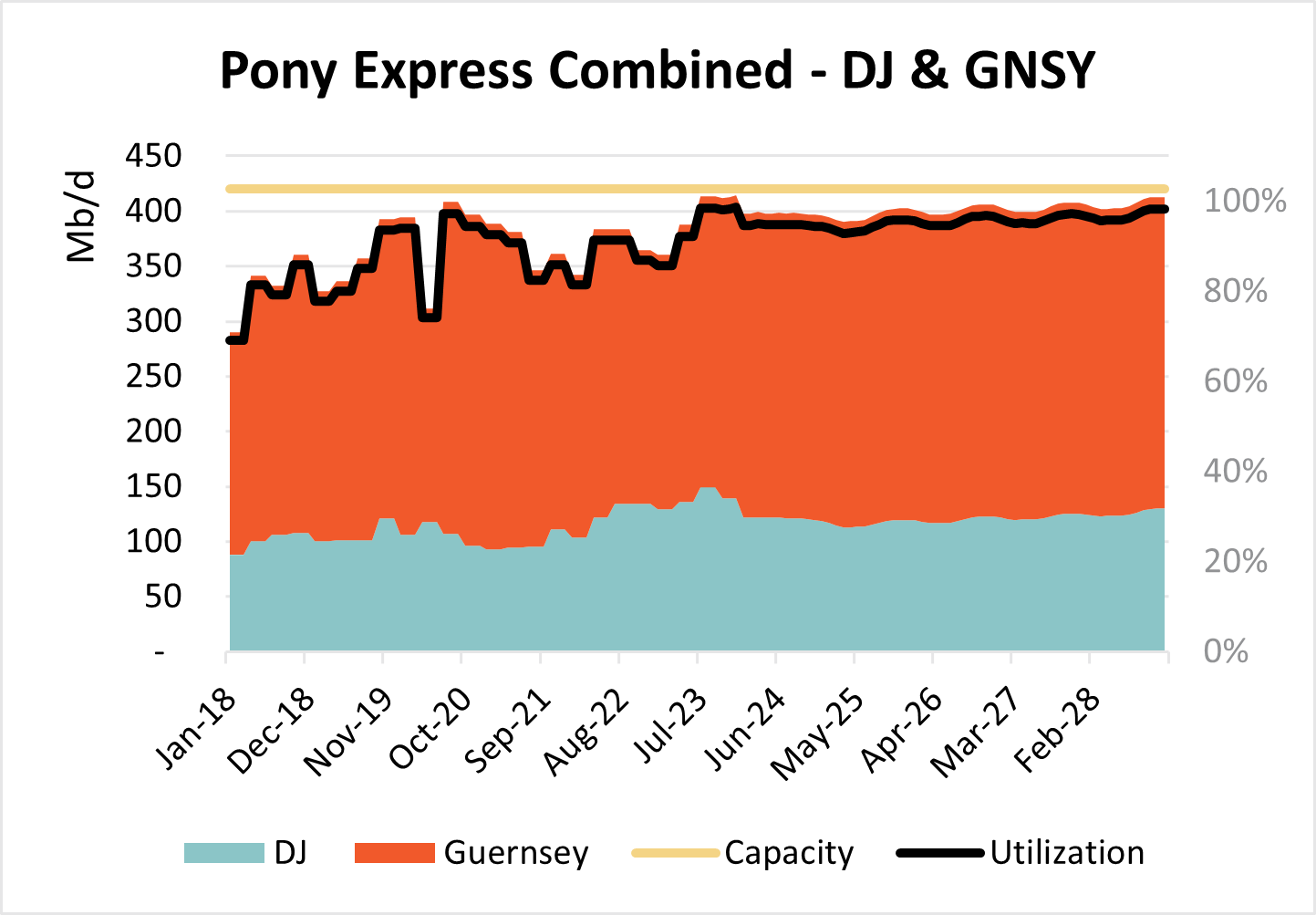

As the Bakken continues to grow, East Daley’s Crude Hub Model forecasts a significant portion of the incremental barrels will feed Pony Express and Saddlehorn Pipelines. Both Pony Express and Saddlehorn have high utilizations; Saddlehorn above 80% and Pony Express is at full utilization.

Pony Express is wholly owned by Tallgrass and is able to pick up production in the Guernsey and the DJ Basin. The two receipt points and corresponding pipelines meet in Sterling, Colorado and have delivery points in Kansas and ultimatley Cushing. Pony Express has a joint tariffs with Bridger Pipeline (True Cos) and Double H Pipeline (Kinder Morgan) allowing them to fully capitialize on caputuring the Bakken growth. Current pipeline flows indicate the majority of Pony Express’ volume is coming from the Guernsy Hub which includes Bakken productin. Roughly 30% of Pony Express’ volumes originate in the DJ Basin.

Saddlehorn has a much more complex ownership structure. ONEOK (OKE) operates the pipe and jointly owns it with Plains (PAA), CVX and Greenfield Investments. The pipeline originates in the DJ and delivers solely to Cushing. The lion’s share (75%) of volumes come from DJ Basin production. However, it also has joint tariffs with Cheyenne and Cowboy pipelines that source crude from Guernsey and thus the Bakken.

The Cheyenne Pipeline goes from Guernsey to Cheyenne, which then connects to the Cowboy Pipeline from Cheyenne to Platteville. Cheyenne Pipeline is owned by PAA and HF Sinclair (DINO) and Cowboy Pipeline is wholly owned by PAA. The Cheyenne and Cowboy connector pipeilnes to Saddlehorn are currently bottlenecked by Cowboy’s 95 Mb/d capacity, whereas, Cheyenne Pipeline is able to carry 120 Mb/d. East Daley believes PAA is in the process of expanding Cowboy to 125 Mb/d, which will relieve some of the bottleneck.

East Daley forecasts DJ growth to be in slow decline, with annual oil production declining by 10% (50 Mb/d) between 2023-2026. Meanwhile, we expect the Powder River to grow 19% (+35 Mb/d) and the Bakken to grow 14% (+178 Mb/d) in that same time frame. Due to Pony Express’ ability to capitilize on the Bakken and Powder River growth, East Daley believes the pipeline will continue to have very high utilization throughout the next few years. Saddlehorn, however, has a bit more risk as it is currently dependent on DJ volumes to maintain 80%+ utilization.

Storage:

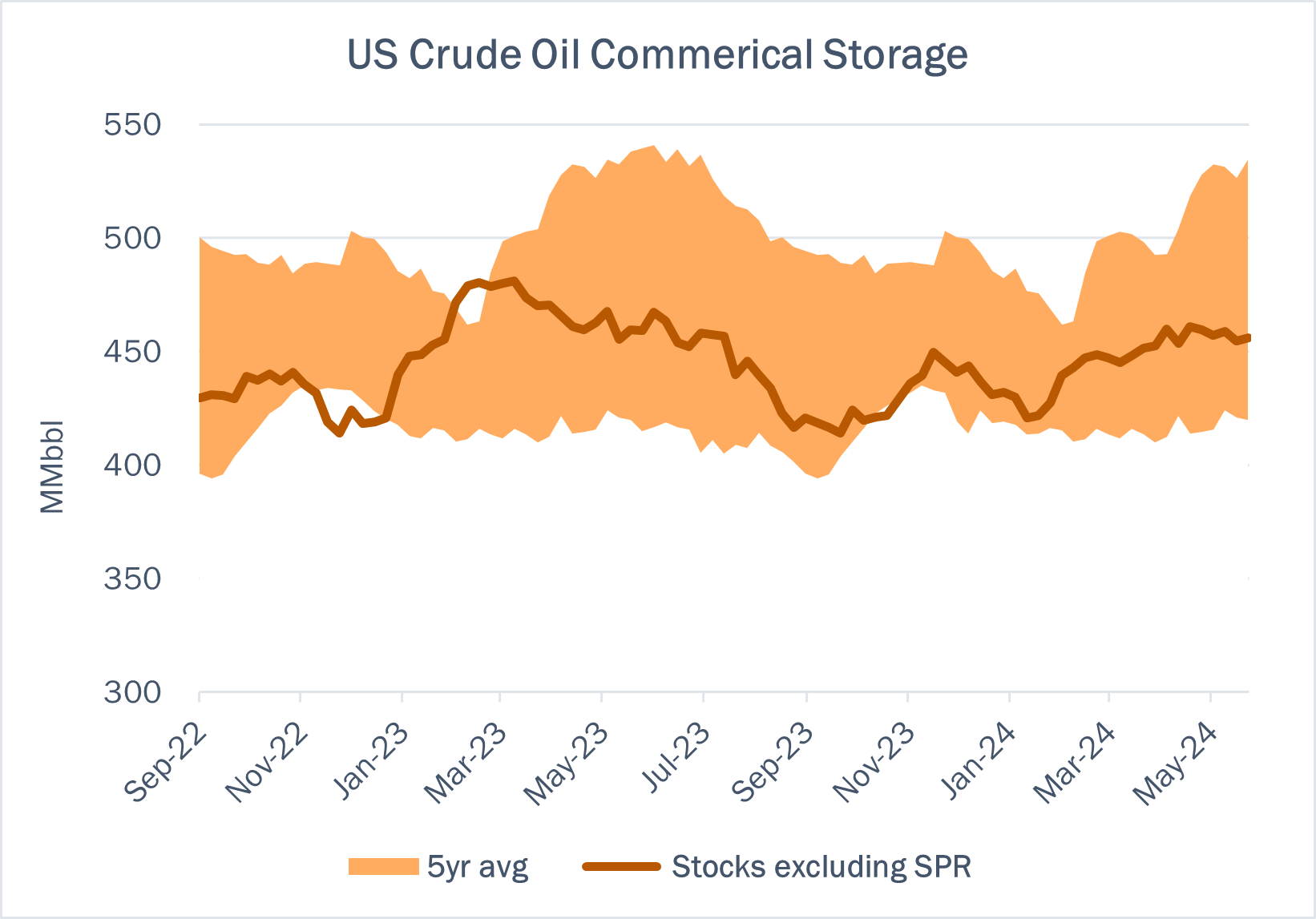

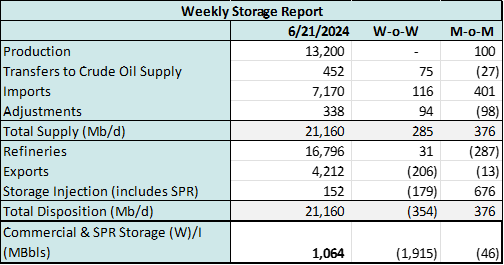

East Daley expects an injection of 1.06 MMbbl in commercial and Strategic Petroleum Reserve (SPR) inventories for the week ending June 21. We expect total US stocks, including the SPR, will close at 827 MMbbl.

The US natural gas pipeline sample, a proxy for change in oil production, increased ~0.54% W-o-W across all liquids-focused basins. Samples decreased 0.95% in the Rockies and 4.54% in the Williston Basin. The decreases were offset by a 2.46% increase in the Gulf of Mexico and a 2.71% increase in the Permian. The Williston Basin and Gulf of Mexico have a high correlation between gas volumes and crude oil volumes, whereas the Permian Basin and Eagle Ford basins’ correlation is less than 45%. We expect weekly US crude production to remain flat at 13.2 MMb/d.

According to US bill of lading data, US crude imports increased by 116 Mb/d W-o-W to 7.17 MMb/d. More than 60% of the supply originated from Canadian pipelines into the US, with the remainder largely coming from ships carrying crude from Mexico, Venezuela and Argentina.

As of June 21, there was ~485 Mb/d of refining capacity offline, including downtime for planned and unplanned maintenance. EDA expects gross crude inputs into refineries to increase by ~31 Mb/d W-o-W, coming in at 16.8 MMb/d.

Vessel traffic monitored by EDA along the Gulf Coast increased W-o-W. There were 28 vessels loaded for the week ending June 21 and 23 the prior week. EDA expects US exports to be 4.21 MMb/d.

The SPR awarded contracts for 2.95 MMbbl to be delivered in June 2024. The SPR has 370 MMbbl in storage as of June 21, 2024.

Regulatory and Tariffs:

Presented by ARBO

Tariffs:

Pembina Cochin LLC Committed rates were established offered in the 2023 Open Seasons with agreement of at least one non-affiliated shipper. Committed rates no longer effective were canceled. The Retention Stock Policy was also revised to be effective on August 1, 2024. Effective August 1, 2024. FERC No 81.12.0 IS24- 604 filed June 7, 2024)

Explorer Pipeline Company Explorer launched an open season commencing May 29, 2024 through June 28, 2024 to secure shipper commitments to support the development of a new project that would increase the transportation capacity of a portion of Explorer’s existing system for shipments of diluent from the U.S. Gulf Coast receipt points to destination points in Illinois.

The above information is provided by ARBO’s Oil Pipeline Tariff Monitor. For more information on regulatory proceedings or tariff rates, please contact please contact Corey Brill via email at [email protected] or phone at 202-505-5296. https://www.goarbo.com/