Market Movers: Energy Transfer is evaluating whether to convert a Permian NGL trunkline to natural gas service. East Daley speculates that the West Texas Gateway (WTG) system would be the likeliest target.

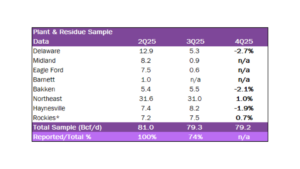

Estimated Quarterly Volumes: The Delaware (-2.7%), Bakken (-2.1%) and Haynesville (-1.9%) are trending down while the Northeast (1.0%) and Rockies (0.7%) are trending up 3Q to 4Q.

Calendar: EDA will be in Houston Jan 13th – Jan 16th and in NYC Feb 9th – Feb 12th. Financial models will be updated on Jan 16th.

Market Movers:

Energy Transfer (ET) is evaluating whether to convert a Permian NGL trunkline to natural gas service, a move that would ride industry momentum for more gas egress from the basin. The company hasn’t revealed which asset it is considering, but East Daley speculates that the West Texas Gateway (WTG) system would be the likeliest target.

On ET’s 3Q25 earning call, management said converting the candidate pipe could roughly double revenue in gas vs NGL service given weak NGL rates and strong gas demand. East Daley expects Permian Y-grade takeaway to be overbuilt as competitors build new NGL pipelines to Mont Belvieu, including Targa Resources’ (TRGP) 500 Mb/d Speedway line and Enterprise Products’ (EPD) Bahia system. The market trend makes redeploying “excess” NGL steel into a gas corridor strategically appealing.

If Energy Transfer pulls the trigger, the project would add to the industry bandwagon for new gas pipelines out of the Permian Basin. EDA expects over 10 Bcf/d of new Permian gas takeaway through 2030 from currently FID’d project, including several by ET. The WhiteWater JV backing the Eiger Express Pipeline recently upsized the project to 3.7 Bcf/d (see story on page 3). In the near term, WhiteWater’s Blackcomb (+2.5 Bcf/d) and ET’s Hugh Brinson Pipeline (+2.2 Bcf/d) are scheduled to start through 2027. Eiger Express and ET’s Desert Southwest (+1.5 Bcf/d) add more takeaway by the end of the decade.

The Permian Basin at a Crossroads: Download Why This Pipeline Boom is Different

The Permian’s next big buildout is already taking shape, but this time, the drivers aren’t producers chasing oil. East Daley’s latest white paper reveals how gas demand from AI data centers, LNG exports, and utilities is rewriting the midstream playbook. Over 9 Bcf/d of new capacity and $12 billion in investments are reshaping flows, turning the Permian into a gas powerhouse even as rigs decline. Read Part II: Why This Pipeline Boom is Different

West Texas Gateway is Plausible Conversion Candidate

East Daley views WTG as a plausible candidate for a conversion project. WTG is a 16-inch NGL pipeline running 570 miles from Winkler County, TX to ET’s Jackson County processing plant on the Gulf Coast. The line has a capacity of ~209 Mb/d and has been in service since 2012. Other pipelines move NGLs north from the WTG system to Mont Belvieu.

WTG was built under hazardous liquids code (Title 49 Code of Federal Regulations [CFR] Part 195); converting the line to gas would place it under Title 49 CFR Part 192 regulations. The project would trigger tighter rules on maximum allowable operating pressure (MAOP), class locations, high-consequence areas (HCAs) and integrity management, per the conversion guidance from the Pipeline and Hazardous Materials Safety Administration (PHMSA).

Using a Panhandle-style scaling for a modern 42-inch, 400-mile line with ~1.5 Bcf/d of capacity, EDA estimates WTG could support only 100–200 MMcf/d of gas transport with added compression. Our capacity and horsepower estimates assume similar MAOP and pressure windows between the reference pipe and a gas conversion. In reality MAOP can vary, so this is a directional estimate.

Assuming 90% utilization and a long-haul tariff in the $0.60–0.80/MMBtu range (based on posted rates for Whistle), we estimate $30–50MM in annual revenue and $20–30MM/yr of EBITDA. A realistic liquids-to-gas conversion likely runs $200–400MM (~15–25% of a greenfield 16-inch build), putting payback in the 8– to 15-year band.

Lone Star Express: Better Steel, Bigger Tradeoff

The 30-inch Bosque–Mont Belvieu leg of the Lone Star Express/Gulf Coast NGL Express system is another conversion candidate. The line moves up to 475 Mb/d of Y-grade and is fed by a 352-mile, 24-inch expansion from Winkler County.

Scaling the same hydraulics, a 30-inch, ~180-mile gas segment could move roughly 0.8–1.0 Bcf/d. At 90% utilization and a $0.60–0.70/MMBtu tariff, that yields $165–240MM of annual revenue and ~$120–180MM/yr of EBITDA.

Building a greenfield replacement project at costs similar to Targa’s Speedway (~$3–3.5MM/mile for a 30-inch NGL pipe) implies $0.6–0.8B for an equivalent gas line. A full conversion that reuses the steel but adds compression and meets CFR Part 192 regulations would likely run $250–400MM in Capex (~30–50% of a greenfield project). The project economics point to a 3– to 5-year payback and clearly superior project economics vs a WTG conversion.

Our Take: Based on engineering and cash flow comparisons, the 30-inch Lone Star Express leg is the best NGL-to-gas conversion candidate in ET’s portfolio. However, Lone Star is also a core artery to ET’s Mont Belvieu fractionation complex, creating big tradeoffs for the NGL business from a conversion.

West Texas Gateway, while a smaller-bore line with modest EBITDA, is an easier asset to sacrifice in an increasingly long NGL pipeline market. In East Daley’s view. WTG is a more plausible conversion candidate, even if it is not the optimal steel in the ground.

Estimated Quarterly Volumes:

Total Sample represents the flow sample and plant data accessible to EDA. The latest Q-o-Q percentage change is estimated by comparing either flow sample data Q-o-Q or plants within a basin that have continuously reported inlet volumes from the prior quarter to the current quarter. Sample data is now inclusive of all plant data within a basin, resulting in a one-time change to total sample basin levels in 2Q and 3Q. 4Q25 is expressed as Q-o-Q growth from 3Q25.

Rockies represents the aggregate of Big Horn, DJ, Green River, Piceance, Powder River, San Juan, Uinta and Wind River basins.

Delaware: Delaware flow sample data is down 2.7% Q-o-Q. Matador’s San Mateo system is down 1.8% while Kinetik’s Durango system is up 13.9% Q-o-Q. The top producers on Durango include Mewbourne Oil, Spur Energy Partners and Permian Resources.

Bakken: Bakken flow sample data is down -2.1% Q-o-Q. Kinder Morgan’s Outrigger II system is down -2.2% while Hess Midstreams’ Tioga system is up 14.6% Q-o-Q. The top producers on Tioga include Chevron, Chord Energy and Devon Energy.

Calendar: