Top Stories of 2025: The Daley Note, Jan. 14, 2025. Phillips 66 (PSX) will buy EPIC Y-Grade’s NGL business for $2.2B in cash. The deal elevates PSX into an elite group of major integrated NGL players and continues a consolidation trend focused on the Permian NGL barrel.

PSX announced the deal on Jan. 6. Phillips will acquire the following assets from EPIC:

PSX announced the deal on Jan. 6. Phillips will acquire the following assets from EPIC:

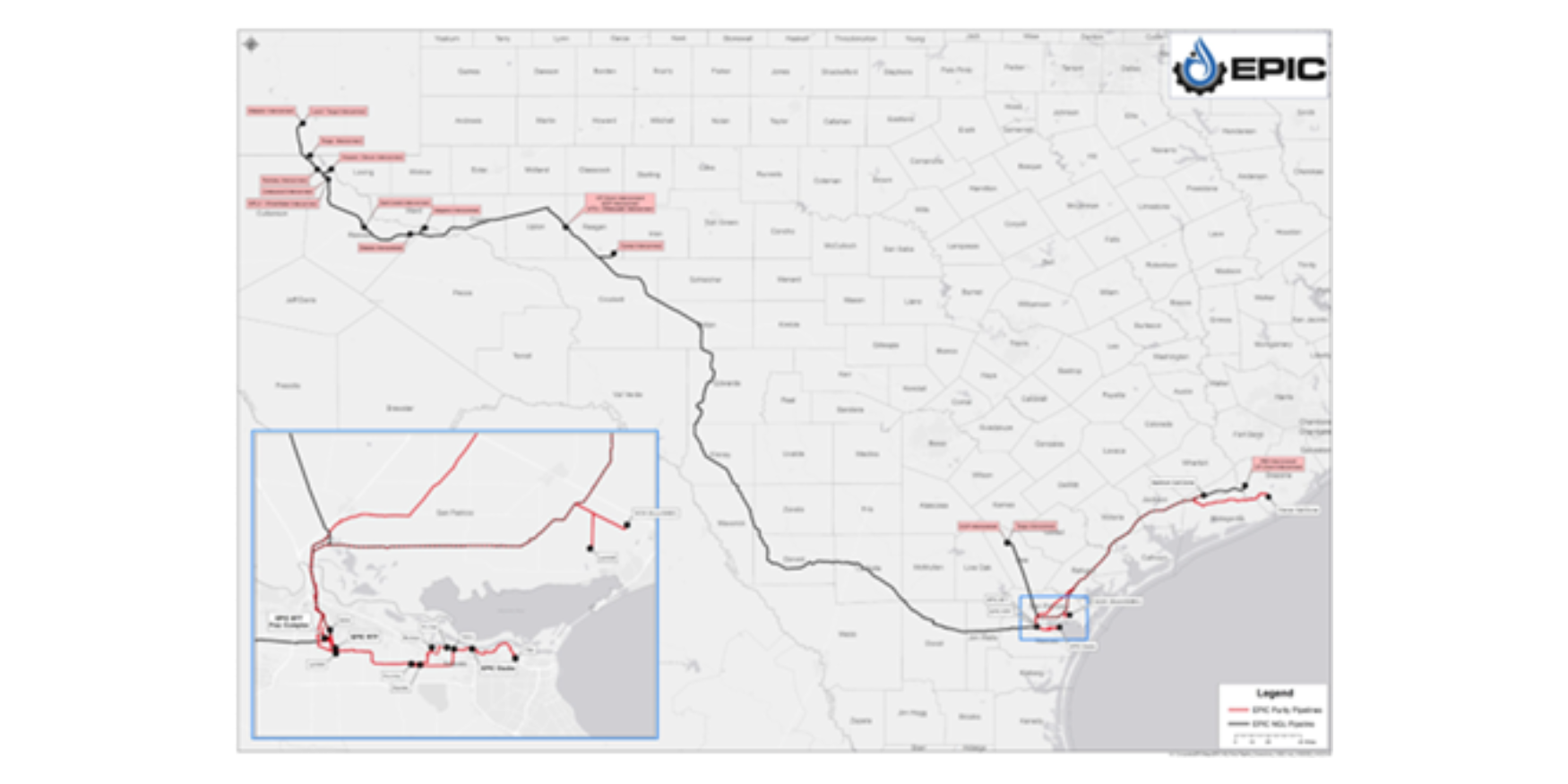

- An NGL long-haul pipeline connecting Permian Basin supply to Corpus Christi, Sweeny and Mont Belvieu demand markets along the Gulf Coast (see map). The pipeline has a capacity of 175 Mb/d and will be expanded to 350 Mb/d.

- A 350-mile purity product distribution system that can move purity NGL products bi-directionally between Corpus Christi, Sweeny and Mont Belvieu. The system has a capacity of 450 Mb/d.

- Two fractionation units near Corpus Christi with 170 Mb/d of capacity, expandable to 280 Mb/d.

What We Like About the Deal: This secures PSX’s position as an integrated NGL player alongside Enterprise Products (EPD), Energy Transfer (ET), Targa Resources (TRGP) and ONEOK (OKE). OKE just made one of its own strategic moves by acquiring EnLink Midstream (ENLC). The EPIC assets will nearly double NGL egress capacity for PSX, once the pipeline reaches its expanded capacity.

Another benefit is exposure to more diversified supply sources via G&P interconnections including Matador Resources (MTDR) and Devon Energy (DVN), and downstream connections to BP (60 Mb/d MVC), ExxonMobil (XOM) and LyondellBasell (LYB).

Areas for Improvement: We believe the $2.2B purchase price yields an EV/EBITDA multiple of about 12x for the latest 12 months. Furthermore, PSX is now short NGL equity barrels with respect to NGL pipeline capacity, which means it is reliant on third parties to direct its NGL plant production to the EPIC Y-Grade and Sand Hills pipelines.

Speculation City: East Daley Analytics believes the next move in integration musical chairs is for PSX to target G&P asset systems that feed EPIC and are not already owned by one of the large midstream companies. Four of these systems are in the Delaware and one is in the Midland. – Rob Wilson, CFA and Ajay Bakshani, CFA Tickers: DVN, ENLC, EPD, ET, LYB, MTDR, OKE, PSX, TRGP, XOM.

The Permian Basin at a Crossroads: Download the Latest White Paper

The Permian Basin at a Crossroads: Download the Latest White Paper

The Permian Basin is the heart of the US energy industry, supplying half of crude oil and NGL production and nearly 20% of natural gas. Yet market pressures are forcing changes, prompting billions in new pipeline investments and reorienting how operators approach the basin. East Daley’s new white paper, The Permian Basin at a Crossroads, is the first of a 3-part series looking at the shifts underway in the Permian. In this series, we reveal how LNG demand and AI data centers could transform Permian gas into a primary revenue driver. We also review the multi-billion-dollar infrastructure needed to unlock this shift, and what’s at stake for oil, gas and midstream operators. — Click here to download the The Permian Basin at a Crossroads white paper!

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.