Executive Summary:

Infrastructure: ExxonMobil (XOM) has agreed to acquire a 40% joint interest in Enterprise Products’ Bahia NGL pipeline, sealing a deal that changes the competitive landscape in the Permian Basin.

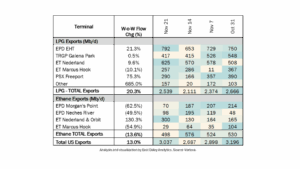

Exports: PSX Freeport and smaller terminals helped lift US NGL exports by 13% for the week ending Nov. 21, even as ethane shipments declined across most hubs.

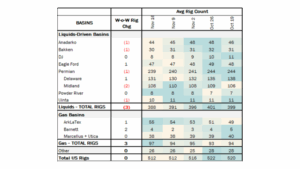

Rigs: The total US rig count remained unchanged during the week of Nov. 16 at 512 rigs. Liquids-driven basins lost 3 rigs W-o-W from 391 to 388.

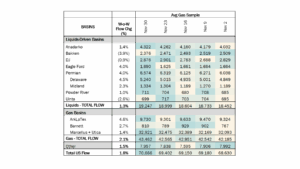

Flows: US natural gas volumes in pipeline samples averaged 70.7 Bcf/d for the week ending Nov. 30, up 1.8% W-o-W.

Calendar: Basin S&Ds Dec. 5

Infrastructure:

ExxonMobil (XOM) has agreed to acquire a 40% joint interest in Enterprise Products’ (EPD) Bahia NGL pipeline, sealing a deal that changes the competitive landscape in the Permian Basin.

Exxon and Enterprise plan to expand Bahia from 600 Mb/d to 1 MMb/d and build a 92-mile lateral directly to XOM’s Cowboy gas plant in Eddy County, NM. The companies expect to complete the Bahia expansion and extension, called the Cowboy Connector Pipeline, in 4Q27. Exxon will invest $650MM under the agreement, according to Reuters.

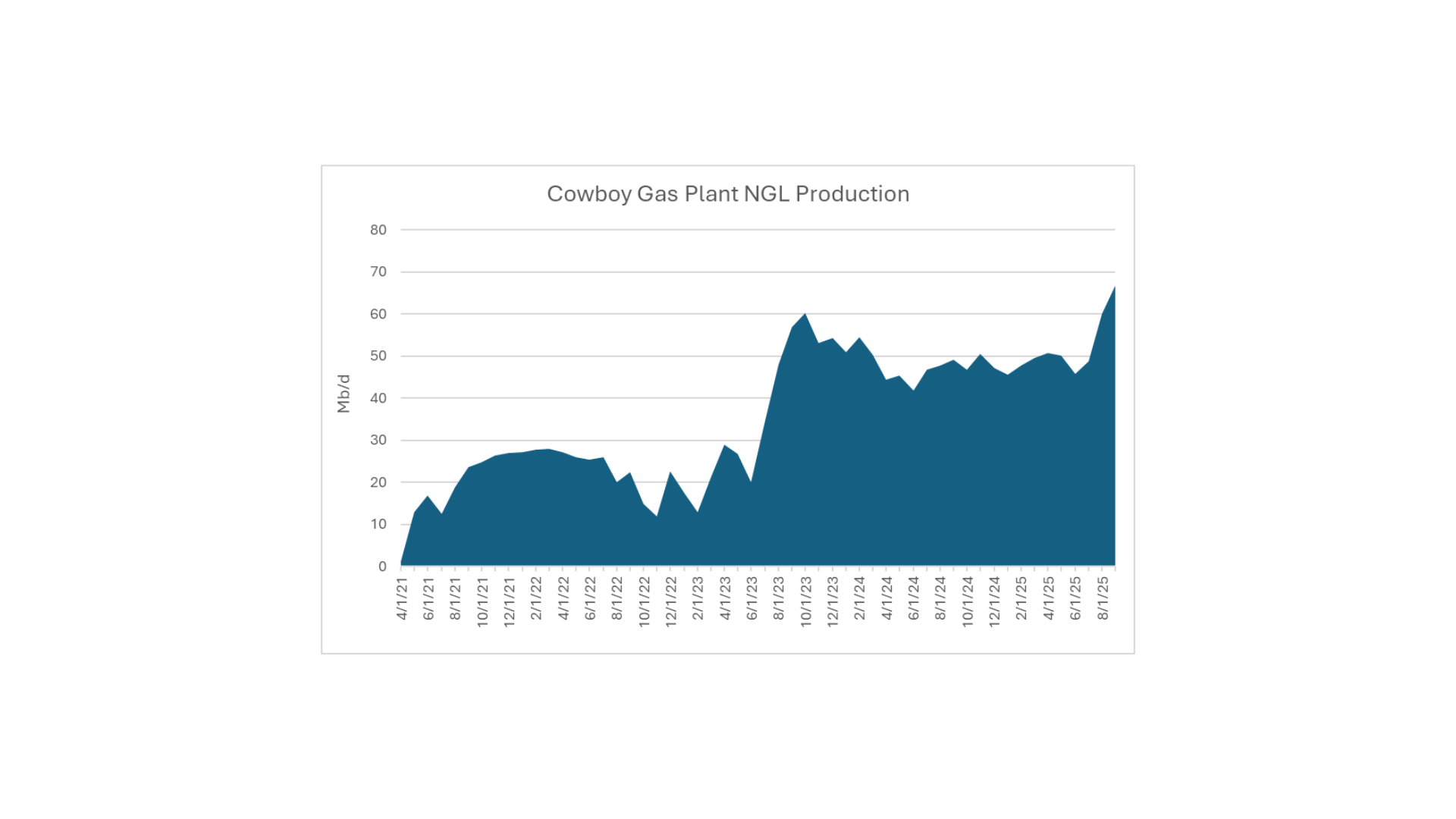

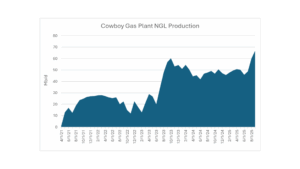

East Daley Analytics’ G&P System Analysis dashboard in Energy Data Studio shows the Cowboy plant running effectively full at its 600 MMcf/d of processing capacity and producing ~60 Mb/d of NGLs (see figure). According to the NGL Hub Model, all the barrels currently flow on EPD’s Mid-America Pipeline (MAPL) system.

While the deal doesn’t shift NGLs to a different pipeline owner, it is strategically meaningful in how it reshapes Exxon’s broader commercial incentives. By partnering with Enterprise and co-sponsoring the Bahia expansion, Exxon is effectively tying its long-term Permian NGL strategy deeper into the EPD network. That matters because XOM is one of the largest upstream contributors to Energy Transfer (ET), accounting for ~18% of its Permian gas processing volumes.

Cowboy itself poses no direct risk to Energy Transfer, but the new alignment with EPD creates a stronger pull for Exxon’s other barrels and future growth volumes, meaning discretionary NGL flows could migrate toward EPD instead of ET. This is the emerging competitive risk for Energy Transfer, small today but potentially material over time across its pipe, frac, storage and export chain.

The Permian Basin at a Crossroads: Download Why This Pipeline Boom is Different

The Permian’s next big buildout is already taking shape — but this time, the drivers aren’t producers chasing oil. East Daley’s latest white paper reveals how gas demand from AI data centers, LNG exports, and utilities is rewriting the midstream playbook. Over 9 Bcf/d of new capacity and $12 billion in investments are reshaping flows, turning the Permian into a gas powerhouse even as rigs decline. Read Part II: Why This Pipeline Boom is Different

This shift highlights a widening philosophical divide among the Permian’s major NGL operators. EPD and Targa Resources (TRGP) are taking bold, offensive positions by investing in long-haul systems, in TRGP’s case the recently announced Speedway Pipeline. The companies have made the commitments despite a nearly 1.5 MMb/d overbuild in Permian NGL takeaway, according to the NGL Hub Model. The strategy is clear: the winners in the next cycle will be those operators that control the molecules, not the ones that wait for perfect utilization.

Energy Transfer, by contrast, is signaling caution. In its 3Q25 earnings, ET executives discussed converting an NGL pipeline to gas service, at the same time its competitors are expanding. ET isn’t structurally weak; its asset base is deep and integrated, but the company is being pressured into a strategic reckoning as the competitive board tilts toward operators willing to take risk to secure barrels.

The outcome is far from settled. Boldness could pay off for EPD and TRGP, or their expansions could deepen pressure on rates in an already crowded market. ET’s discipline could prove prudent, or it could watch competitors reshape the Permian NGL landscape around them.

What is clear is this: The competitive question is no longer about overbuild – it’s about who is positioning to capture market share. EPD and Targa are playing offense. ET must decide whether to match that posture, or risk losing control of the barrels that drive the value chain.

Exports:

PSX Freeport recorded a 75% increase in LPG exports, with gains at the remaining terminals supporting a 20% W-o-W uplift. Conversely, ET Nederland and Orbit experienced a 130% surge in ethane volumes; however, broad declines of roughly 50% at the other export terminals resulted in a 13.6% W-o-W drop in total ethane exports. Despite the ethane pullback, overall US NGL exports increased by 13%.

Rigs:

The total US rig count remained unchanged during the week of Nov. 16 at 512 rigs. Liquids-driven basins lost 3 rigs W-o-W from 391 to 388.

- Anadarko (-1): Ezekial Exploration

- Bakken (-1): ConocoPhillips

- Eagle Ford (+1): EOG Resources

- Permian:

- Delaware (+1): ExxonMobil

- Midland (-2): ExxonMobil

- Uinta (-1): Fourpoint Resources

Flows:

US natural gas volumes in pipeline samples averaged 70.7 Bcf/d for the week ending Nov. 30, up 1.8% W-o-W.

US natural gas volumes in pipeline samples averaged 70.7 Bcf/d for the week ending Nov. 30, up 1.8% W-o-W.

Major gas basin gained 2.1% W-o-W to average 43.5 Bcf/d. The Haynesville sample increased 4.6% to 9.7 Bcf/d, while the Marcellus+Utica sample rose 1.4% to 32.9 Bcf/d.

Samples in liquids-focused basins increased 1.3% to 19.2 Bcf/d. The Permian sample gained 4.0% to 6.6 Bcf/d, while the Eagle Ford sample also rose 4.0% W-o-W.

Calendar: