Energy Transfer (ET) is looking to upsize its Desert Southwest pipeline after selling out the initial 1.5 Bcf/d of capacity in a recent open season. The results confirm strong gas demand potential in the Southwest from utilities and data centers.

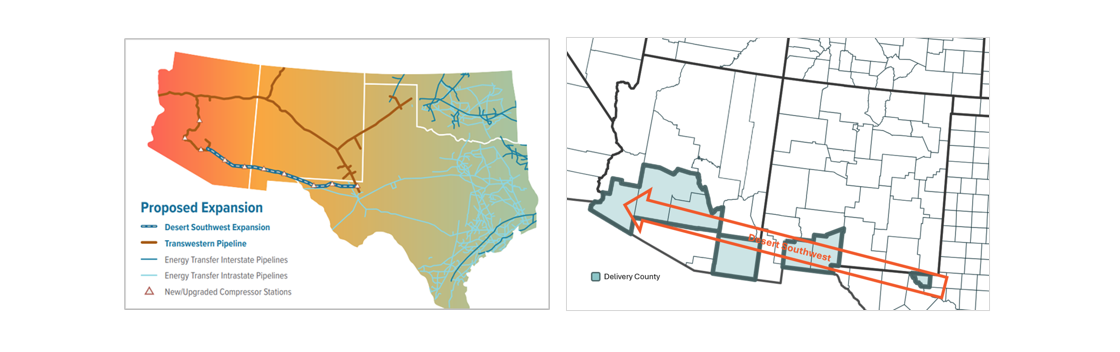

ET made waves this summer when it announced a final investment decision (FID) on Desert Southwest, a proposed expansion of its Transwestern Pipeline, before completing an open season. The project will add 516 miles of 42-inch pipe at an initial capacity of 1.5 Bcf/d, and with the potential for further expansion, ET said in the Aug. 6 announcement.

ET made waves this summer when it announced a final investment decision (FID) on Desert Southwest, a proposed expansion of its Transwestern Pipeline, before completing an open season. The project will add 516 miles of 42-inch pipe at an initial capacity of 1.5 Bcf/d, and with the potential for further expansion, ET said in the Aug. 6 announcement.

The decision to move forward without formal contracts showed confidence in Desert Southwest, a strategy validated by the results of the open season. The project sold all 1.5 Bcf/d of the initial capacity under 25-year contracts with investment-grade counterparties, ET revealed in its 3Q25 investor presentation. Moreover, since closing the initial open season, the project has “received significantly more interest than current planned capacity,” and the company is evaluating expansion options.

Desert Southwest has an expected 4Q29 in-service date, and ET confirmed the $5.3B Capex estimate in the latest update. The company has entered into commitments with US pipe mills to lock in pipe delivery in 4Q27 at favorable prices, and anticipates 100% of the project’s pipe fabrication will be locked in soon.

Management is considering whether to upsize the project from 42- to 48-inch pipeline given the strong interest since the open season, executives said on the investor call. The change would potentially add 0.5-1.0 Bcf/d to delivery capacity.

The success of the proposed expansion comes as no surprise to East Daley Analytics. In the West Coast Supply & Demand Report, we had identified a growing imbalance in the Southwest from new utility and data center demand, well before ET announced the Transwestern expansion. Gas consumption is increasing to support population growth and an emerging technology hub. Including the expected startup of ECA LNG on Mexico’s Pacific coast, we forecast a regional imbalance of over 1.6 Bcf/d by 2030. The Desert Southwest project will go a long way to fill this gap.

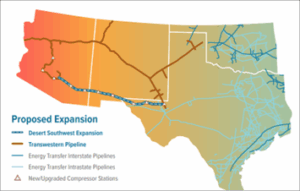

Data center development in Arizona – and Maricopa County in particular – has been strong as the AI boom continues, and gas continues to be the preferred fuel to generate power and reinforce that buildout. In the Data Center Demand Tracker, East Daley is currently tracking nearly 20 data center projects in the county covering Phoenix. If all those projects are powered by gas-fired generation, Maricopa could see nearly 1.2 Bcf/d of additional demand.

Data center development in Arizona – and Maricopa County in particular – has been strong as the AI boom continues, and gas continues to be the preferred fuel to generate power and reinforce that buildout. In the Data Center Demand Tracker, East Daley is currently tracking nearly 20 data center projects in the county covering Phoenix. If all those projects are powered by gas-fired generation, Maricopa could see nearly 1.2 Bcf/d of additional demand.

Desert Southwest is designed to deliver gas to seven counties across Texas, New Mexico and Arizona (see map), following existing pipeline easements for “between 75% to 99% of the route,” according to a project update on ET’s website. We expect Desert Southwest will largely follow the same route as El Paso Natural Gas’s South Mainline before interconnecting with Transwestern’s Phoenix lateral in Arizona.

In addition to building a new lateral, the expansion will also upgrade Transwestern’s existing Phoenix lateral. The project will modify an existing compressor and construct two new compressor stations to allow the lateral to move gas bidirectionally. The upgrades provide greater flexibility supplying gas into California further downstream. – Ian Heming Tickers: ET.

The Permian Basin at a Crossroads: Download the Latest White Paper

The Permian Basin at a Crossroads: Download the Latest White Paper

The Permian Basin is the heart of the US energy industry, supplying half of crude oil and NGL production and nearly 20% of natural gas. Yet market pressures are forcing changes, prompting billions in new pipeline investments and reorienting how operators approach the basin. East Daley’s new white paper, The Permian Basin at a Crossroads, is the first of a 3-part series looking at the shifts underway in the Permian. In this series, we reveal how LNG demand and AI data centers could transform Permian gas into a primary revenue driver. We also review the multi-billion-dollar infrastructure needed to unlock this shift, and what’s at stake for oil, gas and midstream operators. — Click here to download the The Permian Basin at a Crossroads white paper!

Meet Daley, the Best AI Tool in Energy

Meet Daley, the newest member of our energy team. Our new AI assistant is live and available to all East Daley Analytics clients. Early feedback has been phenomenal. Daley is platform-specific and only pulls from East Daley’s own proprietary data and content. It’s not open-source or generic AI, but built to understand our structure, language and analytics. Whether you’re looking for a specific metric, forecast or explanation, Daley can get you there quicker. — Reach out to learn more about Daley!

The Daley Note

Subscribe to The Daley Note for energy insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.