Executive Summary:

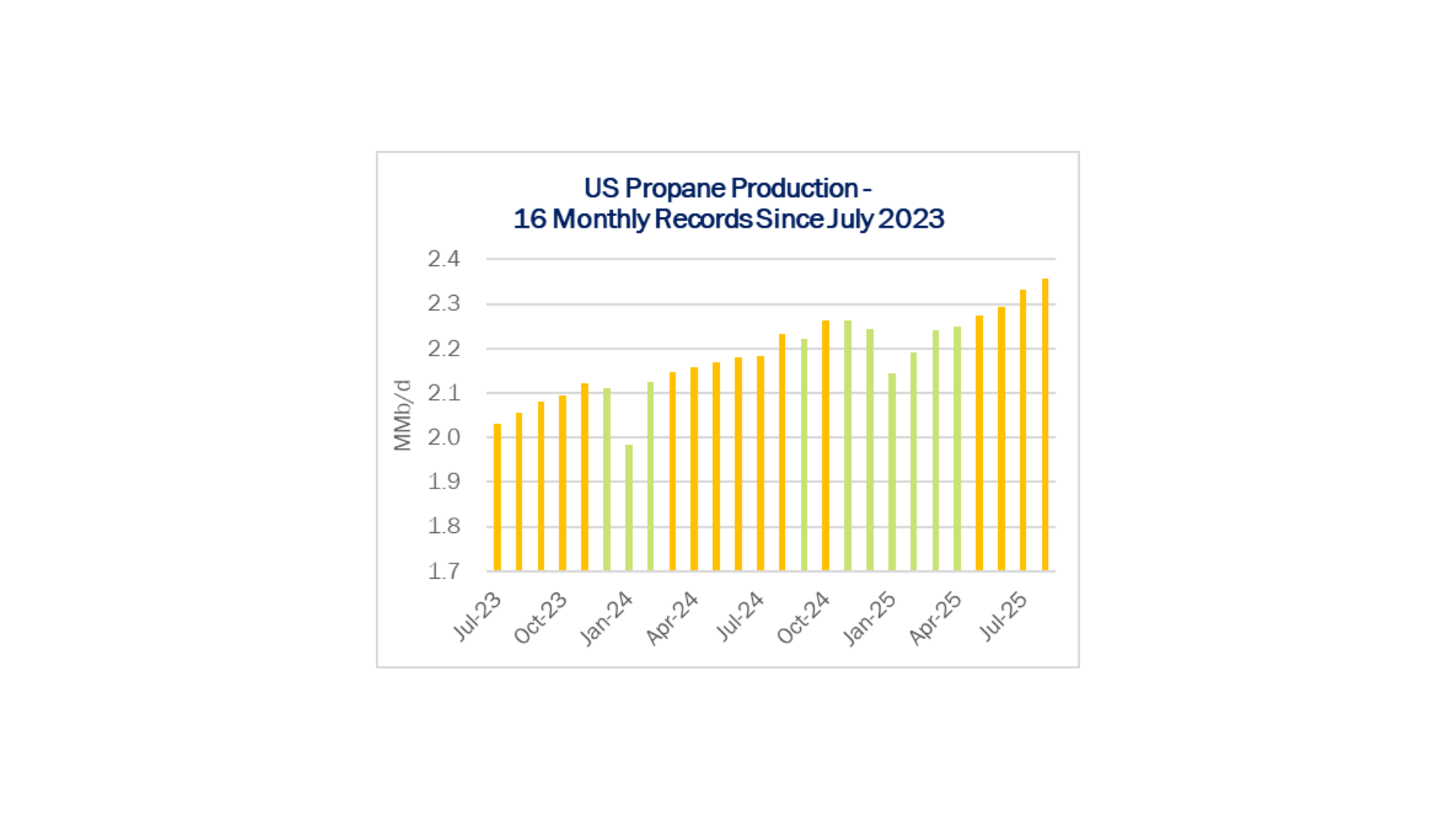

Infrastructure: Since surpassing 2 MMb/d in July 2023, US propane production has set 16 monthly records in just over two years.

Exports: Outside of the week ending Nov. 7, EPD’s Neches River terminal has been exporting roughly 150 Mb/d of ethane per week, running above its 120 Mb/d Phase 1 capacity.

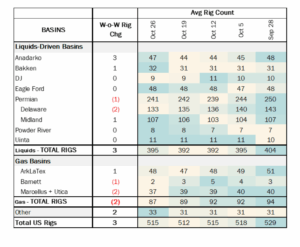

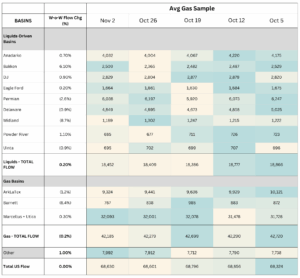

Rigs: The total US rig count increased during the week of Oct. 26 to 515. Liquids-driven basins decreased 4 rigs W-o-W from 397 to 393.

Flows: US natural gas volumes in pipeline samples increased 0.8%, averaging 69.2 Bcf/d for the week ending Nov. 9.

Calendar:

Infrastructure:

Propane has emerged as one of the most powerful drivers of American energy dominance. Since surpassing 2 MMb/d in July 2023, US propane production has set 16 new monthly records in just over two years.

Every month, odds are good that US propane will set a production record – 61% have set fresh highs over the last two years (see chart below). East Daley’s Purity Product Forecast shows volumes climbing past 2.35 MMb/d by Aug ‘25, underscoring how propane’s momentum has become a structural feature of the shale system.

Propane sits at the heart of the US hydrocarbon machine. It links oil, gas and NGL markets – and it has to keep flowing for all three to work. Outside dry gas plays, new wells bring more propane, and unlike ethane, propane must be recovered from the residue stream within strict limits. If propane stops moving, it can back up gas and crude production. Keeping propane barrels flowing is now as essential to sustaining LNG growth as it is to maintaining oil output.

Rather than a byproduct to manage, propane is a competitive advantage, a molecule that turns US abundance into global influence. As exports expand and new markets emerge, propane is powering the next wave of American energy leadership, proving once again that in today’s energy landscape the light end is the right end.

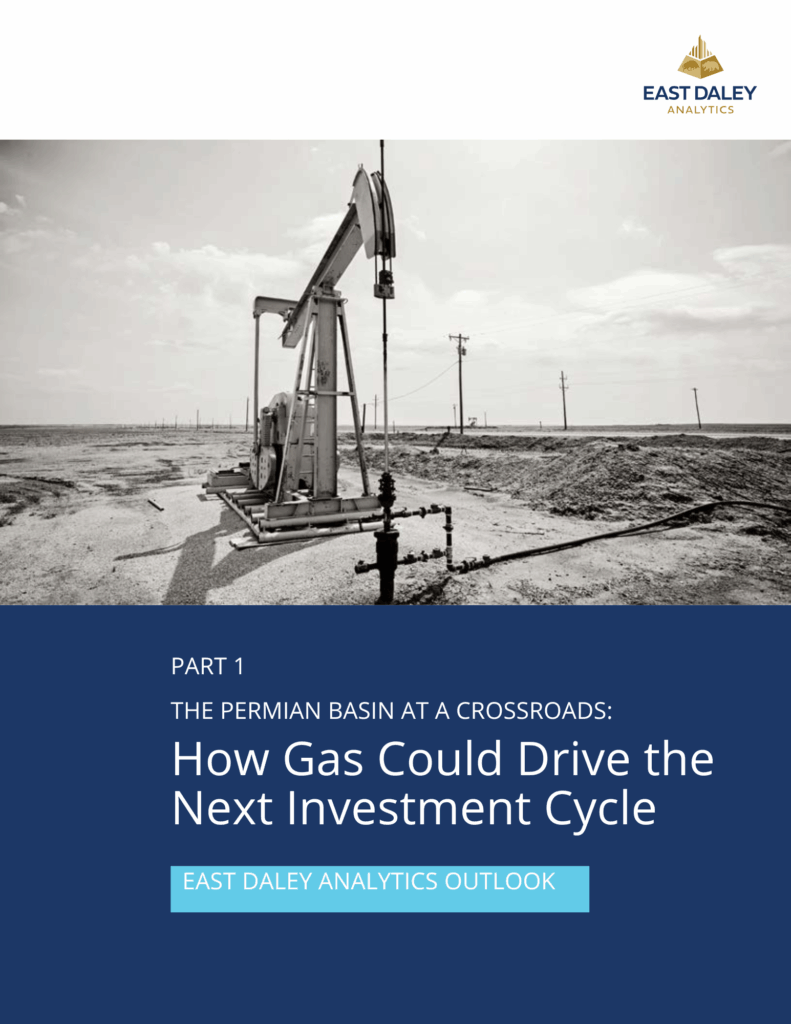

The Permian Basin at a Crossroads: Download Why This Pipeline Boom is Different

The Permian’s next big buildout is already taking shape — but this time, the drivers aren’t producers chasing oil. East Daley’s latest white paper reveals how gas demand from AI data centers, LNG exports, and utilities is rewriting the midstream playbook. Over 9 Bcf/d of new capacity and $12 billion in investments are reshaping flows, turning the Permian into a gas powerhouse even as rigs decline. Read Part II: Why This Pipeline Boom is Different

Exports:

US NGL exports posted a strong week, rising 14% W-o-W for the period ending Nov. 7. The gains were led by a 37% jump in LPG exports, with solid performance across nearly all terminals. ET’s Marcus Hook and Nederland terminals stood out, each nearly doubling export volumes from the prior week.

Ethane exports moved in the opposite direction, declining 32% W-o-W. The pullback was driven largely by reductions at EPD’s Neches River and ET’s Nederland/Orbit terminal, where volumes were down nearly 60% from the previous week.

Outside of the week ending Nov. 7, EPD’s Neches River terminal has been exporting roughly 150 Mb/d of ethane per week, running above its 120 Mb/d Phase 1 capacity.

Rigs:

The total US rig count increased during the week of Oct. 26 to 515. Liquids-driven basins decreased 4 rigs W-o-W from 397 to 393.

- Anadarko (+3): Mewbourne Oil, US Oil Resources, Tamworth Resources

- Bakken (+1): Prima Exploration

- Permian:

- Delaware (-2): Chevron, Civitas Resources

- Midland (+1): Ovintiv

Flows:

US natural gas volumes in pipeline samples increased 0.8%, averaging 69.2 Bcf/d for the week ending Nov. 9.

Major gas basin samples gained 0.8% W-o-W to 42.5 Bcf/d. The Haynesville sample increased 1.6% to 9.5 Bcf/d, while the Marcellus+Utica sample gained 0.2% to 32.2 Bcf/d.

Samples in liquids-focused basins increased 0.2% to 18.5 Bcf/d. The Permian sample declined 2.6% to 6.0 Bcf/d, while the Bakken sample gained 6.1% W-o-W.

Calendar: