Executive Summary:

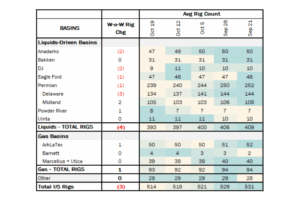

Rigs: The total US rig count decreased during the week of Oct. 19 to 514.

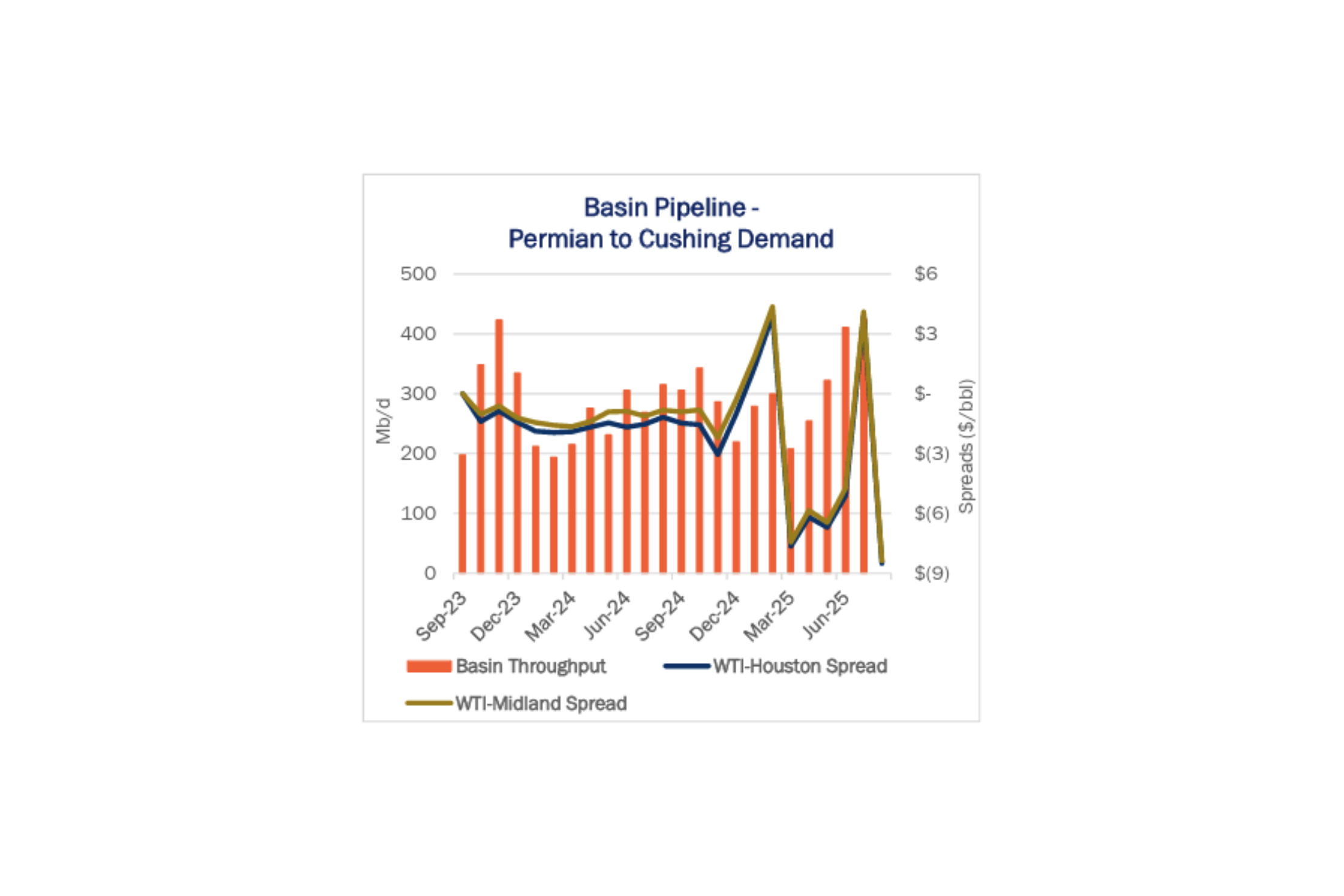

Infrastructure: In June and July, Basin Pipeline’s deliveries to Cushing and Wichita Falls reached levels not seen since November 2023 as traders reacted to an unusual price premium.

Supply & Demand: The US natural gas pipeline sample, a proxy for change in oil production, decreased 4.5% W-o-W across all liquids-focused basins.

Rigs:

The total US rig count decreased during the week of Oct. 19 to 514. Liquids-driven basins decreased by 4 rigs W-o-W from 397 to 393.

- Permian:

- Delaware (-3): Mewbourne Oil, Coterra Energy, Devon Energy

- Midland (+2): Exxon, Highpeak Energy

- DJ (-2): Bison Operating, Dunamis Energy Operating

- Anadarko (-2): Carmen Schmitt, Northern Lights Oil

- Eagle Ford (-1): SM Energy

- Powder River (+1): WRC Energy

Infrastructure:

In June and July, Basin Pipeline’s deliveries to Cushing, OK and Wichita Falls, TX reached levels not seen since November 2023 as traders reacted to an unusual price premium at the Cushing hub.

According to East Daley’s Crude Hub Model, Basin Pipeline deliveries to Cushing and Wichita Falls jumped from ~322 Mb/d in May ’25 to an average of ~417 Mb/d the following two months. The increased throughput coincided with a drastic change in regional price spreads between WTI and the Houston and Midland markets.

From January-May 2025, WTI traded at an average $4.34/bbl discount to Houston and $4.02 under Midland prices. The spreads flipped in July, with WTI trading at an average $3.91 premium to Houston and $4.11 over Midland. Operators responded to the market signal, sending Basin’s deliveries to Cushing and Wichita Falls to an almost two-year high to capture the premium WTI pricing (see figure).

Basin Pipeline has capacities ranging from 240-450 Mb/d depending on the segment, and is operated and predominantly owned by Plains All American (PAA; 87% stake). The remaining interest belongs to Enterprise Products (EPD).

In June, deliveries to Plains Pipeline en route to Cushing rose 23% M-o-M and another 7% in July. Deliveries to Wichita Falls Station via NuStar Energy Pipeline skyrocketed 100% M-o-M from 1.52 MMbbl in May to 3.05 MMbbl in June. In July, deliveries increased 7% to Cushing and 14% to Wichita Falls Station.

The re-routing of Permian barrels to Cushing and Wichita Falls in June-July negatively affected pipelines bound for Houston. Over the same period, BridgeTex Pipeline deliveries to Houston decreased from ~411 Mb/d to ~388 Mb/d.

Overall, Basin Pipeline’s surge in deliveries to Cushing and Wichita Falls reflects operators responding to favorable WTI pricing differentials. As spreads flipped, flows shifted to Cushing and Wichita Falls, underscoring how price signals continue to drive crude routing and regional supply dynamics across Permian systems

The Permian Basin at a Crossroads: Download the Latest White Paper

The Permian Basin is the heart of the US energy industry, supplying half of crude oil and NGL production and nearly 20% of natural gas. Yet market pressures are forcing changes, prompting billions in new pipeline investments and reorienting how operators approach the storied basin. East Daley’s new white paper, The Permian Basin at a Crossroads, is the first of a 3-part series looking at the shifts underway in the Permian. In this series, we reveal how LNG demand and AI data centers could transform Permian gas into a primary revenue driver. We also review the multi-billion-dollar infrastructure needed to unlock this shift, and what’s at stake for oil, gas and midstream operators. — Click here to download the The Permian Basin at a Crossroads white paper!

Supply and Demand

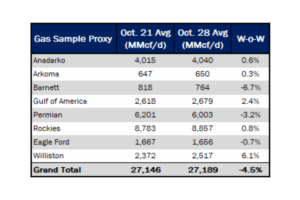

The US natural gas pipeline sample, a proxy for change in oil production, decreased 4.5% W-o-W across all liquids-focused basins.

The Permian sample declined by 3.2%, Barnett by 3.2% and the Eagle Ford sample by a little below 1%. These decreases coincided with increases in the rest of the basins. The Gulf of America sample increased 2.4%, Rockies 0.8% and the Williston increased 6.1%. The Rockies and the Gulf of America have a high correlation between gas volumes and crude oil volumes, whereas the Permian and Eagle Ford basins correlation is less than 45%.

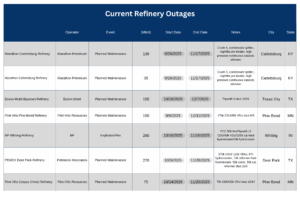

As of Nov. 3, there is currently ~1,100 Mb/d of refining capacity offline for planned maintenance. This is a big fall off from the previous week, with an addition of 155 Mb/d from ExxonMobil’s Baytown refinery in Texas.

Vessel traffic monitored by EDA along the Gulf Coast decreased W-o-W. There were 18 vessels loaded for the week ending November 1, the lowest since

the last week of August 2025.

Regulatory and Tariffs:

Presented by ARBO

Tariffs:

Gray Oak Pipeline, LLC: Certain available capacity discounts were increased.

Magellan Pipeline Company, L.P.: The tariffs were revised to add a new product and to update the product grade document to be consistent with ONEOK’s product grade documents.

The above information is provided by ARBO’s Oil Pipeline Tariff Monitor. For more information on regulatory proceedings or tariff rates, please contact please contact Corey Brill via email at [email protected] or phone at 202-505-5296. https://www.goarbo.com/