Several leading Permian-to-Gulf Coast natural gas pipelines face significant contract expirations over the next few years. Owners and shippers must renegotiate in a transformed market for Permian Basin gas, and both sides can come to the table armed with reasonable data justifying higher or lower rates.

Permian Highway Pipeline (PHP) and Gulf Coast Express (GCX) will see major contracts roll off by 2029, according to East Daley Analytics’ analysis of Form 549D data. Form 549D is a quarterly report intrastate pipelines file with the Federal Energy Regulatory Commission (FERC) covering transportation and contracting activity. Kinder Morgan (KMI), Kinetik (KNTK) and ExxonMobil (XOM) are owners in PHP, and KMI and ArcLight Capital Partners own GCX.

The two pipelines were originally contracted to producers based on supply-push dynamics, with transportation rates structured around spreads between the Waha hub and downstream Gulf Coast markets. Those spreads historically have been wide due to chronic Permian oversupply, limited takeaway capacity and relatively low in-basin demand.

The two pipelines were originally contracted to producers based on supply-push dynamics, with transportation rates structured around spreads between the Waha hub and downstream Gulf Coast markets. Those spreads historically have been wide due to chronic Permian oversupply, limited takeaway capacity and relatively low in-basin demand.

However, with over 9 Bcf/d of new takeaway capacity expected by 2030, Waha-to-Gulf Coast spreads have the potential to compress, putting pressure on the rates shippers are willing to pay. East Daley recently highlighted this recontracting risk following Tallgrass Energy’s announcement of its Permian-to-Rockies Express project.

KMI, however, has argued that the rate risk is overstated. On its 2Q25 earnings call, KMI executives pointed to the likelihood that demand-pull shippers — utilities, data centers and LNG buyers — will step in to replace producers as the pipeline anchors, bringing a greater willingness to pay and mitigating downside exposure.

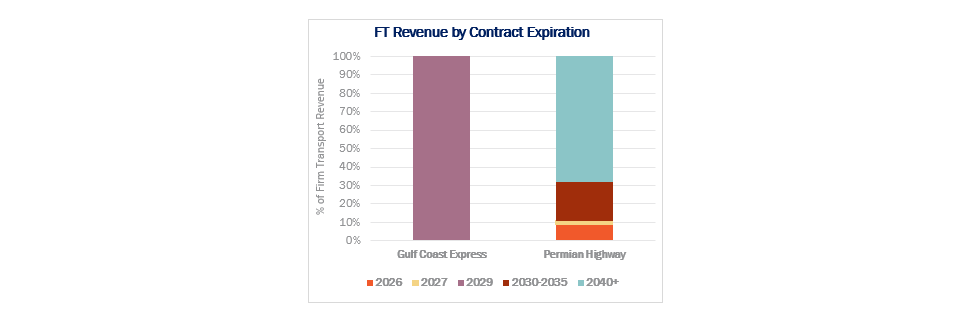

East Daley’s analysis of 549D intrastate data underscores this risk-reward dynamic. On PHP, three firm transport (FT) contracts representing ~10% of annual pipeline revenue will roll off by 2027. The stakes are higher for GCX. The pipeline will see all 11 of its FT contracts expire by 2029, accounting for virtually all of its FT revenue.

The timing gives GCX a potentially unique advantage: the ability to recontract in bulk with demand-pull shippers, particularly as it brings online a fully contracted 570 MMcf/d expansion in 2H26. PHP has a more staggered contract expiration profile, leaving ~70% of its firm revenue intact through 2040 (see figure). The staggered expirations support a more stable outlook for PHP over the next decade.

The recontracting environment could also favor GCX, because demand-pull shippers such as utilities, LNG export facilities and data centers are likely to pay higher rates than producers moving molecules out of the basin. This shift could drive a moderate revenue uplift for GCX when its contracts roll off in 2029.

While the risk of a Permian overbuild could still weigh on supply-side tariff rates, the growing influence of demand-pull markets offers a meaningful offset, supporting the long-term revenue outlook for both pipelines. – Garrett Streit Tickers: KMI, KNTK, XOM.

Meet Daley, the Best AI Tool in Energy

Meet Daley, the newest member of our energy team. Our new AI assistant is live and available to all East Daley Analytics clients. Early feedback has been phenomenal. Daley is platform-specific, and only pulls from East Daley’s own proprietary data and content. It’s not open-source or generic AI, but built to understand our structure, language and analytics. Whether you’re looking for a specific metric, forecast or explanation, Daley can get you there quicker. — Reach out to learn more about Daley!

Get the FERC Intrastate Pipeline Data

East Daley Analytics’ FERC 549D Intrastate Contract Data delivers contract shipper data for intrastate pipelines — scrubbed and ready to use. Use the 549 data to identify which intrastate pipelines have available capacity, understand pipeline rate structures, gain insights into shippers, and spot contract cliffs and opportunities for higher rate renewals. Reach out to East Daley to learn more.

The Daley Note

Subscribe to The Daley Note for energy insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.