Keyera’s (KEY.TO) $3.75B acquisition of Plains All American’s (PAA) Canadian NGL assets transforms the company into a coast-to-coast powerhouse with arguably the most flexible NGL platform in Canada.

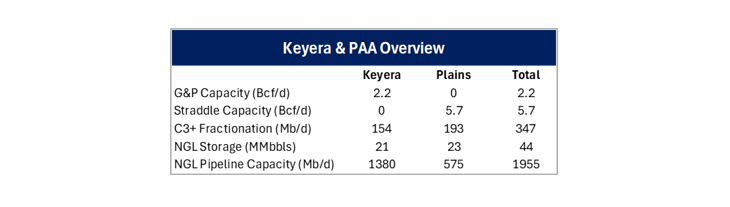

Keyera and Plains announced the CAD$5.15B deal on June 17. By adding ~193 Mb/d of fractionation capacity and 23 MMbbl of NGL cavern storage across Fort Saskatchewan and Sarnia, KEY can offer producers and marketers full-service logistics from northeastern British Columbia to Eastern Canada. The deal also contributes 5.7 Bcf/d of straddle plant capacity at Empress and a critical Y-grade pipeline network (see table), putting Keyera in direct competition with Pembina (PBA) for NGL transport and fractionation services. PAA and KEY expect to close the transaction in 1Q26.

While Pembina remains dominant at Alberta’s core NGL hub — with Redwater’s capacity soon hitting 256 Mb/d and 21 MMbbl of integrated storage — KEY will challenge that leadership in scale and redundancy. PBA still has the edge in long-haul liquids pipelines (~1.1 MMb/d across Peace and Northern), but Keyera’s KAPS system (~175 Mb/d and expanding into northeastern BC) offers strong Montney connectivity and is already ~75% contracted under long-term take-or-pay contracts. With both firms positioned at Edmonton/Fort Saskatchewan, customer decisions may hinge on service bundling, pricing and downstream access.

AltaGas, meanwhile, is carving out a different lane entirely. Its dominant West Coast export footprint — RIPET and Ferndale today, REEF by 2026 — makes it the LPG egress leader. Unlike KEY or PBA, AltaGas controls over 70 Mb/d of LPG export capacity and is vertically integrating upstream with Pipestone and North Pine. Notably, AltaGas has inked an 18-year deal to lease frac space at Keyera’s KFS, hinting at greater midstream cooperation as Montney propane volumes surge.

The PAA deal grows Keyera from a regional midstreamer to a national NGL integrator combining scale, geography and flexibility. While PBA still leads on pipeline and storage depth, and AltaGas leads at the dock, Keyera now offers a credible “best-of-both-worlds” platform. Its next test: execution. If Keyera can integrate Plains’ assets and optimize east-west flows while leveraging AltaGas’ terminals, it may become Canada’s most versatile NGL operator. – Julian Renton Tickers: KEY.TO, PBA.

TODAY – July Production Webinar

Join East Daley on July 9 for the Monthly Oil & Gas Production Webinar – your essential update on the latest production trends and midstream impacts across natural gas, NGLs and crude oil. Our experts unpack the latest rig trends, basin-level supply shifts, and midstream constraints shaping commodity markets. Join us on July 9!

NEW – The Burner Tip

The Burner Tip provides East Daley’s weekly coverage of natural gas markets. Every Thursday, The Burner Tip brings you our expert perspective on drivers shaping prices and flows in North America — including production trends, infrastructure dynamics, and forward-looking fundamentals — all grounded in EDA’s proprietary data and models. Whether you’re trading, investing, or managing risk, The Burner Tip delivers the insights you need to drive smarter strategy. Subscribe now to The Burner Tip!

Data Center Demand Monitor – Available Now!

Introducing Data Center Demand Monitor by East Daley Analytics. This is your go-to source for tracking data center projects and demand. We monitor and visualize nearly 300 US data center projects. Use Data Center Demand Monitor to forecast demand, identify pipeline corridors and track data center projects. — Request your demo now of the Data Center Demand Monitor!

The Daley Note

Subscribe to The Daley Note for energy insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.