Kinetik Holdings (KNTK), among the shining stars in midstream, faces a lawsuit by Energy Transfer (ET) that challenges one of the pillars supporting the company’s rapid growth.

East Daley Analytics recently provided a recap of KNTK’s 1Q25 earnings call. We noted future earnings tailwinds from the expiration of high-cost NGL transportation contracts that expire between 2026-28.

It has come to light that ET affiliate Lone Star NGL Product Services, LLC filed a lawsuit in May ’21 against Eagle Claw Midstream Ventures, LLC

and CR Permian Processing, LLC – entities now part of Kinetik (formerly BCP Raptor). The case centers on two long-term NGL purchase agreements that run through 2026 and require Eagle Claw to sell a daily volume of Y-grade NGL mix to the ET affiliate. The value of the allegations is estimated in excess of $100MM.

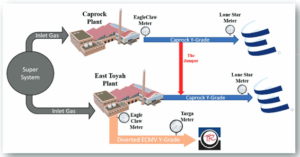

ET claims KNTK is in breach of contract and is selling its Y-grade to other NGL pipelines like Shin Oak and Targa Resource’s (TRGP) Grand Prix instead of honoring the ET deal. ET’s legal argument focuses on breach of contract and possibly fraudulent inducement or concealment. For example, ET alleges Eagle Claw installed a secret ‘jumper’ pipeline to divert NGLs away from Lone Star (see picture above).

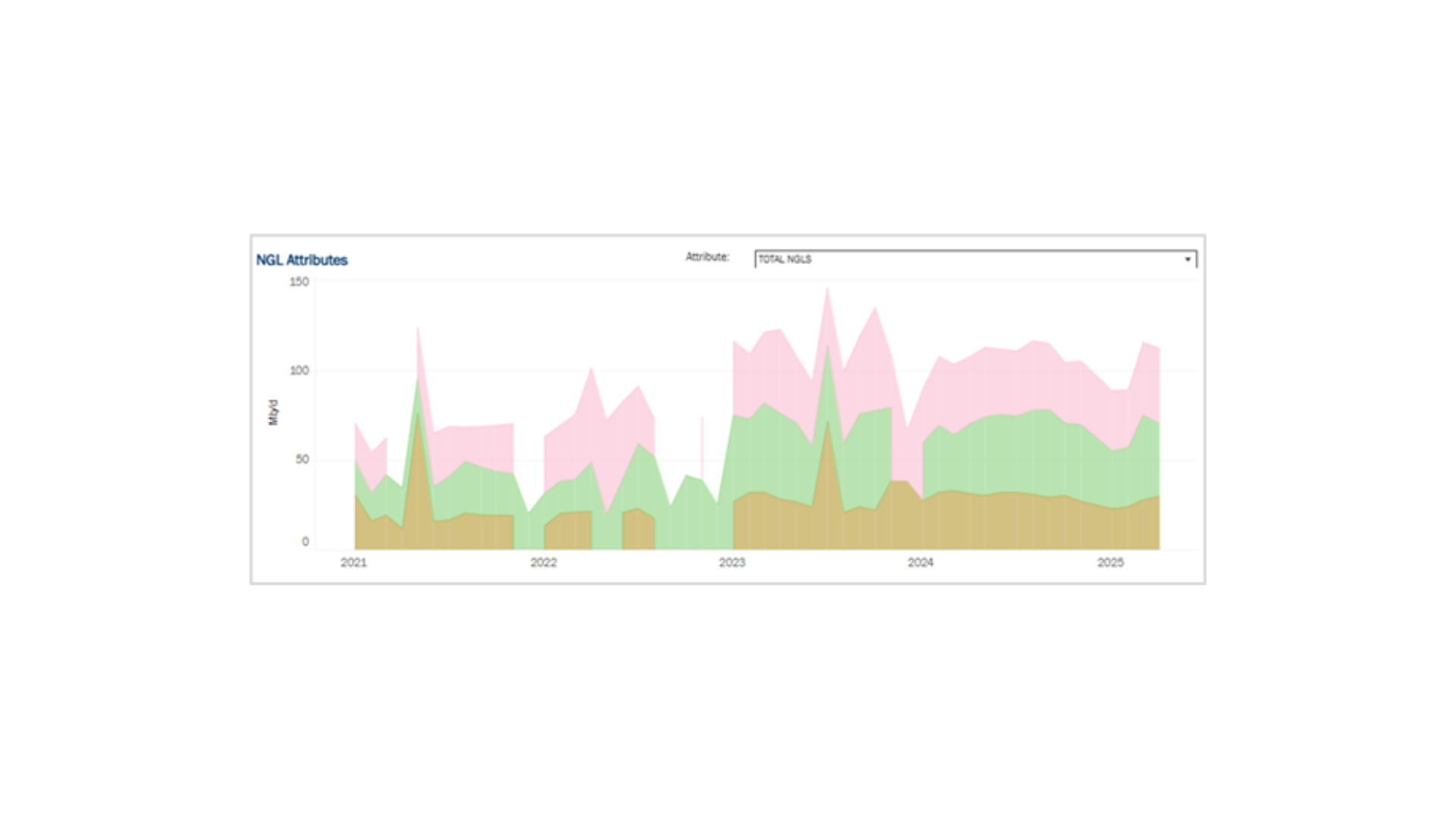

The KNTK Raptor system now has plant capacity of almost 1.3 Bcf/d, and the legal claim is for Y-grade produced from the first 840 MMcf/d of rich gas processed at Eagle Claw’s East Toyah and Caprock facilities. Total NGL production from the Delaware Basin G&P system is shown above from Energy Data Studio. There are gaps in state-reported NGL data at the Raptor system, but NGL production has averaged 108 Mb/d from rich-gas plant inlets of 946 MMcf/d over the trailing twelve months ending April ’25.

What is unclear is the volume of NGL production being delivered to ET under the long-term agreement. EDA estimates 75 Mb/d of contracted NGLs will roll off ET and onto Shin Oak and Grand Prix by YE26. – Rob Wilson, CFA Tickers: ET, KNTK, TRGP.

NEW – July Production Webinar

Join East Daley on July 9 for the Monthly Oil & Gas Production Webinar – your essential update on the latest production trends and midstream impacts across natural gas, NGLs and crude oil. Our experts unpack the latest rig trends, basin-level supply shifts, and midstream constraints shaping commodity markets. Join us on July 9!

NEW – The Burner Tip

The Burner Tip provides East Daley’s weekly coverage of natural gas markets. Every Thursday, The Burner Tip brings you our expert perspective on drivers shaping prices and flows in North America — including production trends, infrastructure dynamics, and forward-looking fundamentals — all grounded in EDA’s proprietary data and models. Whether you’re trading, investing, or managing risk, The Burner Tip delivers the insights you need to drive smarter strategy. Subscribe now to The Burner Tip!

Data Center Demand Monitor – Available Now!

Introducing Data Center Demand Monitor by East Daley Analytics. This is your go-to source for tracking data center projects and demand. We monitor and visualize nearly 300 US data center projects. Use Data Center Demand Monitor to forecast demand, identify pipeline corridors and track data center projects. — Request your demo now of the Data Center Demand Monitor!

The Daley Note

Subscribe to The Daley Note for energy insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.