The Trump administration appears to be laying the groundwork to ease restrictions on ethane exports to China. The President last Thursday (June 26) said the US and China have signed a trade agreement, while Enterprise Products (EPD) and Energy Transfer (ET) received letters informing them they can now load ethane cargoes bound for China, but still need further authorization to unload the cargoes

In an interview with Bloomberg, US Commerce Secretary Howard Lutnick said the two countries have signed a trade agreement codifying the terms of an accord reached last month in Geneva. Those talks were meant to resolve a trade war between Washington and Beijing that escalated from February-May, resulting in China imposing a 125% tariff on US goods. The US and China on May 12 signed a 90-day truce to the trade fight.

Lutnick said the new trade agreement hinges on China removing barriers to trade in rare earth minerals, after which the US will take down its own countermeasures. Those measures presumably include recently imposed restrictions on ethane exports.

The Bureau of Industry and Security (BIS) on May 23 set a special licensing requirement for ethane exports to China, citing a national security risk, and on June 3 denied export licenses to Enterprise Products (EPD) for three ethane cargoes totaling 2.2 MMbbl.

Meanwhile, EPD disclosed in an 8-K filing a letter dated June 25 from the BIS, an agency of the Department of Commerce, lowering some trade barriers for ethane exports. The letter states that EPD can now load ethane for China and anchor in a foreign port, but “may not complete such export, reexport, or transfer (in-country) to a party that is located in China, or that is a Chinese ‘military end user,’ wherever located, without further BIS authorization.” Reuters reports that ET received a similar letter from the agency.

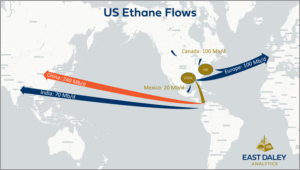

China consumes ~50% of US ethane exports (see map above), so the downside risk is significant for terminal operators ET and EPD. East Daley Analytics estimates the companies have $166MM of combined EBITDA exposure to the ethane trade with China.

Ship-tracking data from Vortexa shows Satellite Chemical has one ethane ship docked at ET’s Orbit terminal and a second en route to the Gulf Coast. The Chinese petrochemical company holds capacity at the Orbit terminal near Nederland, TX.

In the monthly Ethane Supply & Demand Report, we have assumed export restrictions would last through the end of 2025, but will likely revise our forecast higher based on the latest developments. – Andrew Ware and Alex Albazzaz Tickers: EPD, ET.

NEW – July Production Webinar

Join East Daley on July 9 for the Monthly Oil & Gas Production Webinar – your essential update on the latest production trends and midstream impacts across natural gas, NGLs and crude oil. Our experts unpack the latest rig trends, basin-level supply shifts, and midstream constraints shaping commodity markets. Join us on July 9!

NEW – The Burner Tip

The Burner Tip provides East Daley’s weekly coverage of natural gas markets. Every Thursday, The Burner Tip brings you our expert perspective on drivers shaping prices and flows in North America — including production trends, infrastructure dynamics, and forward-looking fundamentals — all grounded in EDA’s proprietary data and models. Whether you’re trading, investing, or managing risk, The Burner Tip delivers the insights you need to drive smarter strategy. Subscribe now to The Burner Tip!

Data Center Demand Monitor – Available Now!

Introducing Data Center Demand Monitor by East Daley Analytics. This is your go-to source for tracking data center projects and demand. We monitor and visualize nearly 300 US data center projects. Use Data Center Demand Monitor to forecast demand, identify pipeline corridors and track data center projects. — Request your demo now of the Data Center Demand Monitor!

The Daley Note

Subscribe to The Daley Note for energy insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.