Executive Summary: Infrastructure: An escalating trade fight with China creates risk to a relatively strong outlook for propane in 2025 following a more normal winter. Rigs: The total US rig count increased by 5 during the week of March 23 to 564. Liquids-driven basins remained flat W-o-W at 465. Flows: US natural gas pipeline samples averaged 69.8 Bcf/d the week ending April 06, relatively flat from previous week. Calendar: Plant data updated April 15, FERC Form 6 deadline is April 18.

Infrastructure:

An escalating trade fight with China creates risk to a relatively strong outlook for propane in 2025 following a more normal winter. In the latest monthly Propane Supply & Demand Report, East Daley forecasts propane demand to increase 5.7% from 2024 to 2025.

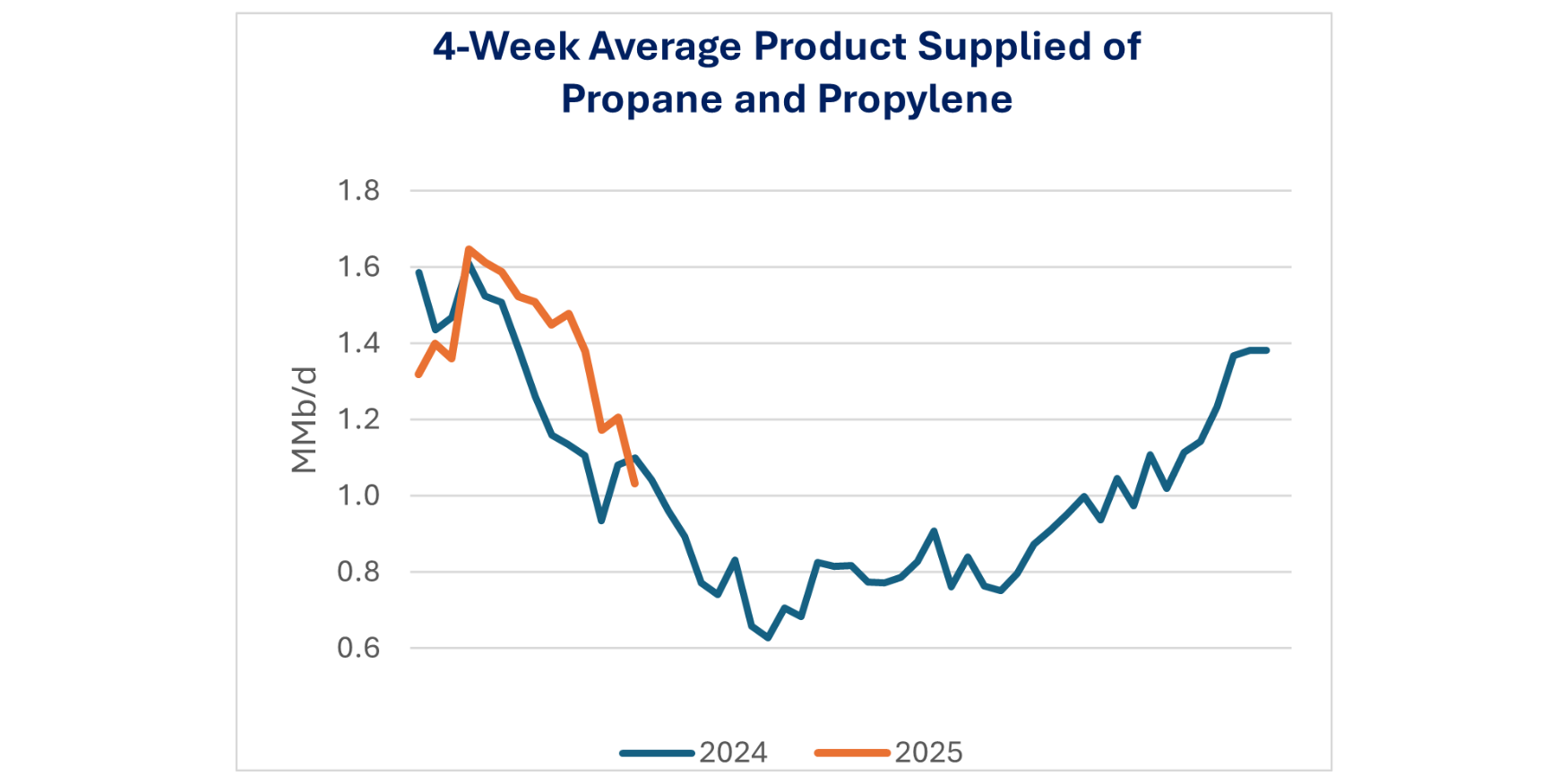

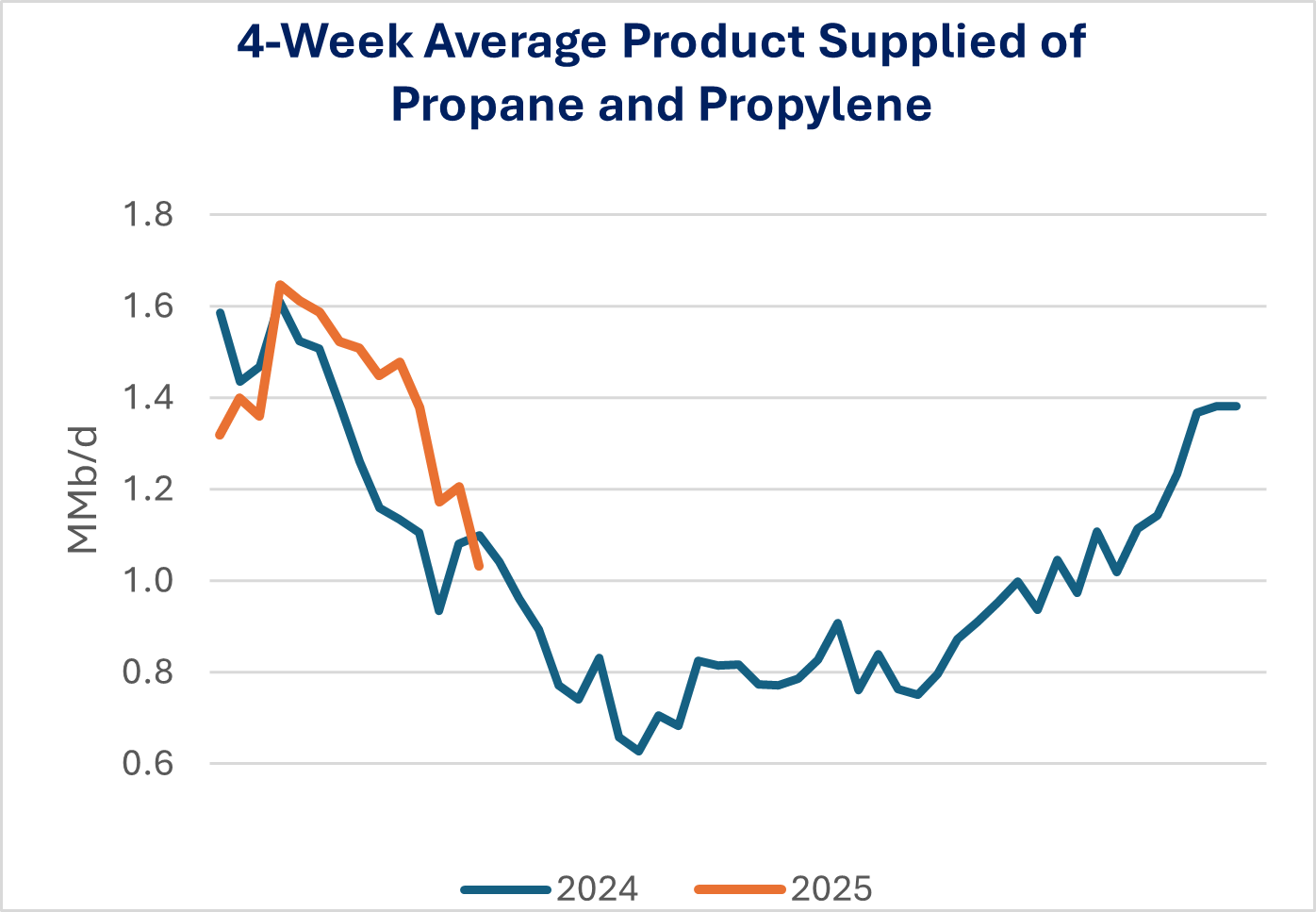

Domestic demand through March is up 11% compared to the same period in 2024, thanks to frigid temperatures in January and February. Colder weather returned the market to more normal winter consumption after the warmest winter on record in 2024. The relationship is shown in the chart below of average propane and propylene product supplied, according to EIA data. Propane inventory has fallen below a year ago as a result, setting the market up for firmer demand to restock in the spring and summer.

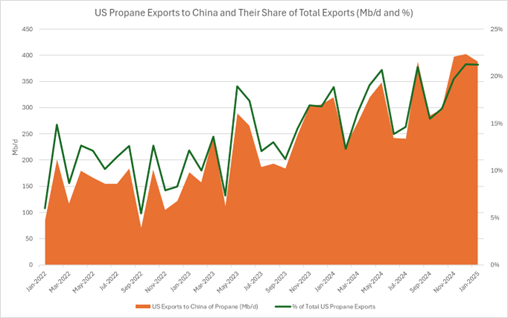

The other important piece of the propane demand puzzle is exports, and the news on that front is less supportive. The Trump administration on Wednesday (April 9) raised the tariff rate on Chinese imports to 125% after China imposed new 84% duties on US goods.

The latest tariffs will increase costs for exports to the fastest-growing propane market and put market share at risk. In 2024, US propane exports to China averaged ~310 Mb/d, accounting for 17% of total propane exports. We are closely monitoring tariff negotiations and are likely to revise down the export forecast in the next Propane Supply & Demand Report.

Rigs:

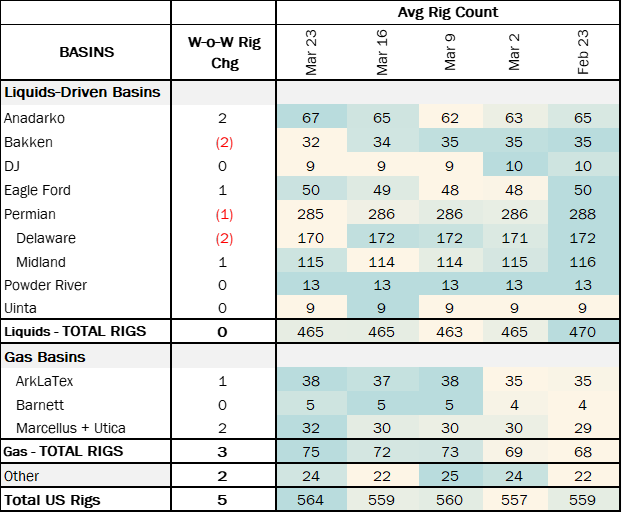

The total US rig count increased by 5 during the week of March 23 to 564. Liquids-driven basins remained flat W-o-W at 465.

- Anadarko (+2): Mach Natural Resources, Crawley Petroleum

- Bakken (-2): Devon Energy, Iron Oil

- Eagle Ford (+1): Kimmeridge Texas Gas, LLC

- Permian (-1):

- Delaware (-2): Marlin Operating, LLC, Greenstone

- Midland (+1): Occidental Petroleum

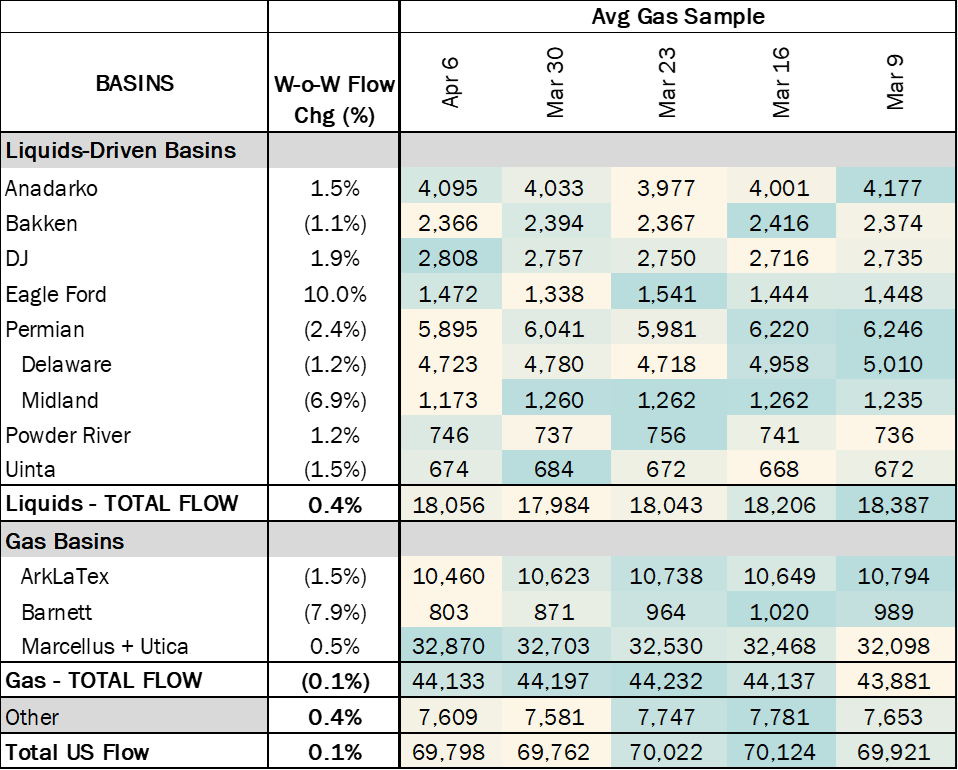

Flows: For the week ending April 06, natural gas pipeline samples averaged 69.8 Bcf/d, holding flat from the previous week.

Liquids-driven basins were relatively stable, down 72 MMcf/d W-o-W to bring the average to 18.0 Bcf/d. The Permian Basin posted a loss of 3%, decreasing by 142 MMcf/d, while the Anadarko Basin saw a 1.5% rise, growing from 4.03 Bcf/d to 4.09 Bcf/d.

Gas-driven basins also held steady on a W-o-W basis, maintaining an average flow of 44.2 Bcf/d. Haynesville declined by 1.5%, falling from 10.62 Bcf/d to 10.46 Bcf/d — a reduction of ~163 MMcf/d. This decrease was counterbalanced by a 0.5% increase in Appalachia, which averaged 32.87 Bcf/d.

Looking ahead, the Appalachia and Haynesville will be pivotal basins to monitor. With US natural gas storage levels now below the 5-year average due to significant withdrawals in February, increased production from these regions will be critical to restoring balance between supply and demand.

Calendar: