Executive Summary:

Infrastructure: Ethane exports have resumed to China, but that doesn’t mean the industry will return to business as usual.

Exports: Total US NGL exports rose 14.7% W-o-W, primarily driven by a 17.9% increase in LPG exports.

Rigs: The total US rig count increased during the week of June 29 to 530. Liquids-driven basins increased by 2 W-o-W from 404 to 406.

Flows: US natural gas volumes averaged 69.8 Bcf/d in pipeline samples for the week ending July 13, down 0.2% W-o-W.

Calendar: MTDR, EQT and RRC Earnings 7/22

Infrastructure:

Ethane exports have resumed to China, but that doesn’t mean the industry will return to business as usual. For years, US ethane was the quiet powerhouse of global petrochemicals — cheap, abundant, and presumably insulated from geopolitics. That assumption no longer holds.

The US-China trade war has exposed a critical truth: there is no global substitute for US ethane at scale. What was once a stable feedstock is now caught in the crosscurrents of trade policy and long-cycle demand risk.

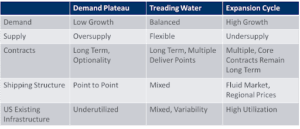

East Daley sees three plausible paths ahead, each with distinct implications for infrastructure, pricing dynamics and contract structures.

Scenario 1: The Demand Plateau

Global petrochemical investment slows in an uncertain macro environment. China hedges its exposure to US ethane with LPG and mixed-feed crackers. Europe also diversifies. US export infrastructure remains underutilized.

- Chronic overcapacity in docks, pipelines and fractionation.

- Ethane remains cheap, but its strategic role fades.

- Contracts stay long-term, but with wider volume tolerance and delivery flexibility.

Position for: Blending, storage and LPG switching. Reduce exposure to ethane-pure assets.

Scenario 2: The Treading-Water Cycle

Global demand recovers moderately. Chinese buyers return with diversified sourcing strategies. Very large ethane carriers (VLECs) operate across basins. Regional price spreads emerge.

- Ethane retains a cost advantage but carries an embedded risk premium.

- Utilization becomes more variable across terminals and pipelines.

- Contracts remain long-term with flexible delivery points and contingency clauses.

Position for: Infrastructure with multi-feed capability. Build flexibility into commercial terms.

Scenario 3: The Expansion Cycle

Global demand accelerates. Asia and Europe scale ethane cracker investments. US ethane gains status as the cheapest and most reliable feedstock.

- Mont Belvieu tightens, boosting frac spreads.

- Trade patterns deepen, supporting market liquidity.

- Assets earn premium returns under multi-decade contracts.

Position for: Lock in long-term volumes now. Every new ethane dock becomes a strategic asset.

Bottom Line: Ethane is no longer insulated. The next era belongs to those who prepare for volatility and invest with conviction.

Exports:

Total US NGL exports rose 14.7% W-o-W, primarily driven by a 17.9% increase in LPG exports. The surge was led by strong loadings out of Marcus Hook (+150%) and Galena Park (+46%).

On the ethane side, total exports declined 1% W-o-W, with lower volumes out of Morgan’s Point and Marcus Hook. However, this was largely offset by a sharp rebound in exports from Nederland, which posted a 235% W-o-W increase.

Rigs:

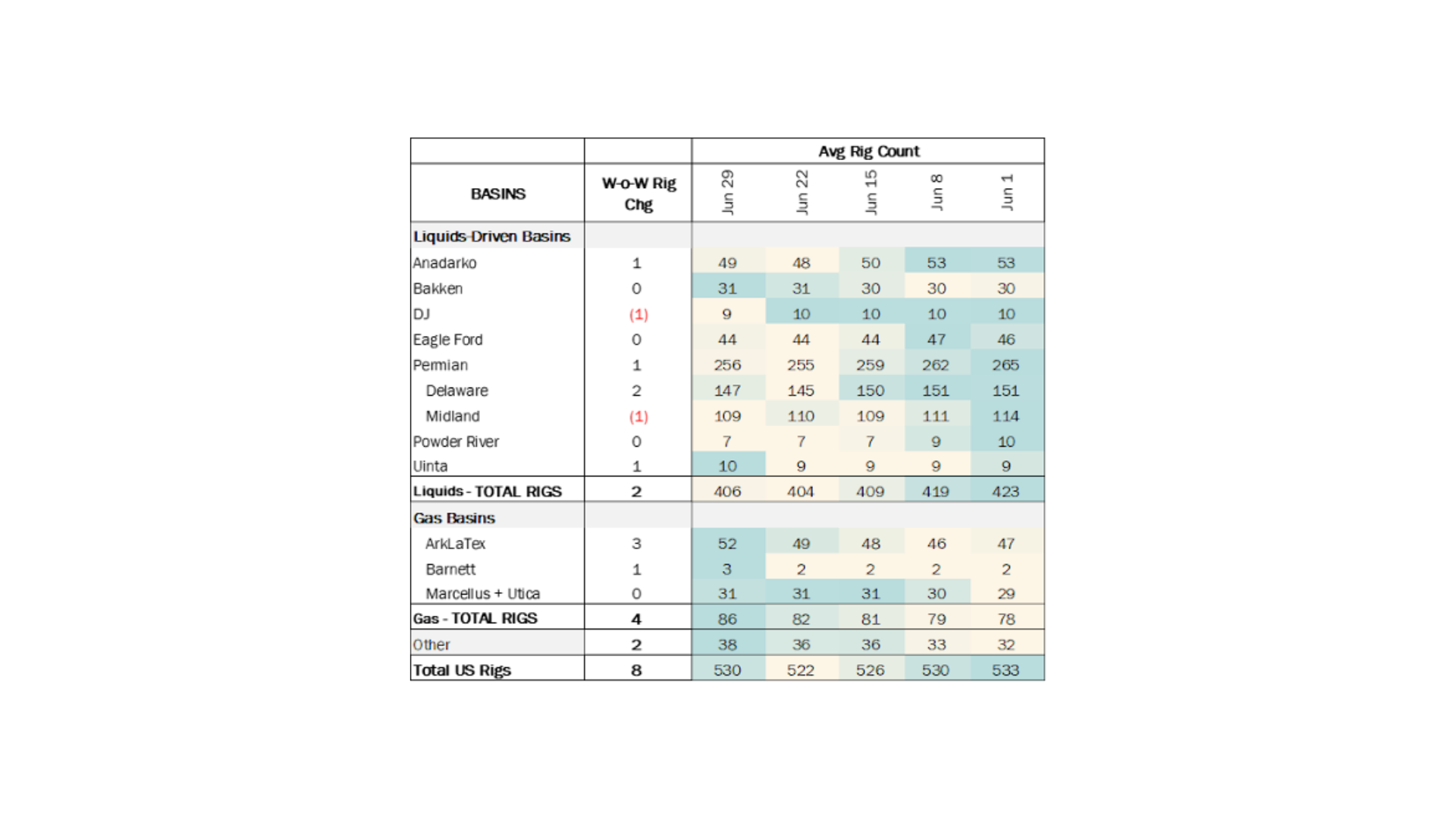

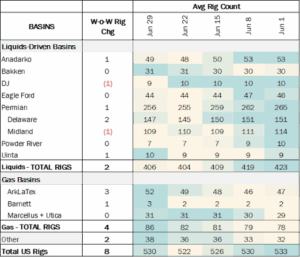

The total US rig count increased during the week of June 29 to 530. Liquids-driven basins increased by 2 W-o-W from 404 to 406.

- Anadarko (+1): Blue Ridge Petroleum

- Denver-Julesburg (-1): Creek Road Miners

- Permian (+1):

-

- Delaware (+2): EOG Resources, BP

-

- Midland (-1): Reatta Energy

- Uinta (+1): Scout Energy Partners

Flows:

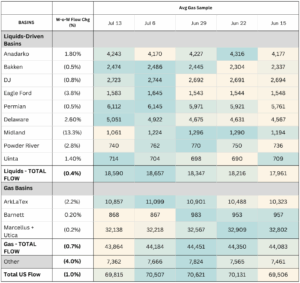

US natural gas volumes averaged 69.8 Bcf/d in pipeline samples for the week ending July 13, down 1.0.% W-o-W from 70.5 Bcf/d the previous week.

Gas basins declined 0.7% W-o-W to average 43.9 Bcf/d. The Haynesville sample declined 2.2% to 10.9 Bcf/d. The Marcellus+Utica declined 0.2% to 32.1 Bcf/d. The Anadarko sample rose 1.8 to 4.2 Bcf/d.

Calendar: