Executive Summary:

Infrastructure: Ethane export restrictions have been rescinded, and the market looks to return to growth with China sliding back into its role as buyer of first resort.

Exports: Total US NGL exports declined 4.3% W-o-W, driven by lower volumes of both LPG and ethane.

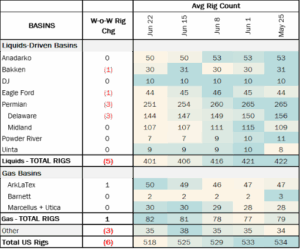

Rigs: The US rig count decreased during the week of June 22 to 518. Liquids-driven basins decreased by 5 W-o-W from 406 to 401.

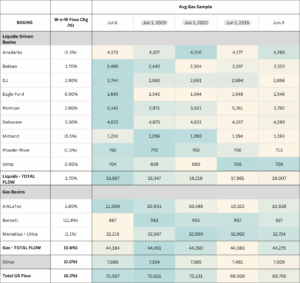

Flows: US natural gas volumes averaged 70.5 Bcf/d in pipe samples for the week ending July 6, down 0.2% W-o-W.

Calendar: Plant Data Updated 7/15 | KMI Earnings 7/17

Infrastructure:

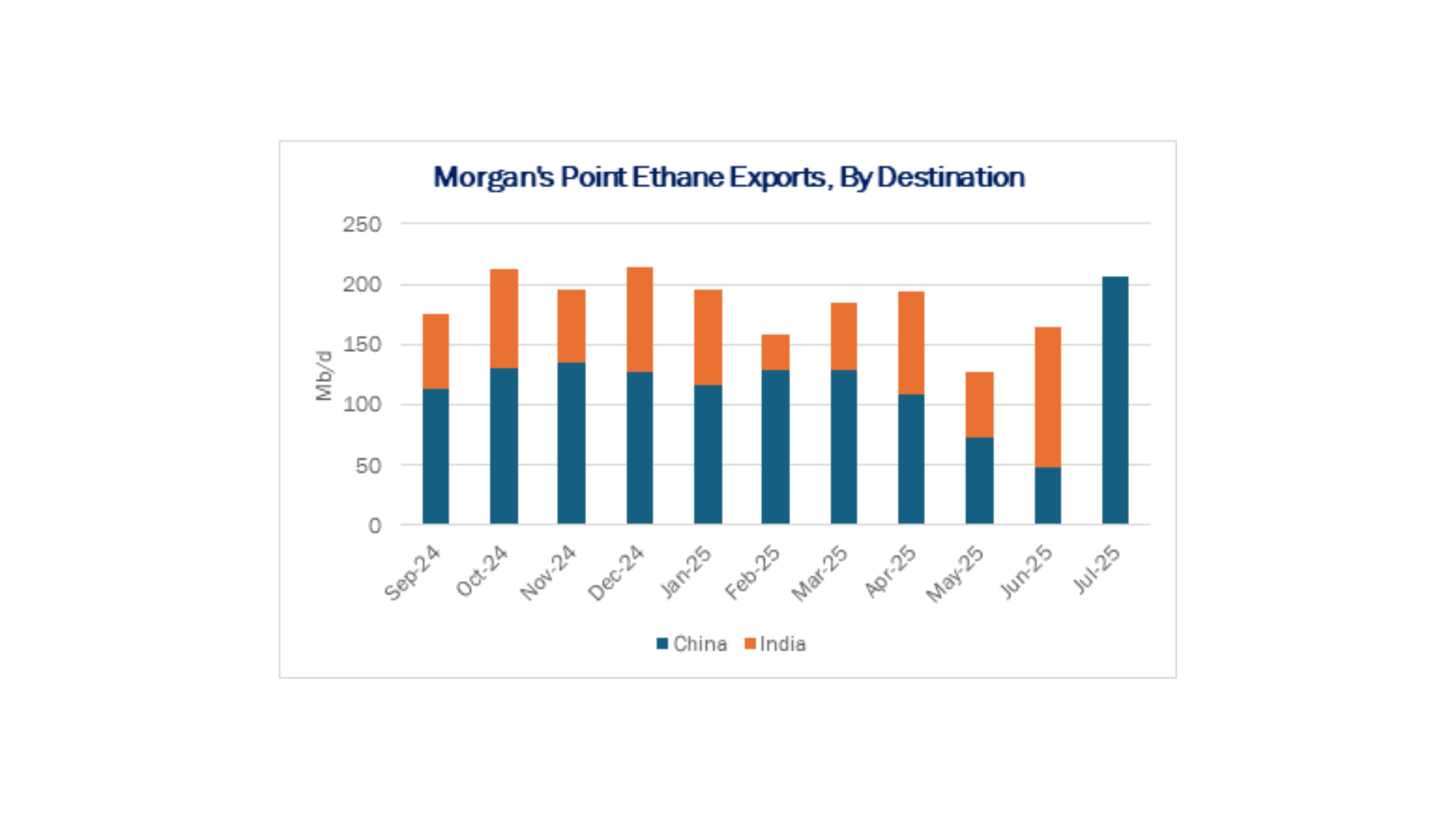

The Trump administration has formally eased restrictions on ethane exports to China, closing out a turbulent chapter for the ethane trade. With the largest market for US ethane cargoes largely unavailable, Indian buyers stepped into the void to keep the market in balance.

On July 2, Energy Transfer (ET) and Enterprise Products (EPD) received letters from the Bureau of Industry Security (BIS) stating that it had rescinded a licensing requirement for ethane exports to China, the companies revealed in 8-K filings.

The communication from BIS, a Department of Commerce agency, ends 40 days of uncertainty for the NGL sector. On May 23, the BIS sent the two companies letters informing them of a special license requirement for high-purity ethane cargoes bound for China, citing a national security risk. Then on June 3, the agency denied EPD’s request to export three ethane cargoes to China. The BIS eased the export restrictions after the US and China reached a broader trade agreement at the end of June.

Amid the trade spat, the ethane trade developed interesting dynamics. Rather than losing total exports, terminals saw buyers from India step up their purchases to absorb cargoes normally destined for China.

Prio to the export restrictions, EPD’s Morgan’s Point terminal had been sending ~125 Mb/d of ethane from its docks to China every month, according to ship-tracking data from Vortexa. Ethane carriers headed to India from the terminal had been averaging around 25-75 Mb/d monthly. When the restrictions went into effect in late May, exports to India jumped to 116 Mb/d.

The winners from this dynamic were buyers like India’s GAIL or Reliance Industries exposed to ethane-to-ethylene spreads. Ethane prices fell from around $0.235/gal to $0.20 amid the export curbs. Prices today have returned to pre-restriction levels, and ethane exports to China are regaining lost ground in July. However, a large share of the cargoes currently waterborne (~134 Mb/d) is labeled as “Undetermined” for destination in the Vortexa data. Whether Indian buyers continue to step up will depend on pricing and cargo availability, with eager Chinese buyers ready to resume their role as buyers of first resort.

Exports:

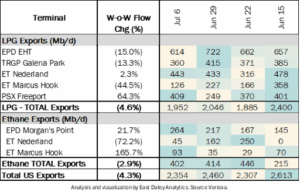

Total US NGL exports declined 4.3% W-o-W, driven by lower volumes of both LPG and ethane.

Total US NGL exports declined 4.3% W-o-W, driven by lower volumes of both LPG and ethane.

LPG exports fell 4.6% W-o-W, primarily due to a 44.5% drop in volumes out of Marcus Hook, partially offset by a 64.3% increase in exports from Freeport.

Ethane exports declined 2.9% W-o-W, led by a sharp reduction in volumes shipped from Nederland.

Rigs:

The total US rig count decreased during the week of June 22 to 518. Liquids-driven basins decreased by 5 W-o-W from 406 to 401.

- Permian (-3):

- Delaware (-3): Permian Resources (-1), Occidental Petroleum (-2)

- Bakken (-1): Hunt Oil

- Eagle Ford (-1): Kimmeridge Texas Gas

Flows:

US natural gas volumes averaged 70.5 Bcf/d in pipe samples for the week ending July 6, down 0.2% W-o-W.

Calendar:

Calendar: