Executive Summary: Infrastructure: MPLX is building a 40 Mb/d de-ethanizer at its Harmon Creek complex in the Northeast, though the company has not announced a customer for the expansion. Rigs: The total US rig count decreased by 16 during the week of March 9 to 542. Liquids-driven basins decreased by 17 W-o-W to 447. Flows: Total US pipeline volumes decreased slightly W-o-W to 70.0 Bcf/d for the week ending March 23, up from 70.1 Bcf/d the prior week. Despite the increase, current volumes remain ~491 MMcf/d below February’s peak levels.

Infrastructure:

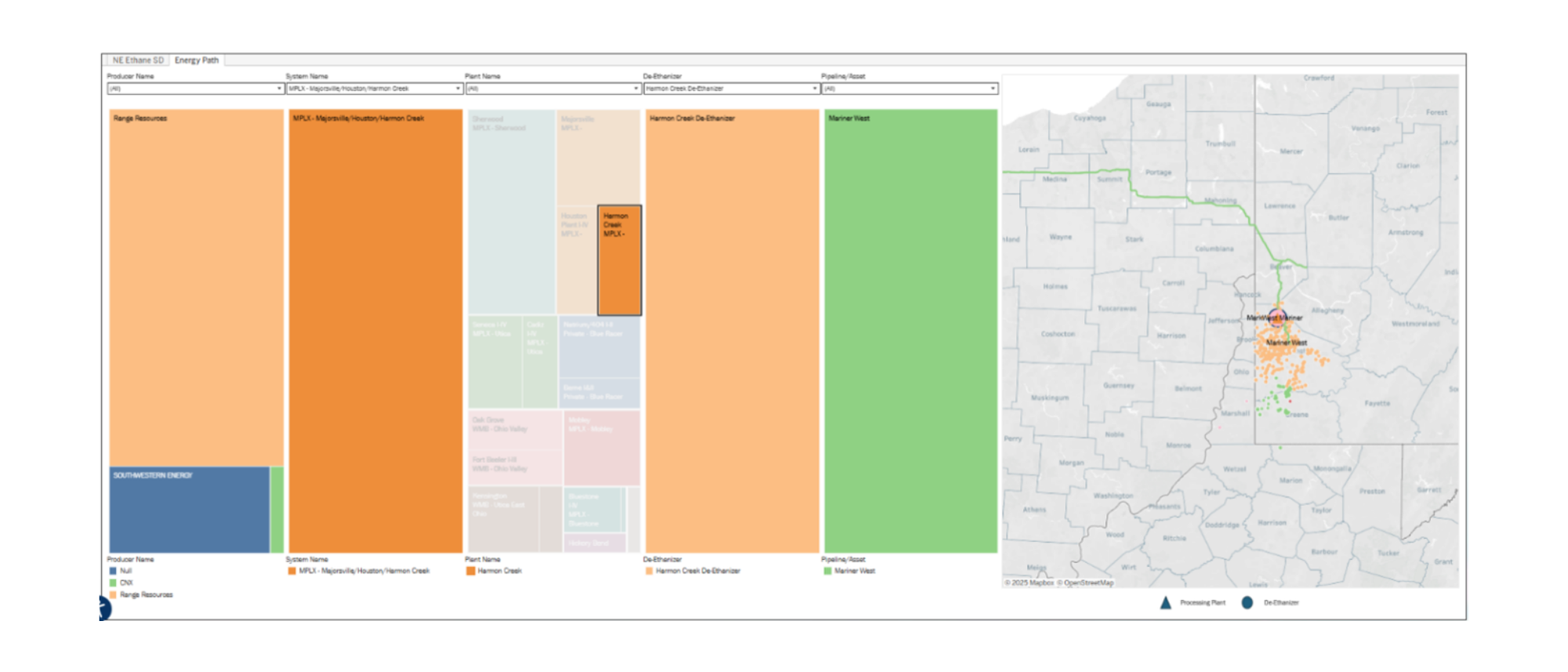

- East Daley is monitoring several infrastructure expansions in the Northeast that will increase regional ethane production. One of these, MPLX’s Harmon Creek III expansion, is a project without an identified market, though we can probably narrow down the list.

- MPLX is building a 300 MMcf/d gas processing plant and 40 Mb/d de-ethanizer at its Harmon Creek complex in southwestern Pennsylvania. The expansion would triple its ethane production off an existing 20 Mb/d de-ethanizer at Harmon Creek. MPLX is targeting start-up in 2H26.

- According to East Daley’s new Northeast Ethane Supply & Demand Visual and Data Set, the Harmon Creek plant only ships ethane on Mariner West Pipeline. Mariner West delivers ethane to NOVA’s Corunna cracker in Sarnia, Ontario. Mariner West also competes directly with Kinder Morgan’s (KMI) Utopia Pipeline to supply ethane to the Corunna cracker.

- It isn’t clear who will take the additional ethane from Harmon Creek III. Utopia recently completed an expansion to accommodate NOVA’s own 25 Mb/d expansion at the Corunna site, and NOVA has not announced any other projects at the Corunna site.

- Could the Harmon Creek expansion challenge KMI and supply more ethane to NOVA? This could lead to pressure on shipping rates, though MPLX may also be looking to other markets. We would not be surprised if the company established a connection between Harmon Creek and Shell’s Monaca cracker. The Shell cracker has been plagued by operational issues but is reported to be in full operations since early 2025.

Rigs:

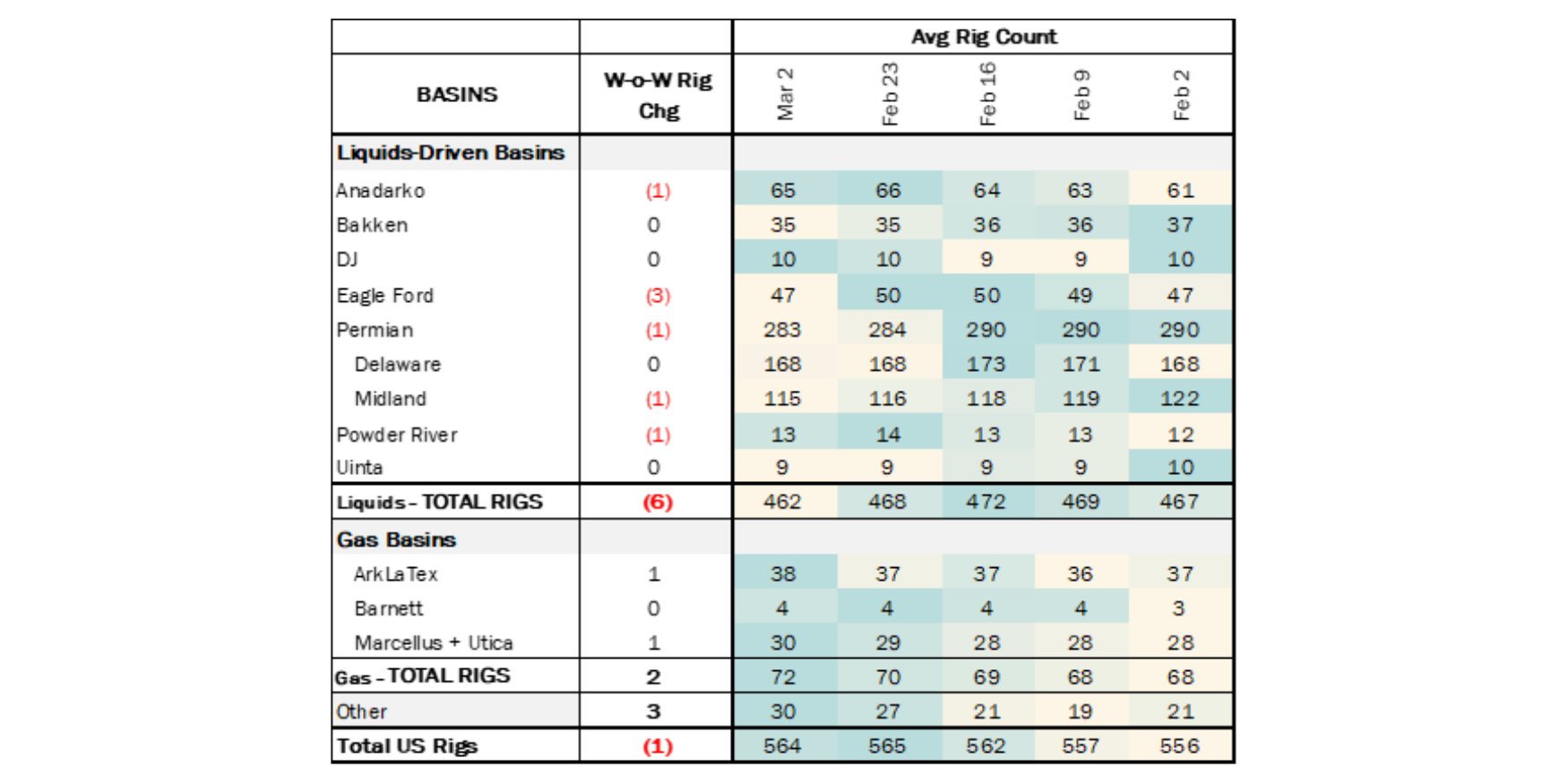

The total US rig count decreased by 16 during the week of March 9 to 542. Liquids-driven basins decreased by 17 W-o-W to 447.

- Permian (-8):

- Midland (-6): Occidental Petroleum, Ovintiv, APA Corp, Chevron, Moriah Operating, Continental Resources

- Delaware (-2): Occidental Petroleum, Devon Energy

- Bakken (-4): Continental Resources (-3), Devon Energy

- Anadarko (-2): Darrah Oil Company, Wavetech Helium Inc

- DJ (-2): Bison Operating LLC, Fundare Resources Operating Co

- Uinta (-1): Uinta Wax Operating, LLC

Flows:

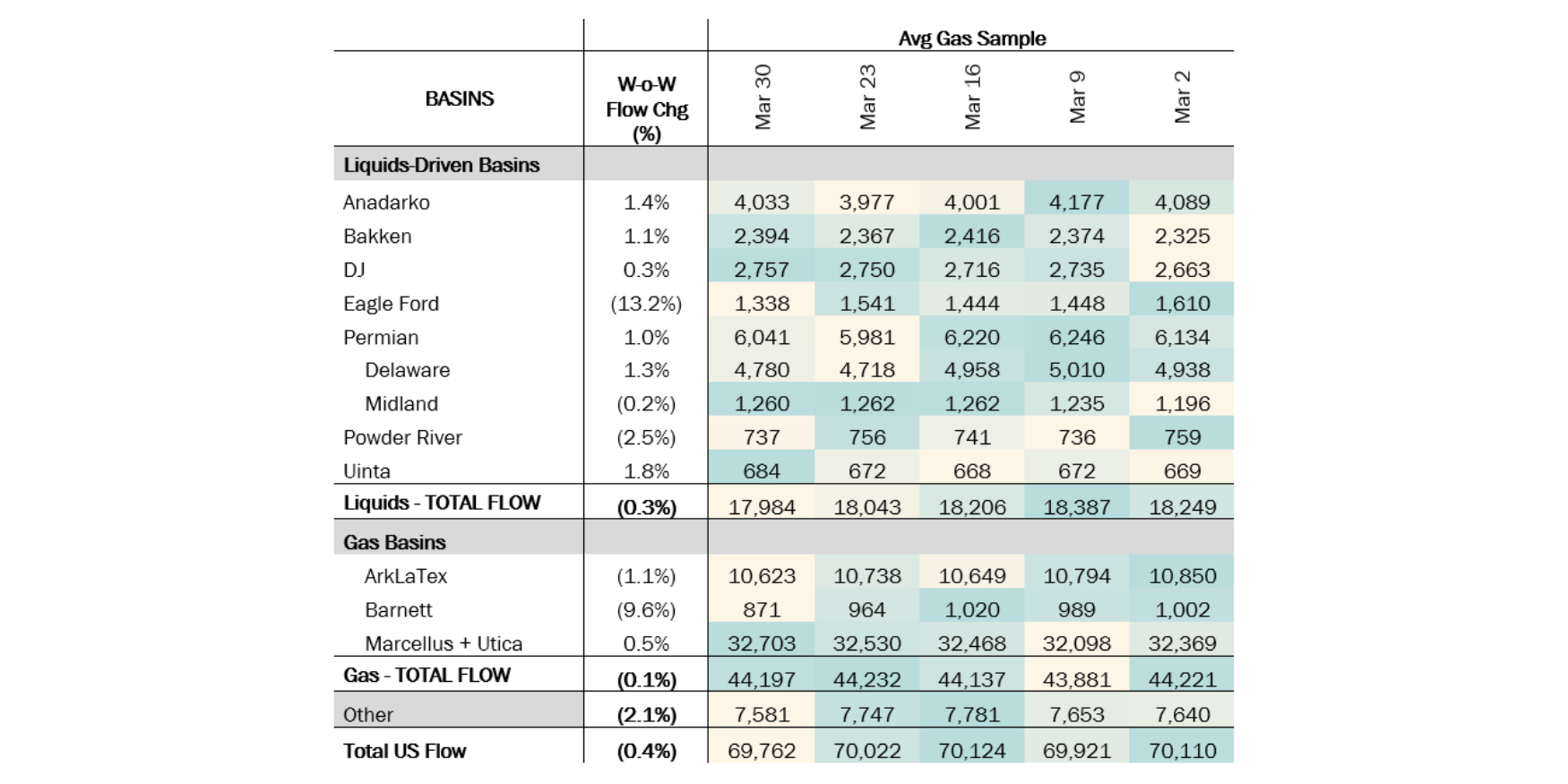

Total US pipeline volumes decreased slightly W-o-W to 70.0 Bcf/d for the week ending March 23, up from 70.1 Bcf/d the prior week. Despite the increase, current volumes remain ~491 MMcf/d below February’s peak levels.

Liquids-driven basins saw a 1% decrease W-o-W, with volumes declining from 18.2 Bcf/d to 18.0 Bcf/d. The Permian Basin posted a 4% loss, decreasing from 6.2 Bcf/d to 6.0 Bcf/d, while the Powder River rose 2% from 0.74 Bcf/d to 0.76 Bcf/d. The Bakken Basin declined 2% W-o-W, averaging 2.4 Bcf/d.

In contrast, gas-driven basins were relatively flat W-o-W, remaining on average at 44.2 Bcf/d. The Haynesville rose by 1% from 10.64 Bcf/d to 10.74 Bcf/d, an increase of ~89 MMcf/d. The Appalachian was flat, averaging 32.53 Bcf/d.

These two basins — Appalachia and Haynesville — will be crucial to monitor in the coming months. With US natural gas storage now below the 5-year average following substantial withdrawals in February, ramping up production in these regions will be key to balancing supply and demand.

Calendar:

-1.png)

-1.png)

-3.png)