Western Midstream (WES) has sanctioned the Pathfinder pipeline as part of a $400-450MM investment in produced-water infrastructure in the Delaware Basin. The commitment is one of the largest ever by a midstream company to manage the water produced along with oil and gas from Permian wells.

Pathfinder is a 30-inch pipeline that will transport produced water 42 miles from WES’ gathering system to designated disposal facilities. Pathfinder will have an initial capacity of 800 Mb/d and can be expanded up to 1.2 MMb/d. WES will also construct nine saltwater disposal facilities in eastern Loving County, TX to receive water from the pipeline, as well as build several produced-water gathering facilities in the region. The disposal wells will have a combined capacity to handle 220 Mb/d of produced water.

The project is underpinned by a long-term water agreement with Occidental Petroleum (OXY) for 280 Mb/d of firm gathering/transportation capacity and 220 Mb/d of disposal capacity. WES plans to begin service on Pathfinder in 1Q27.

The Pathfinder announcement comes at a pivotal moment for water management in the Delaware. Water-to-oil ratios are rising from upstream operations, and water disposal in deep formations is increasingly limited by induced seismicity concerns. With Pathfinder, WES can efficiently transport produced water out of the Delaware’s core into shallower, underutilized injection zones with lower pore pressure, effectively mitigating many of these issues. So far, OXY is the only announced customer on the system.

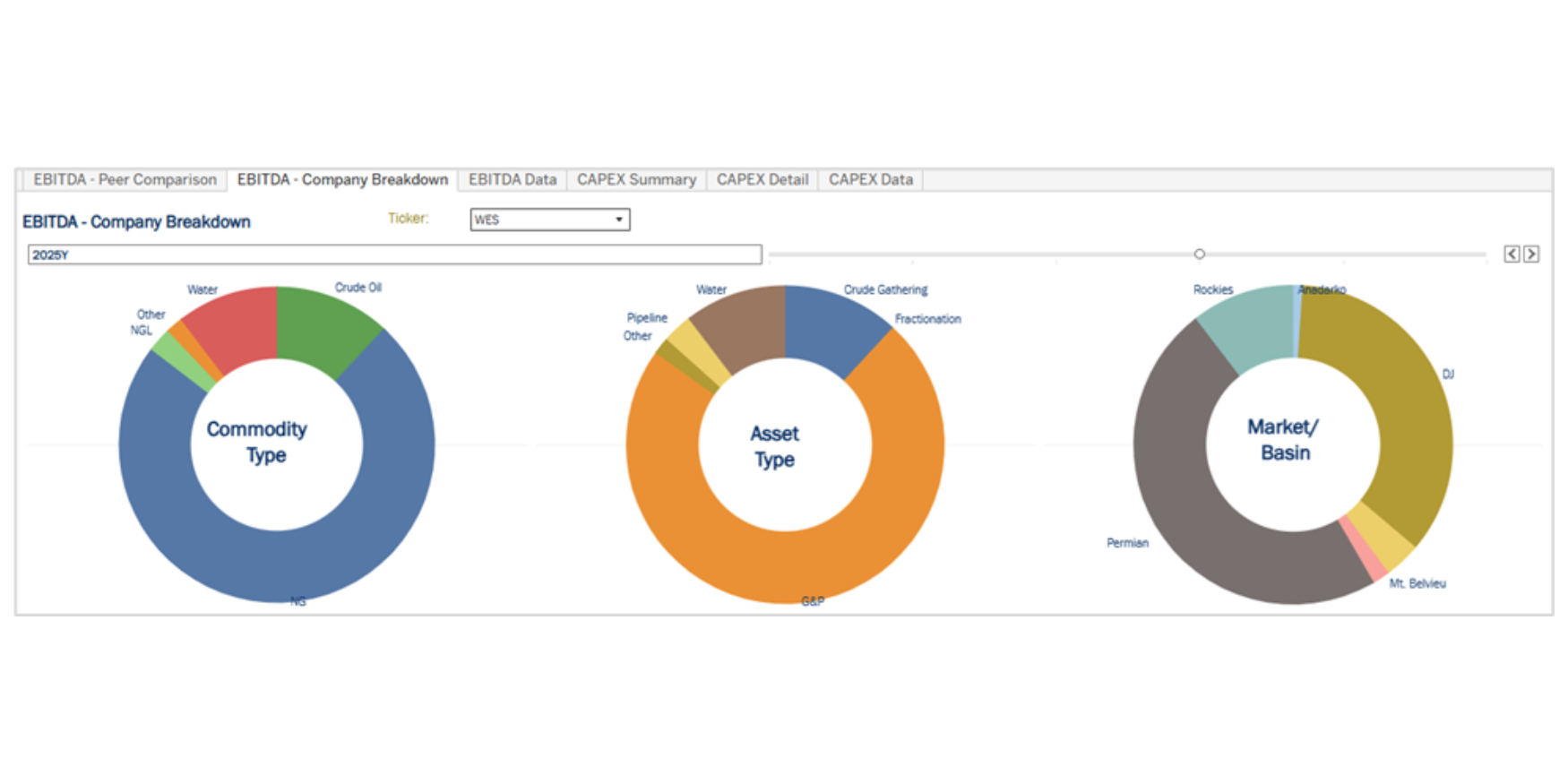

The figures above, available in the Peer Comparison Tool in East Daley’s Energy Data Studio, break down our WES 2025 EBITDA forecast by commodity, asset and basin. Water disposal is a big business for Western, accounting for ~12% of company earnings.

WES anticipates investing $400-450MM in the Pathfinder project, with $65MM earmarked for 2025 and the remaining funds to be spent in 2026. Assuming a 5x build multiple, the Pathfinder system could contribute $85MM in additional EBITDA. – James Taylor Tickers: OXY, WES.

Join East Daley’s Upcoming Gas Webinar

Join East Daley on April 3rd at 10 AM MST for an in-depth webinar on natural gas. In Natural Gas Market Dynamics: Henry Hub Premiums, Haynesville Trends & the 2026 Outlook, we will cover:

- Henry Hub Price Forecast: Our early 2024 call for stronger prices came true. How long will the premium last, and what’s next?

- Haynesville Outlook: Most producers are set to boost 2025 output despite some holdouts. Citadel’s buy of Paloma Resources has also heightened acquisition buzz.

- 2026 Overbought: Although 2025 production will meet demand, our forecast suggests 2026 prices are about $0.20 inflated, echoing our forward-looking 2024 outlook. Sign up now to attend.

Data Center Demand Monitor – Available Now!

Introducing Data Center Demand Monitor by East Daley Analytics. This is your go-to source for tracking data center projects and demand. We monitor and visualize nearly 300 US data center projects. Use Data Center Demand Monitor to forecast demand, identify pipeline corridors and track data center projects. — Request your demo now of the Data Center Demand Monitor!

Energy Path – Powered by Energy Data Studio

Introducing Energy Path by East Daley Analytics — a revolutionary tool designed to transform how you view the energy market. With Energy Path, you can seamlessly track the molecule from wellhead to demand, gaining a complete view of the entire oil and gas value chain. From upstream to midstream to downstream, this multi-commodity product offers unparalleled insights across natural gas, NGLs and crude oil. Monitor volumes and fees at every stage, empowering your decision-making with a holistic market perspective.

See energy differently — Request your Energy Path demo now!

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.