The Daley Note: February 8, 2023

Rapid supply growth is baked into the natural gas outlook in 2023 and will require a market correction, according to East Daley’s latest Macro Supply and Demand Forecast. Producers will take a punch based on our analysis, though we expect operators in certain basins will disproportionately absorb the blow of lower prices.

In the Feb. 7 issue of The Daley Note, we present the case for sub-$2.00 natural gas. Rig counts are near multi-year highs in most basins, and we expect drilling momentum to generate 5 Bcf/d of unconstrained gas production growth by year-end 2023. Aside from the return of the Freeport LNG facility, we struggle to find similar gains on the demand side of the ledger this year.

The result is a growing imbalance in the Macro Supply and Demand Forecast. At the 5 Bcf/d pace of supply growth, US storage facilities would fill rapidly and exceed the 4.0 Tcf upper limit on inventories, likely causing natural gas prices to crash. We see the need for a ”shock to the system” from lower prices to slow growth and avoid this outcome.

Importantly, a large share of new supply will come from the Permian Basin, where the economics of drilling are driven by crude oil. We model 1.5 Bcf/d of Permian supply growth by year-end 2023 once expansions to MPLX’s Whistler Pipeline (500 MMcf/d) and Kinder Morgan’s (KMI) Permian Highway (550 MMcf/d) begin service. So long as oil prices hold up, we expect Permian growth is baked into the market.

In our latest monthly Macro Supply and Demand Forecast report, East Daley provides clients with two scenarios: an unbalanced forecast showing the severity of the near-term natural gas supply problem, and a “forced balance” scenario that avoids oversupply in 2023.

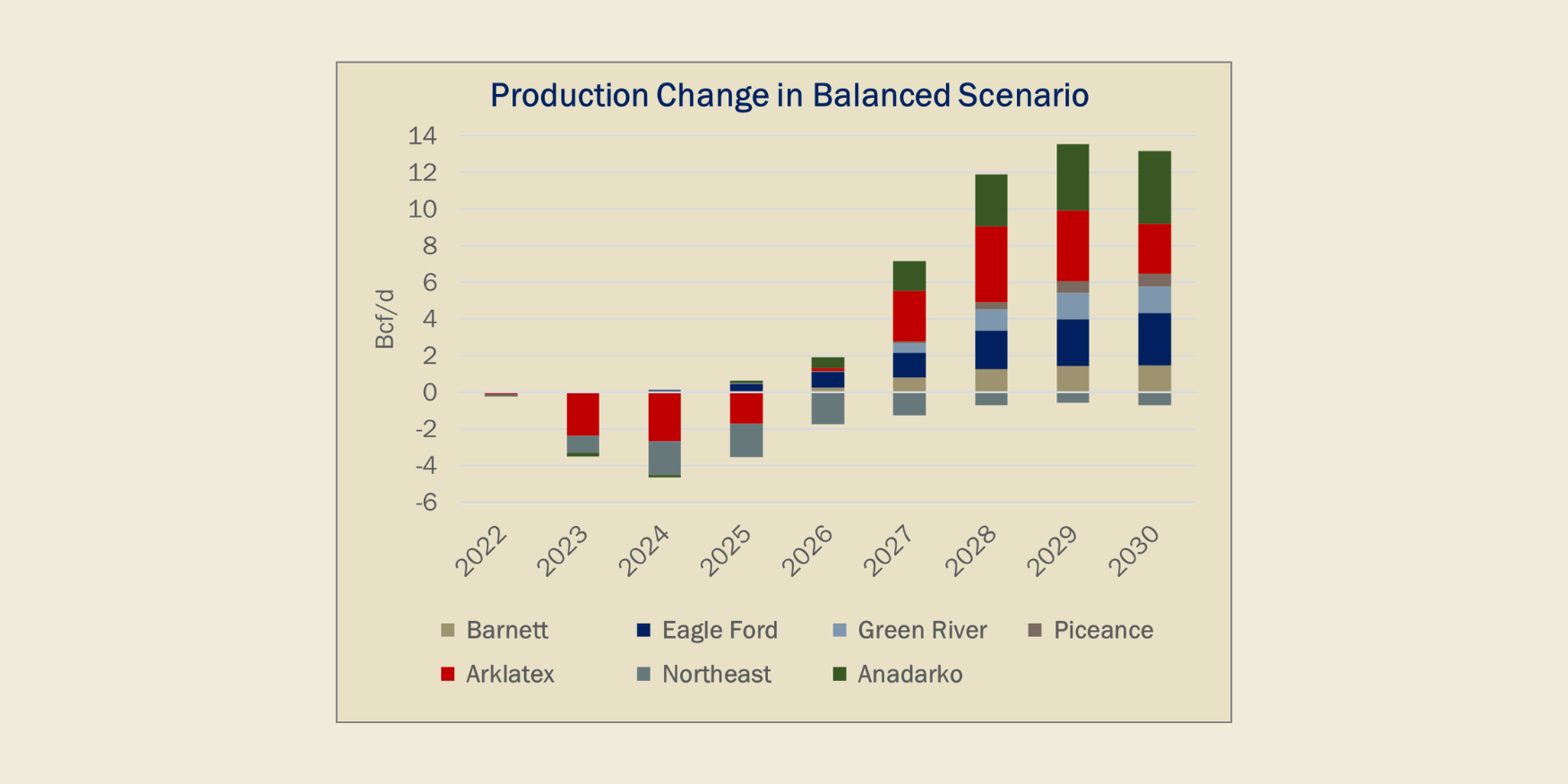

With Permian growth locked in, the job of slowing production will fall to producers in other regions. The figure shows the relative change by basin in a balanced scenario compared to one with unconstrained growth. We see the Haynesville (ArkLaTex) and Marcellus, the two leading gas shale plays, as the likeliest sources of deceleration in the near term, though other basins contribute as well.

To create a balanced market, we curtail rigs and build an inventory of drilled but uncompleted wells (DUCs) in several basins. In the ArkLaTex, we reduce activity by 19 rigs Y-O-Y and build a DUC inventory of 350 wells by year-end 2023. We also add DUCs in the Marcellus (+250 wells), the Anadarko (+110 wells) and the Eagle Ford (+50 wells). These steps help reduce production growth to within a reasonable margin and prevent storage from exceeding 4 Tcf in 2023.

While we are near-term bearish, the natural gas story is dynamic, and we see plenty of long-term opportunities ahead. As shown in the figure, a massive ramp in LNG demand in the post-2025 period will require additional supply from basins like the Anadarko, Green River and Barnett to clear the market. In our view, this shift is not being properly reflected in the forward price curve, and will create new demand for upstream investment and infrastructure growth across the US.

East Daley will further explore these dynamics in our latest market update for clients, “Dirty Little Secrets: After Hours – The Natural Gas Undoing Project,” scheduled on Thursday, Feb. 23. Sign up to attend this webinar. – Justin Carlson Tickers: CRK, KMI, MPLX, SWN.

Dirty Little Secrets: After Hours – The Natural Gas Undoing Project

East Daley will host a webinar on Thursday, Feb. 23 at 1 PM EST to look deeper into the natural gas story. In “Dirty Little Secrets: After Hours – The Natural Gas Undoing Project,” East Daley explores the short- and long-term supply and demand factors driving natural gas prices. Are market risks being accurately priced in the forward curve? East Daley explores the short- and long-term dynamics driving the natural gas market. Sign up to attend our latest webinar.

Stay Ahead of the Market with Natural Gas Weekly

East Daley Analytics’ Natural Gas Weekly provides a weekly update to our monthly Macro Supply and Demand Forecast. The update covers rigs, flows, production, prices and capacity constraints that materially change our view on supply and demand. This update highlights what investors and traders need to monitor in natural gas to ensure they are on the right side of the market. Contact us for more information on Natural Gas Weekly.

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.