The Daley Note: October 12, 2023

A drought is restricting tanker traffic through the Panama Canal and could slow growth in LPG exports from the Gulf Coast.

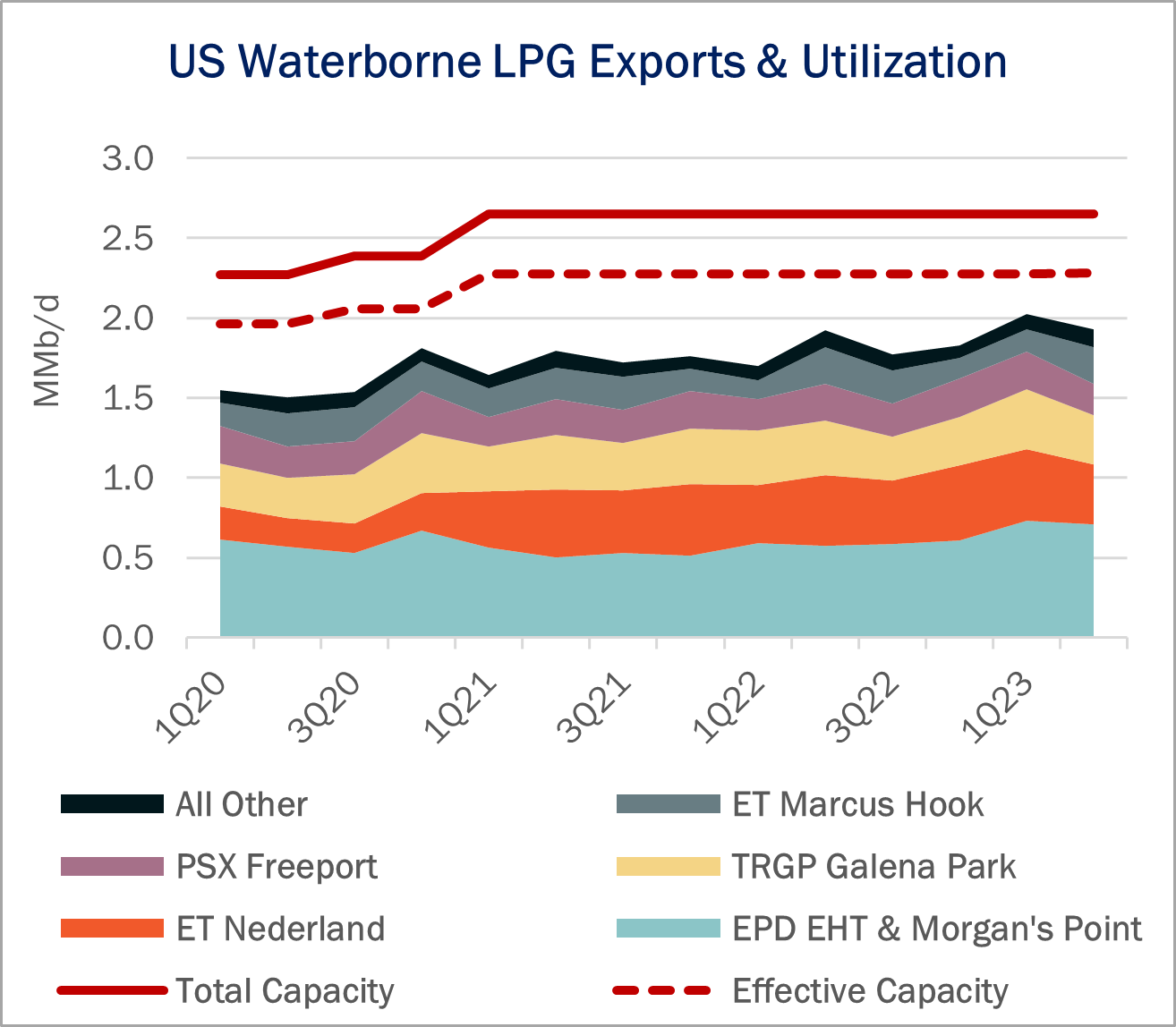

The Panama Canal is the main trade route linking Gulf Coast terminals to the Asia-Pacific market, the main driver of new demand. Exports account for around 70% of propane demand and have been a bright spot in the market in 2023, according to East Daley’s NGL Network Model. Terminal operators like Energy Transfer (ET) and Enterprise (EPD) anticipate more growth ahead.

The drought in Central America could disrupt the emerging trade. In late July, the Panama Canal Authority, the agency in charge of operations, began limiting the number of vessels allowed to pass through the canal to 32/day, from 36-38/day previously. Water levels at Lake Gatun, the transit route for ships and Panama’s main source of drinking water, fell to the lowest level since at least 1995, according to reporting by the EIA.

The Panama Canal Authority reported water depth at Lake Gatun of 79.9 feet in early October 2023, down from a peak of 88 feet in December 2022. The canal needs water levels as high as possible to allow vessels with drafts of 44 feet to transit safely. The canal operator plans to further restrict daily traffic to 31 vessels starting November 1.

The bottleneck is causing shipping rates to rise and forcing very large gas carriers (VLGCs), the specialized vessels that carry LPGs, to take longer journeys to Asia. LPG exports are up 5% YTD in 2023 vs 2022 in the NGL Network Model, but growth could slow in the back half of the year due to shipping delays.

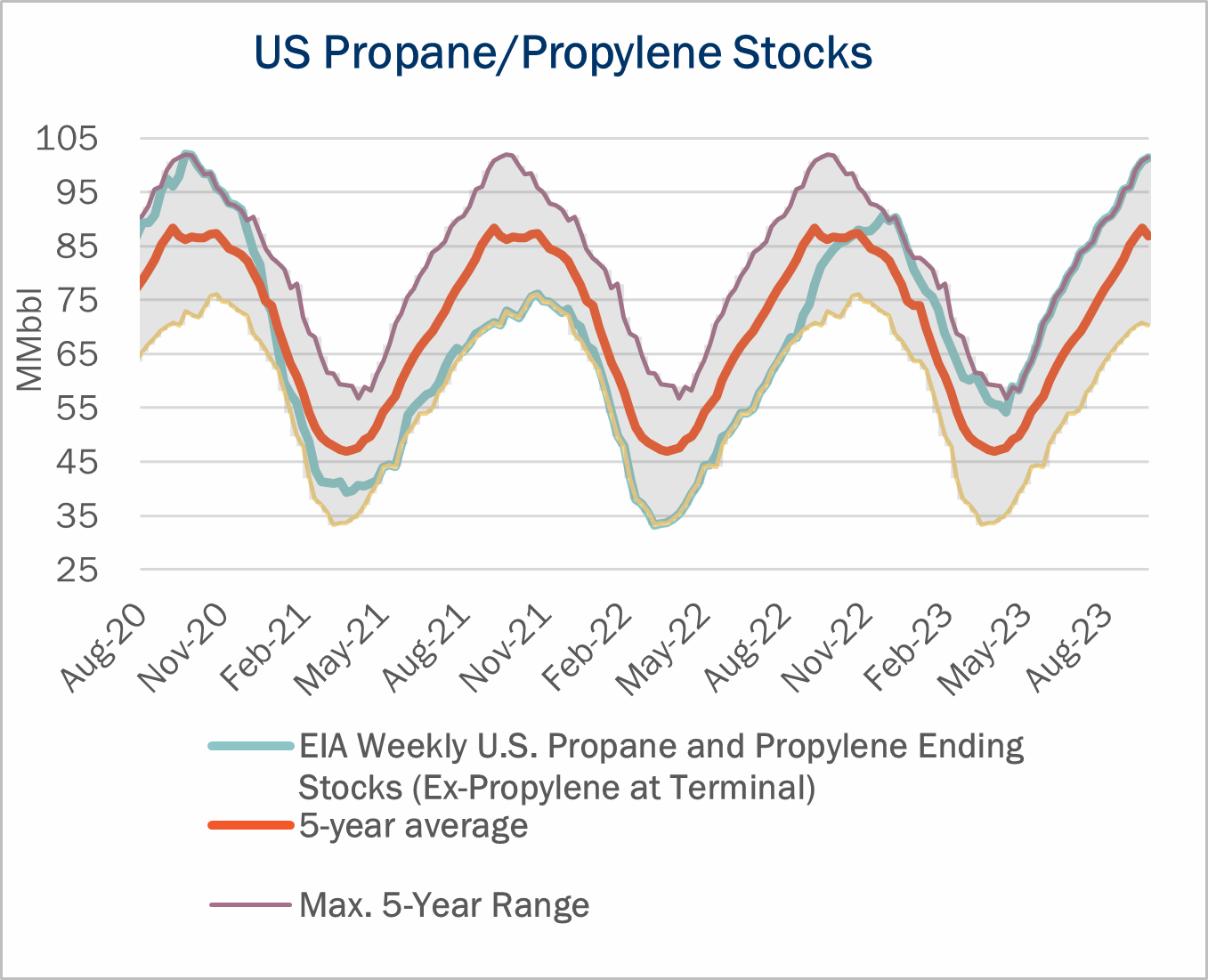

East Daley is monitoring the propane market in particular for volatility. Surging propane exports have helped balance the market amid an otherwise down year for demand, hitting a record high in September 2023 of 1.66 MMb/d, according to Energy Information Administration data. Nevertheless, US propane/propylene inventories are at a 5-year high of about 100 MMbbl as of September 2023 (see chart). Any disruptions to exports and another warm winter could send propane prices cratering. – Christina Adjiman Tickers: EPD, ET.

{% module_block module “widget_acbcaa23-dc30-43a8-9d0f-3a26e16b0b89” %}{% module_attribute “button_text” is_json=”true” %}{% raw %}”Request Natural Gas Liquids Data”{% endraw %}{% end_module_attribute %}{% module_attribute “child_css” is_json=”true” %}{% raw %}null{% endraw %}{% end_module_attribute %}{% module_attribute “css” is_json=”true” %}{% raw %}null{% endraw %}{% end_module_attribute %}{% module_attribute “label” is_json=”true” %}{% raw %}null{% endraw %}{% end_module_attribute %}{% module_attribute “link” is_json=”true” %}{% raw %}{“url”:{“content_id”:null,”href”:”https://share.hsforms.com/1ZFPr3qKtR5qPiNPU6IaFVA4x9p7?__hstc=226329541.d05115244755a01574b19b20b95e7e98.1682018112919.1697053560348.1697056296818.367&__hssc=226329541.2.1697056296818&__hsfp=1375341707″,”type”:”EXTERNAL”},”open_in_new_tab”:true,”no_follow”:false}{% endraw %}{% end_module_attribute %}{% module_attribute “module_id” is_json=”true” %}{% raw %}95364674432{% endraw %}{% end_module_attribute %}{% module_attribute “schema_version” is_json=”true” %}{% raw %}2{% endraw %}{% end_module_attribute %}{% module_attribute “tag” is_json=”true” %}{% raw %}”module”{% endraw %}{% end_module_attribute %}{% end_module_block %}

Sign Up for the Crude Oil Edge

East Daley’s Crude Oil Edge provides weekly updates on the US Crude Oil Market including supply and demand fundamentals, basin-level views, and analysis of market constraints and infrastructure proposals. We explore sub-basin dynamics and provide market insights on crude oil flows, production growth, and import and export characteristics. Sign up now for the Crude Oil Edge.

Energy Data Studio

East Daley Analytics has launched Energy Data Studio, a platform for our industry-leading midstream data and commodity production forecasts. All clients have access to the new client portal. If you have not yet logged in, please fill out the form to request a registration email be resent.

Energy Data Studio leverages our G&P data set for insights into midstream assets across every major oil and gas basin in North America. Users can navigate detailed visual dashboards by region, pipeline, or individual asset to understand crude oil, natural gas and NGL supply at the most granular level.

Energy Data Studio is available through data downloads from the visual interface, in Excel files, or as a direct feed delivered into subscribers’ workflow via secure file transfer. To learn more about Energy Data Studio, please contact [email protected].

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.