Exec Summary

Market Movers: Williams will take a 10% stake in the Louisiana LNG project and commit to offtake volumes under a strategic partnership with Woodside Energy.

Estimated Quarterly Volumes: Bakken plant inlets are up 2% from 3Q25.

Calendar: All financial models will be updated this week. SOBO will host its earnings call Nov. 14.

Market Movers:

Williams (WMB) has jumped into the LNG business in a big way. The company reached a strategic partnership with Woodside Energy (WDS) under which it will invest in the 16.5 Mtpa (2.5 Bcf/d) Louisiana LNG project. WMB will acquire a 10% interest in Louisiana LNG and has committed to a 1.5 Mtpa offtake obligation.

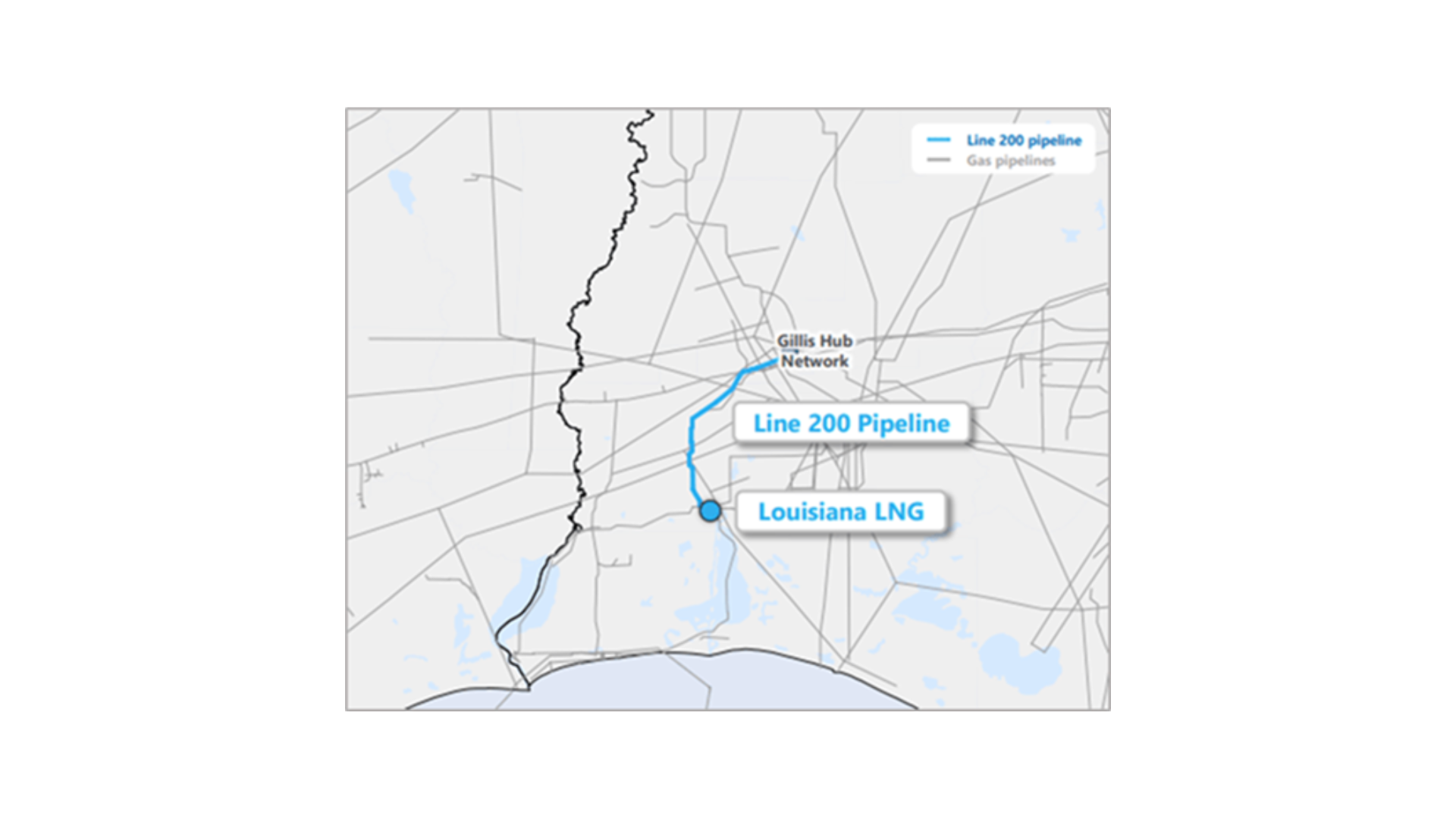

Under the deal announced Oct. 22, WMB will also acquire an 80% ownership stake and become operator of Driftwood Pipeline. The company will assume responsibility for construction of Driftwood Line 200, a 3+ Bcf/d header line extending from Lake Charles to the Gillis hub. At Gillis, Driftwood Line 200 will connect with WMB’s Transcontinental and Louisiana Energy Gateway (LEG), as well as several other pipelines. In total, WMB expects to invest $1.9B under the agreement.

The deal with Williams gives Woodside much-needed counterparty backing for Louisiana LNG. WDS in late April announced a $17.5B project FID, despite having only one customer (a 1 Mtpa sales and purchase agreement with Uniper) at the time. WDS in April also sold a 40% stake in the project to Stonepeak for $5.7B.

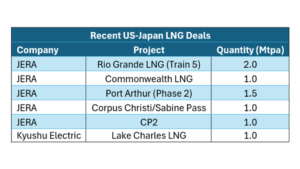

Along with the Woodside announcement, WMB and GEP Haynesville II LLC reached an agreement with JERA to sell 100% of their respective interests in the South Mansfield upstream assets in DeSoto Parish, LA. The properties produce more than 500 MMcf/d currently, and the deal includes a plan to develop ~200 undeveloped locations to grow production to over 1 Bcf/d. JERA is one of the largest buyers of US LNG, with a total of 5.5 Mtpa contracted between five LNG projects (see table).

This is just the latest in a string of Haynesville land grabs by Japanese companies in an effort to ensure security of supply. Last year, Tokyo Gas bought Rockcliff Energy for $2.7B, and Mitsubishi was reportedly in talks to buy Aethon Energy Management earlier this year. Mitsui has been among the companies active in the exploratory Western Haynesville, alongside Comstock Resources (CRK) and Aethon. Expand Energy (EXE) also recently committed to the emerging play, acquiring 75,000+ net acres in the region for $178MM.

All of this buzz around the Haynesville is for good reason. East Daley Analytics’ current balanced forecast in the Macro Supply & Demand Report sees nearly 4 Bcf/d of ArkLaTex production growth in 2026. While this amount of growth is ambitious based on current producer guidance, we expect a step change in gas demand from new LNG facilities and data centers will put serious upward pressure on prices next year. Among leading gas basins, the Haynesville has demonstrated a unique ability to respond quickly to changing fundamentals.

See our upcoming Dirty Little Secrets publication for in-depth analysis of the full range of possibilities next year and beyond.

Estimated Quarterly Volumes:

Notes: 3Q25 is expressed as Q-o-Q growth from 2Q25. Rockies is the sum of Big Horn, DJ, Green River, Piceance, Powder River, San Juan, Uinta and Wind River.

- Bakken plant inlets are up 2% from 3Q25. The ET–CEQP Bear Den system is up 3.7% and the XOM-Nesson system is up 7.2% Q-o-Q from 3Q25. Continental is the largest producer behind the ET– CEQP Bear Den system.

- Rockies meter point samples have increased 1.1% from 3Q25. The WMB–Echo Springs system is up 9.3% and KMI–Red Cedar Treating is up 16.1% from 3Q25. Crowheart Energy is the largest producer behind the WMB–Echo Springs system.

Calendar: