Exec Summary

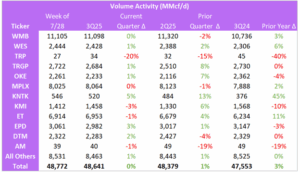

Market Movers: Total Lower 48 gas sample volumes rose 1.4% Q-o-Q from 1Q25 in Energy Data Studio, signaling a recovery from the weather-related downturn earlier this year.

Flows: ONEOK flows are down 4% so far in 3Q25 from 3Q24, a result of reduced rigs in 1H25 in the Permian.

Calendar: PAA, SMC, PBA, TRP models to be updated this week. ENB, EPD, GEL, DTM, AM report this week.

Market Movers:

The volumetric picture for companies that process rich gas is becoming clearer for 2Q25. Total Lower 48 sample volumes rose 1.4% Q-o-Q from 1Q25, according to East Daley’s Energy Data Studio, signaling a recovery from the weather-related downturn earlier this year (see table below).

- Bakken: Rebounding After a Weather-Driven Dip. Plant volumes in the Bakken rose 1%, recovering from 1Q disruptions. ONEOK (OKE) saw a standout 6.1% Q-o-Q increase in the region, driven by growth from Continental Resources and ConocoPhillips (COP).

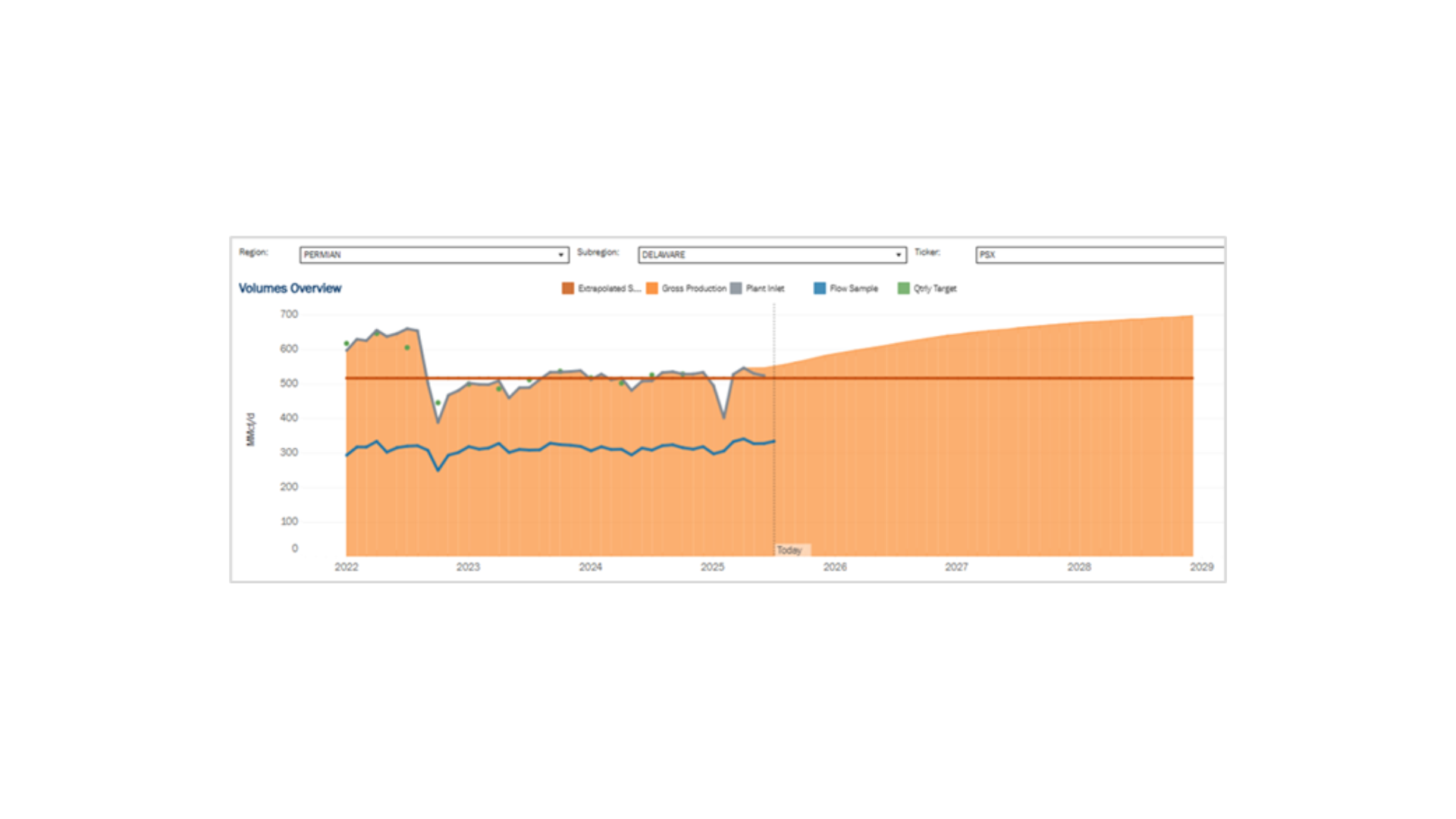

- Delaware: PSX, TRGP Surge. Phillips 66 (PSX) reported strong earnings on Friday supported by 4% volume growth in the Delaware Basin, with Devon Energy (DVN) the leading contributor (refer to gray line in graph below).

Similarly, Targa Resources’ (TRGP) Delaware volumes are up more than 5% 1Q25 to 2Q25. Based on nearly completed plant reporting in Energy Data Studio, TRGP’s Delaware volumes are up because TRGP’s Bull Moose plant became operational in 2Q25. We expect TRGP management to emphasize producer-led growth in 2H25, supported by the 0.5 Bcf/d compression expansion on Matterhorn Express, scheduled to enter service in 4Q25.

Eagle Ford: A Tale of Two Midstreams. Data for the Eagle Ford is currently limited to May 2025. Still, early indicators show TRGP and Enterprise Products (EPD) is seeing strong momentum from its Eagle Ford G&P systems, while Western Midstream (WES) may show a dip in volumes, which will likely be embedded in its “Other” category.

The Bigger Picture: Volume Recovery, Strategic Shifts: The 2Q25 rebound signals the end of a weather-driven slowdown, but it’s also part of a larger structural change. As East Daley has highlighted in past presentations, including our recent trip to the IEA in Paris, growth in the Permian will begin to moderate as producers tap the brakes.

At the same time, the Northeast is expanding takeaway capacity, creating new growth opportunities. Notably, companies like Range Resources (RRC) are targeting 20% production growth by 2027 – a stark contrast to more mature basins. We expect the market narrative to pivot toward multi-basin diversification as the dominant theme through 2026.

Join the Conversation: East Daley will explore these trends in more detail during our August Monthly Oil & Gas Production Webinar. Don’t miss it – we’ll dig into:

- Updated basin-level growth forecasts

- Key midstream winners and laggards

- Infrastructure impacts on supply directionality

Register here for the upcoming production webinar!

Flows:

- TRGP’s gas volumes are outpacing Street expectations, but its rig counts in the Permian are down Q-o-Q in 3Q25.

- OKE flows are opening 3Q25 down 4% from 3Q24. The flow sample reduction results from reduced rigs in the Permian in 1H25.

Calendar: