Exec Summary

Market Movers: Kinder Morgan plans to expand the NGPL system to meet growing demand for power generation.

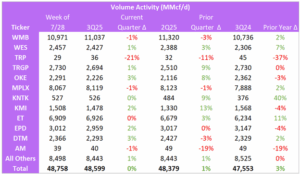

Flows: KMI flows continue to increase, up 3% in latest week, led by Haynesville growth.

Calendar: ET, KNTK, MPLX, OKE, SOBO, TRGP, WES and WMB report this week.

Market Movers:

In Kinder Morgan’s (KMI) 2Q25 earnings materials, the company announced two expansions on the Natural Gas Pipeline Company of America (NGPL) system: the North Extension and the Texas Arkansas Power projects.

The North Extension project will expand capacity from existing Iowa-Illinois receipt points to the Market Delivery Zone north of Chicago. The project will add 210 MMcf/d of capacity with an estimated in-service date of 4Q28. The total project cost is $454MM ($170MM net to KMI).

The Texas Arkansas Power project will expand capacity by 488 MMcf/d from the existing TexOk and Iowa-Illinois receipt points to a new interconnect in the Gulf Coast zone. The $250MM project ($90MM net to KMI) is expected to enter service in 1Q28.

KMI management said both expansions will serve new power projects, one located in Arkansas and the second in Wisconsin. Given the sparse details, East Daley Analytics assumes that the power demand is associated with data centers.

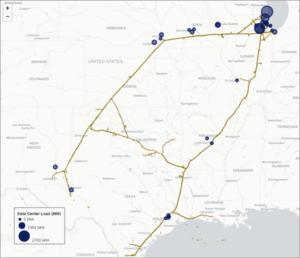

In our Data Center Demand Monitor, we currently account for 37 data center projects located within 50 miles of NGPL (see map). These projects have a total estimated load of over 14.5 GW.

The Data Center Demand Monitor shows that NGPL is only 12 miles from Microsoft’s Mount Pleasant data center in Wisconsin. In Arkansas, NGPL is proximate to two data centers being developed by ForgeLight Ventures and Willowbend Capital.

While these are the leading suspects for project counterparties, commercial agreements to secure power and fuel often precede announcements of data center facilities, so the pipeline expansions may signal more demand in addition to these three facilities on NGPL’s pipeline footprint.

Flows:

Flows:

- The KMI flow sample continues to trend higher, up 13% for the July 28 week from the 2Q25 average, led by growth in the Haynesville. Volumes on the KinderHawk system have been particularly strong since July.

- The DTM flow sample increased 3% from the 3Q25 average.

Calendar: