Exec Summary:

Market Movers: The first round of Earnings Previews points to some interesting data for 2Q25 results.

Rigs: TRGP rigs for the week ending June 29 are down 20% from 3Q24, mainly due to Exxon cutting 8 rigs in the Permian.

Flows:The DTM flow sample fell 3% from the prior quarter, due partly to maintenance on Creole Trail.

Calendar: East Daley will be in NYC July 29-31. Please reach out if you would like to schedule a market update while we are in town.

Market Movers:

East Daley Analytics has published updated models and 2Q25 Earnings Previews for Kinder Morgan (KMI), Targa Resources (TRGP), Enterprise Products (EPD), ONEOK (OKE) and SouthBow (SOBO), with several others out for delivery to clients. Here are a few data points we’re seeing so far:

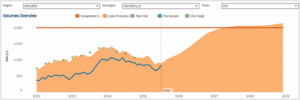

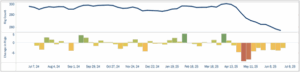

1. Haynesville Volumes: Short-Term Pain, Long-Term Gain

Haynesville volumes are down Q-o-Q. We expect lower 2Q25 volumes through assets like:

- KMI’s KinderHawk system (see figure below from Energy Data Studio)

- EPD’s Haynesville gathering and Acadian assets.

-

While 2Q25 will be disappointing, we expect management teams will rightly point to the future. We have already seen a strong uptick in Haynesville volumes on KMI’s KinderHawk beginning in June and especially in July – refer to the uptick in the blue line in the chart from Energy Data Studio showing the KinderHawk forecast.

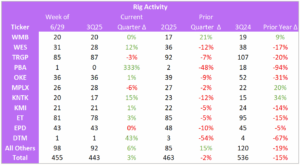

2. Rig Declines Weigh on Permian Outlook

- Permian Basin rig counts declined from 295 at the end of 1Q25 to 255 rigs at the end of 2Q25 (see Rig Activity Tracker from Energy Data Studio below).

The engine of US crude and NGL production growth will continue to grow, albeit at a slower pace. Economic uncertainty brought about by the changes to international trade has lowered WTI crude prices and affected producers’ spending plans in the Permian. The lower rig activity reduces EDA’s forecast for Targa EBITDA by $260MM in 2027 when comparing the updated outlook to our pre-“Liberation Day” model.

The engine of US crude and NGL production growth will continue to grow, albeit at a slower pace. Economic uncertainty brought about by the changes to international trade has lowered WTI crude prices and affected producers’ spending plans in the Permian. The lower rig activity reduces EDA’s forecast for Targa EBITDA by $260MM in 2027 when comparing the updated outlook to our pre-“Liberation Day” model.

While the declining rig count weighs on the long-term outlook for Permian assets, we expect gas production from the Midland and Delaware to be up 1.5% and 1.0% in aggregate 1Q25 to 2Q25.

3. ONEOK’s Bakken G&P Quietly Outperforms

Data in Energy Data Studio shows 6% Q-o-Q growth for OKE’s Bakken G&P system, based on two full months of volumes.

- Exceeding Guidance: This run rate beats the low-single-digit growth baked into OKE’s 2025 guidance and is in line with upbeat management commentary from the prior earnings call.

- Benchmarking: Bakken G&P volumes are growing ahead of the basin average, according to our plant and residue sample data.

Watch out for East Daley’s updated Financial Blueprints and 2Q25 Earnings Previews to learn more.

Rigs:

- TRGP rigs for the week ending June 29 are down 20% from 3Q24, mainly due to Exxon cutting 8 rigs in the Permian.

- KNTK rigs are 12% lower from 2Q25 but up 34% from 3Q24.

- The Permian Basin rig count is down 38 rigs from 3Q24.

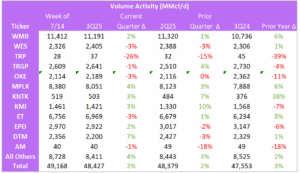

Flows:

- The DTM flow sample for the July 14 week fell 3% from the prior quarter. The decline is partly attributed to maintenance on Creole Trail lowering flows. DTM has the option to send gas on intrastate pipelines to move the displaced volumes.

- MPLX flows consistently increased throughout the analysis, with the Northeast driving this growth and outperforming the basin’s overall growth.

Calendar: