Exec Summary:

Market Movers: Brazos Midstream’s Midland G&P system is likely to attract interest from suitors, aided by a strong performance from the recently started Sundance plant.

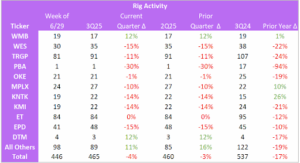

Rigs: Williams has seen stable rig activity on the Louisiana-Magnolia system with Expand Energy and Paloma running 2 rigs each.

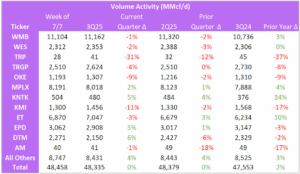

Flows: Total flows were up slightly for the week ending July 7 at 48.4 Bcf/d.

Calendar: East Daley will be in NYC July 29-31. Please reach out if you would like to schedule a market update while we are in town.

Market Movers:

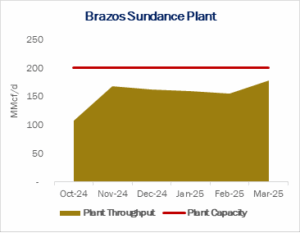

Brazos Midstream’s 200 MMcf/d Sundance plant entered service in October 2024 and quickly ramped up volumes in the Midland Basin. The cryogenic facility in Martin County, TX was initially supplied gas previously processed by third parties from Brazos’ gathering system, aiding the ramp. Sundance inlets averaged 178 MMcf/d in March 2025, or 89% utilization, according to asset data available in East Daley Analytics’ Energy Data Studio.

We believe Diamondback Energy (FANG) is the largest contributor of volumes to the Sundance plant. FANG in April 2025 acquired Double Eagle IV, the anchor producer on the G&P system, likely underpinning the surge in throughput. Brazos plans to add a second 300 MMcf/d plant later in 2025, though the exact timing is unclear.

Brazos receives $0.20/Mcf for gathering services on its Midland system, according to the tariff filed with state regulators. Data in Energy Data Studio shows a Permian-wide gross margin of $0.99/Mcf for gathering and processing services. Based on the recent throughput, we estimate the Midland system including Sundance delivers EBITDA about $49.8MM.

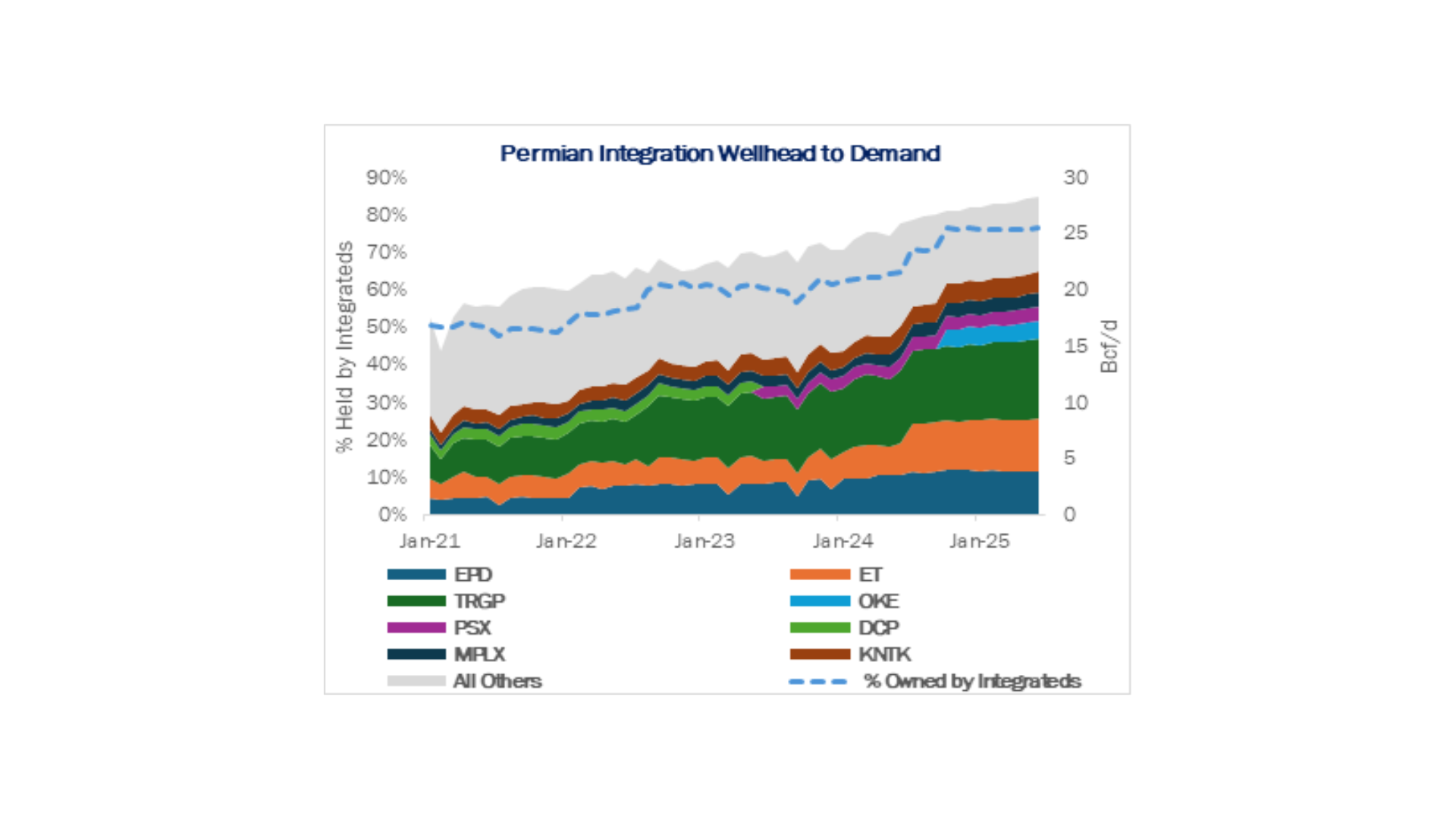

East Daley anticipates elevated interest in this emerging G&P asset, particularly from large integrated public companies that already account for ~75% of rich gas processing in the region (see figure below). Nearly all (except MPLX, which operates exclusively in the Delaware) have overlapping infrastructure with the Brazos system (see Energy Data Studio for asset map). Investor interest likely centers not only on G&P capabilities but also the NGL stream, which supports downstream revenue from NGL takeaway, storage, fractionation and exports — assets typically tied to fee-based cash flows.

Rigs:

Rigs:

- While the number of rigs appears to have decreased, this may be attributed to companies relocating their equipment rather than an actual reduction in operational rigs.

- Williams is an outlier to this decline. WMB has stable rig activity on the Louisiana-Magnolia system with Expand Energy and Paloma running 2 rigs each.

Flows:

- Total flows were up slightly for the week ending July 7 at 48.4 Bcf/d.

- WMB has seen stable flows of 5 Bcf/d on its systems in northeast Pennsylvania.

- DTM flows are up 6% QTD. East Daley has seen a gradual increase in volumes on the Blue Union system.

Calendar: