Exec Summary

Market Movers: Plains’ search for crude oil assets could land on its Eagle Ford JV with Enterprise.

Estimated Quarterly Volumes: Delaware plant inlets are up 4.6% Q-o-Q through August, led by gains on Kinetik and Targa systems.

Calendar:

Market Movers:

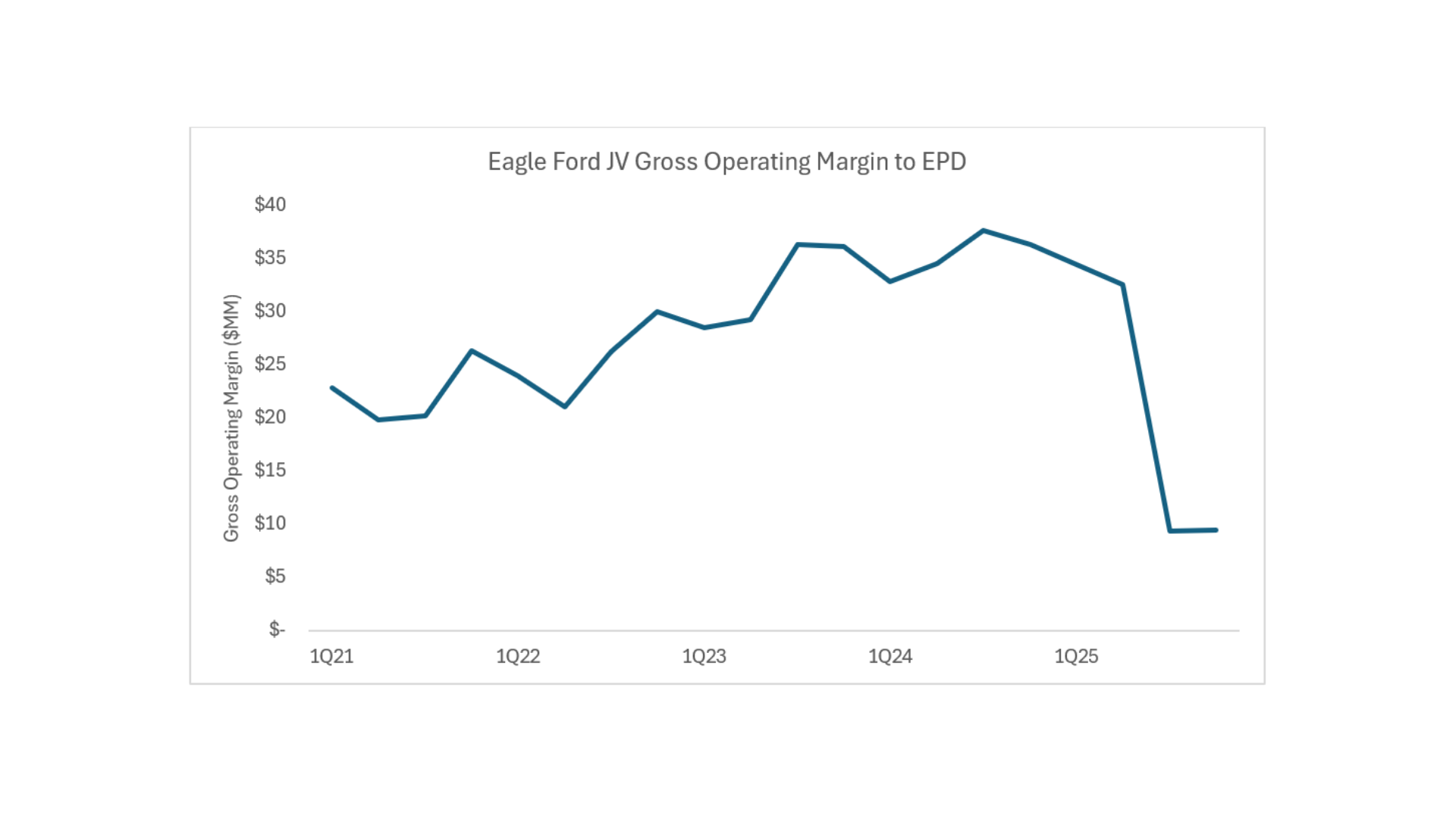

This week’s non-core asset focus is the Eagle Ford joint venture between Enterprise Products (EPD) and Plains All American (PAA). The 50/50 JV includes a pipeline system and a dock in Corpus Christi. The pipeline moves volumes from Gardendale Station to the dock for storage and export, supported by gathering systems that PAA wholly owns.

PAA has doubled down on crude oil assets. Its recent acquisition of the EPIC crude oil pipeline and associated infrastructure gives the company full control from wellhead to water in the Permian. That deal included an export dock just half a mile from the Eagle Ford JV dock. Owning the remaining 50% of the Eagle Ford JV would allow PAA to:

- Extend its wellhead-to-water integration to include the Eagle Ford.

- Physically connect the Eagle Ford and EPIC docks, creating operational synergies.

- Potentially expand capacity with a third berth, enhancing its ability to compete with the Buckeye terminal four miles upriver.

Crude oil has become less central for Enterprise. In 2020, crude pipelines and services represented nearly 25% of EBITDA. By 2024, that share had fallen to 16%, with East Daley’s EBITDA forecasts holding flat. Meanwhile, natural gas and NGLs have become the company’s growth engines.

In crude, EPD’s footprint is geographically concentrated at the Houston Ship Channel and in Texas City. The Eagle Ford JV is outside that core. Earnings pressure also looms when joint tariffs with PAA’s Cactus system are re-contracted, potentially reducing returns. Selling the JV interest would allow EPD to:

- Monetize a non-core asset at an attractive multiple.

- Free up capital for higher-return projects aligned with its gas and NGL strategy.

The strategic incentives align:

- PAA gains scale and integration, improving its competitive position in Corpus Christi.

- EPD exits a peripheral crude position, recycling capital into growth priorities.

The key question is whether both sides can agree on terms. If they do, this transaction could reshape the competitive landscape for the Eagle Ford and Corpus Christi crude exports. Clients can browse Equity Coverage on Energy Data Studio to find more details behind asset-level earnings that roll up into company EBITDA outlooks.

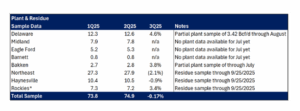

Estimated Quarterly Volumes:

Notes: 3Q25 is expressed as Q-o-Q growth from 2Q25. Rockies is the sum of Big Horn, DJ, Green River, Piceance, Powder River, San Juan, Uinta and Wind River.

- Delaware plant inlets are up 4.6% Q-o-Q through August. The KNTK – Durango Midstream system is up 7% and the TRGP – Lucid S Carslbad system is up 9% from 2Q25. We forecast the Delaware sub-basin to grow 2.1% from 2Q to 3Q25. KNTK’s Durango/Frontier system is anchored by the Maljamar sour gas-capable gas plant. Chevron (CVX) is one of the largest producers behind the system and has guided to 5-6% growth from 2025-26.

- Bakken plant inlets are up 4.6% Q-o-Q through July. The OKE – Bakken system is up 4.6% and the KMI – Bakken system is up 6% from 2Q25. The Bakken is forecast to grow 0.8% from 2Q to 3Q25.

Calendar: